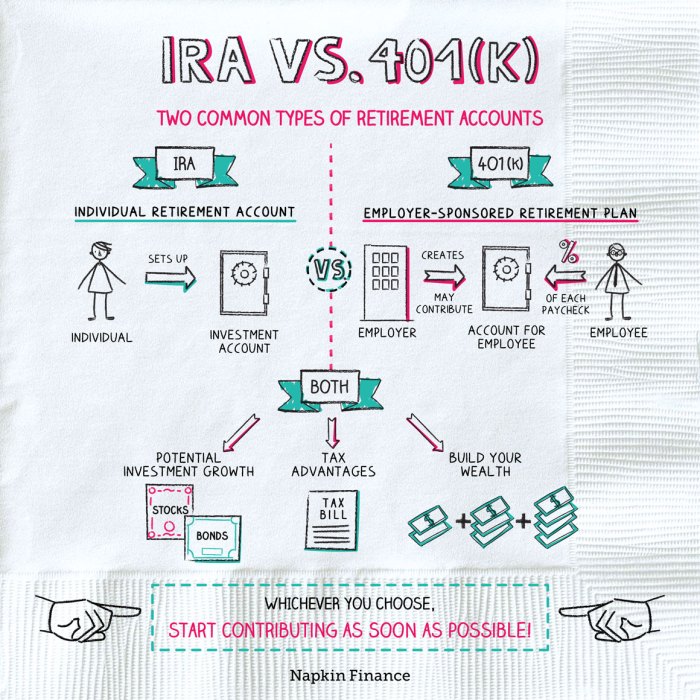

Exploring the differences between 401(k) and IRA sheds light on crucial aspects of retirement planning. This comparison delves into contribution limits, eligibility criteria, tax implications, and withdrawal rules, providing a holistic view of these popular retirement accounts.

Discuss the differences between 401(k) and IRA

401(k) and IRA are two popular retirement savings options, each with its own set of rules and benefits. Here are the key differences between the two:

Contribution Limits

When it comes to contribution limits, 401(k) plans typically allow for higher contributions compared to IRAs. In 2021, the maximum contribution limit for a 401(k) is $19,500, with an additional catch-up contribution of $6,500 for individuals aged 50 and older. On the other hand, IRAs have a lower contribution limit of $6,000 in 2021, with a catch-up contribution of $1,000 for those 50 and older.

Eligibility Criteria

401(k) plans are usually offered by employers, so eligibility is often tied to employment status. Employers may have specific requirements, such as a minimum age or length of service, to participate in a 401(k) plan. On the other hand, IRAs are available to anyone with earned income, regardless of employment status. However, there are income limits for contributing to a Roth IRA.

Tax Implications

Contributions to a traditional 401(k) are made on a pre-tax basis, reducing your taxable income in the year of contribution. This means you won’t pay taxes on the money you contribute until you withdraw it in retirement. Conversely, contributions to a traditional IRA may be tax-deductible, depending on your income and whether you or your spouse are covered by a retirement plan at work. Roth 401(k) and Roth IRA contributions are made with after-tax dollars, but qualified withdrawals are tax-free.

Withdrawal Rules and Penalties

Withdrawing funds from a 401(k) or IRA before age 59½ may result in a 10% early withdrawal penalty, in addition to ordinary income taxes. However, there are exceptions, such as for certain medical expenses or first-time home purchases, that may allow penalty-free withdrawals. Roth IRAs offer more flexibility for early withdrawals of contributions (but not earnings) without penalties or taxes.

Benefits of a 401(k) over an IRA

When considering retirement savings options, a 401(k) offers several advantages over an Individual Retirement Account (IRA). These benefits can help individuals maximize their savings and secure a more comfortable retirement.

Employer Match Contributions

One significant advantage of a 401(k) is the potential for employer match contributions. Many employers offer to match a percentage of their employees’ contributions to a 401(k) up to a certain limit. This means that by contributing to a 401(k), individuals can effectively double their retirement savings through employer contributions.

Higher Contribution Limits

401(k) plans typically have higher contribution limits compared to IRAs. As of 2021, the annual contribution limit for a 401(k) is $19,500 for individuals under 50 years old and $26,000 for those 50 and older. In contrast, the contribution limit for an IRA is $6,000 for individuals under 50 and $7,000 for those 50 and older. The higher contribution limits of a 401(k) allow individuals to save more for retirement on a tax-deferred basis.

Automatic Payroll Deductions

Another advantage of a 401(k) is the option for automatic payroll deductions for retirement savings. Through automatic deductions, individuals can ensure consistent contributions to their 401(k) without having to remember to make manual deposits. This automated approach can help individuals build their retirement savings steadily over time.

Ability to Take Out a Loan

In certain situations, a 401(k) allows individuals to take out a loan from their retirement savings. While this should generally be considered a last resort due to potential tax implications and impact on long-term savings, the option to borrow from a 401(k) can provide financial flexibility in emergencies. It is essential to understand the terms and conditions of 401(k) loans before considering this option.

Advantages of an IRA compared to a 401(k)

When comparing an Individual Retirement Account (IRA) to a 401(k), there are several advantages that an IRA offers over a 401(k) plan.

IRA provides flexibility in investment choices:

One key advantage of an IRA compared to a 401(k) is the flexibility in investment choices. With an IRA, individuals have the ability to choose from a broader range of investment options, including stocks, bonds, mutual funds, and even alternative investments like real estate or precious metals. This flexibility allows investors to tailor their portfolio to their risk tolerance, investment goals, and preferences.

Broader range of investment options available in an IRA:

In addition to the flexibility in investment choices, IRAs typically offer a broader range of investment options compared to 401(k) plans. While 401(k) plans are usually limited to a selection of mutual funds and other investment options chosen by the employer, IRAs provide access to a wider array of investment opportunities, giving investors more control over their investment decisions.

Potential for lower fees associated with an IRA:

Another advantage of an IRA is the potential for lower fees compared to a 401(k). 401(k) plans may have higher administrative and management fees, which can eat into investment returns over time. IRAs, on the other hand, often offer lower fees, especially if investors opt for low-cost index funds or ETFs. By minimizing fees, investors can potentially keep more of their investment gains.

Portability of an IRA when changing jobs:

One of the key benefits of an IRA is its portability when changing jobs. Unlike a 401(k) plan, which is typically tied to a specific employer, an IRA can be retained and continued by the individual even if they switch jobs. This portability allows for seamless transitions between employers without the need to roll over or transfer funds, providing continuity in retirement savings and investment strategies.

Considerations for choosing between a 401(k) and an IRA

When deciding between a 401(k) and an IRA, various factors need to be considered to make an informed choice that aligns with your financial goals and circumstances.

Impact of Age and Income

Age and income play a crucial role in determining whether a 401(k) or an IRA is more suitable for an individual. Younger individuals with lower incomes may benefit more from an IRA due to its flexibility and potential for tax advantages. On the other hand, older individuals with higher incomes may find the contribution limits of a 401(k) more advantageous for maximizing their retirement savings.

Employer-Sponsored Plans Influence

The presence of an employer-sponsored retirement plan can significantly impact the decision between a 401(k) and an IRA. If your employer offers a 401(k) plan with matching contributions, it is generally advisable to take advantage of this benefit as it can boost your retirement savings significantly. However, if your employer does not offer a 401(k) or you are self-employed, an IRA may be a better option to consider.

Individual Risk Tolerance and Investment Preferences

Your risk tolerance and investment preferences should also be taken into account when choosing between a 401(k) and an IRA. 401(k) plans typically offer a limited selection of investment options, while an IRA provides more flexibility to choose investments that align with your risk tolerance and financial goals. If you prefer more control over your investment choices, an IRA may be the better option for you.

Long-Term Growth Potential

Both 401(k) and IRA accounts have the potential for long-term growth, but the growth rates can vary based on factors such as investment choices, fees, and market performance. Generally, 401(k) plans offer the potential for higher growth due to higher contribution limits and potential employer matching contributions. However, IRAs can also provide significant growth potential, especially if you choose investments that perform well over time.