529 college savings plans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. These plans provide a strategic approach to saving for higher education, ensuring financial stability for the future.

As we delve deeper into the intricacies of 529 college savings plans, a world of opportunities and benefits unfolds, highlighting the importance of financial planning and investment in shaping educational aspirations.

What are 529 college savings plans?

529 college savings plans are tax-advantaged investment accounts designed to help individuals save for future education expenses, primarily for higher education. These plans are named after Section 529 of the Internal Revenue Code, which governs their tax treatment.

How do 529 plans work?

529 plans work by allowing individuals to contribute after-tax dollars into an account, where the funds can grow tax-free as long as they are used for qualified education expenses. These expenses may include tuition, room and board, books, and other related costs at eligible educational institutions.

- Contributions to a 529 plan are made on behalf of a designated beneficiary, typically a child or grandchild.

- Investment options within a 529 plan vary based on the state program, offering choices such as mutual funds or age-based portfolios.

- Withdrawals from a 529 plan for qualified education expenses are not subject to federal taxes, and in many cases, state taxes as well.

Benefits of investing in a 529 plan

529 plans offer several advantages for individuals looking to save for education:

- Tax advantages: Earnings in a 529 plan grow tax-deferred and are tax-free when used for qualified education expenses.

- Flexible use: Funds from a 529 plan can be used at eligible educational institutions nationwide, including colleges, universities, and vocational schools.

- Control and ownership: The account owner retains control over the funds in a 529 plan, even after the beneficiary reaches college age.

Types of 529 College Savings Plans

When it comes to saving for college using a 529 plan, there are two main types to consider: prepaid tuition plans and education savings plans. Additionally, these plans can be offered by states or private institutions, each with its own set of features and benefits. Understanding the differences between these types of plans and their tax implications is crucial in making an informed decision for your college savings strategy.

Prepaid Tuition Plans vs. Education Savings Plans

Prepaid tuition plans allow account holders to purchase credits or units at participating colleges and universities at today’s prices. These credits can then be used in the future to cover tuition costs, protecting against tuition inflation. On the other hand, education savings plans, also known as 529 savings plans, allow for contributions to be invested in various investment options, such as mutual funds. The funds can be used for qualified higher education expenses, including tuition, room and board, and books.

Differences between State-Sponsored and Private 529 Plans

State-sponsored 529 plans are typically more common and offer tax benefits for residents of the state sponsoring the plan. These plans may also provide additional incentives, such as matching grants or scholarships. Private 529 plans, on the other hand, are offered by financial institutions and may have different investment options and fees. It’s important to compare the features of both types of plans to determine which best suits your needs.

Tax Implications of Different Types of 529 Plans

Both prepaid tuition plans and education savings plans offer tax advantages, such as tax-deferred growth and tax-free withdrawals for qualified education expenses. However, it’s essential to note that the specific tax benefits can vary depending on the state and type of plan. Additionally, some plans may offer state income tax deductions for contributions, further enhancing the tax advantages of investing in a 529 plan.

Eligibility and contribution limits

Opening a 529 college savings plan is relatively easy, as almost anyone can do so. Parents, grandparents, other family members, or even friends can open an account for a designated beneficiary. There are no age limits for the beneficiary or the account owner, and there are also no income restrictions for contributing to a 529 plan.

Contribution Limits

- Each state sets its own contribution limits for 529 plans, which can range from $235,000 to over $500,000 per beneficiary. These limits are based on the cost of attending the most expensive colleges in the state.

- Contributions to a 529 plan are considered gifts for tax purposes, and the annual gift tax exclusion allows individuals to contribute up to $15,000 per year per beneficiary without incurring gift tax consequences. Married couples can gift up to $30,000 per year per beneficiary without triggering gift tax.

- Additionally, it is possible to make a lump-sum contribution of up to five times the annual exclusion amount without incurring gift tax, as long as no further contributions are made to the same beneficiary for the next five years.

It is important to note that contributions to a 529 plan may impact the beneficiary’s eligibility for financial aid. In general, assets held in a parent’s name, including those in a 529 plan, are assessed at a lower rate (up to 5.64%) for financial aid purposes, compared to assets held in the student’s name (up to 20%).

Investment options and strategies

When saving for education expenses through a 529 college savings plan, it is crucial to consider the various investment options and strategies available to maximize returns and meet your financial goals effectively.

Investment Options

- Age-Based Portfolios: These portfolios automatically adjust the asset allocation based on the beneficiary’s age. They are typically more aggressive when the beneficiary is young and gradually shift to more conservative investments as they approach college age.

- Static Portfolios: These portfolios allow you to choose a specific asset allocation and maintain it over time. They offer more control over the investment strategy but require active monitoring and adjustments.

- Individual Investment Options: Some 529 plans also offer individual investment options like mutual funds, stocks, and bonds, allowing you to customize your portfolio according to your risk tolerance and investment preferences.

Choosing the Right Investment Strategy

It is essential to align your investment strategy with the beneficiary’s age and risk tolerance. Young beneficiaries can afford to take more risk by investing in equities for higher potential returns, while older beneficiaries may opt for more conservative investments to protect their savings from market volatility.

It is crucial to periodically review and adjust your investment strategy to ensure it continues to align with your financial goals and risk tolerance.

Maximizing Returns

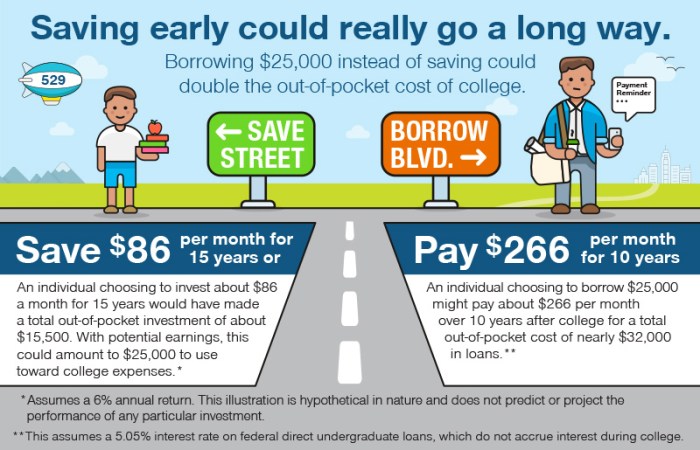

- Start Early: The earlier you start contributing to a 529 plan, the more time your investments have to grow.

- Take Advantage of Tax Benefits: 529 plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses, maximizing your returns over time.

- Regular Contributions: Consistent contributions over time can help boost your savings and take advantage of dollar-cost averaging to reduce the impact of market fluctuations.

- Rebalance Periodically: Rebalancing your portfolio ensures that your asset allocation stays in line with your investment goals and risk tolerance.

Using funds from a 529 plan

When it comes to using funds from a 529 plan, it is essential to understand the qualified expenses that can be paid for, the process of withdrawing funds from a 529 account, as well as the penalties associated with non-qualified expenses.

Qualified Expenses

- Tuition and fees: Funds from a 529 plan can be used to pay for tuition and mandatory fees at eligible educational institutions.

- Room and board: The cost of on-campus or off-campus housing and meal plans can be covered by a 529 plan.

- Books and supplies: Expenses for required textbooks, materials, and equipment are considered qualified expenses.

- Technology: Computers, software, and internet access can be paid for using funds from a 529 plan if required by the educational institution.

- Special needs services: Costs associated with special needs services for a beneficiary can be considered eligible expenses.

Withdrawing Funds

To withdraw funds from a 529 account, the account owner typically needs to submit a withdrawal request to the plan administrator. The funds can be sent directly to the educational institution or to the account owner, depending on the preference. It is important to keep track of the expenses and retain receipts for documentation purposes.

Non-Qualified Expenses and Penalties

- Non-qualified expenses: Some expenses that are not considered qualified include transportation, insurance, student loan payments, and non-educational expenses.

- Penalties: If funds from a 529 plan are used for non-qualified expenses, the earnings portion of the withdrawal is subject to income tax and a 10% penalty. It is crucial to use the funds for eligible educational expenses to avoid penalties.

State-specific 529 plans

State-specific 529 plans are college savings plans offered by individual states, each with its own set of features and benefits tailored to residents of that state. These plans are designed to help families save for future education expenses in a tax-advantaged way.

Differences between state-sponsored 529 plans

- Each state offers its own 529 plan with varying investment options, fees, and contribution limits.

- Some states may offer additional benefits such as state tax deductions or matching grants for contributions.

- Residents may choose to invest in their own state’s plan or opt for an out-of-state plan based on their preferences and financial goals.

Benefits of investing in an in-state 529 plan vs. an out-of-state plan

- Investing in an in-state 529 plan may offer residents tax advantages, such as state tax deductions or credits for contributions.

- Out-of-state plans may have different investment options or lower fees that could be more attractive to some investors.

- Residents should consider factors like performance, fees, and available incentives when deciding between in-state and out-of-state plans.

State tax deductions or credits for contributions to 529 plans

- Some states provide tax deductions or credits for contributions made to a 529 plan sponsored by that state.

- These incentives can help reduce the tax burden for residents while saving for education expenses.

- It is important to check the specific rules and limitations of each state’s tax benefits for 529 plans before making contributions.