Peer-to-peer lending, a revolutionary financial concept, connects individuals looking to borrow or invest money through online platforms. This innovative system challenges traditional banking institutions and offers exciting opportunities for both borrowers and investors. Let’s delve into the world of peer-to-peer lending and explore its intricacies.

In the following sections, we will cover the fundamental aspects of peer-to-peer lending, its benefits, associated risks, regulatory landscape, and legal considerations.

Overview of Peer-to-peer lending

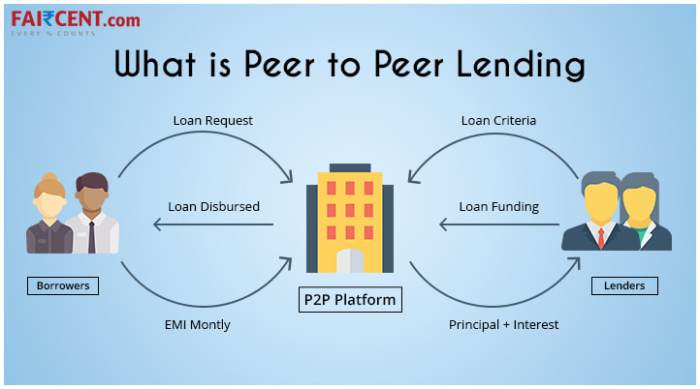

Peer-to-peer lending, also known as P2P lending, is a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary. In this system, borrowers are matched directly with lenders through online platforms, cutting out the traditional banking system.

Key Players in Peer-to-peer lending

- 1. Borrowers: Individuals or small businesses in need of financing.

- 2. Lenders: Individuals or institutional investors looking to earn interest on their money by lending it out.

- 3. Peer-to-peer lending platforms: Online platforms that facilitate the matching of borrowers and lenders, as well as managing the loan process.

Popular Peer-to-peer lending Platforms

- 1. LendingClub: One of the largest peer-to-peer lending platforms in the U.S., offering personal loans, business loans, and patient solutions.

- 2. Prosper: Another well-known platform that connects borrowers with individual and institutional investors for personal loans.

- 3. Funding Circle: Specializes in small business loans, connecting businesses with investors looking to fund their growth.

Benefits of Peer-to-peer lending

Peer-to-peer lending offers several advantages for both borrowers and investors, making it a popular alternative to traditional lending methods.

Advantages for Borrowers

- Lower interest rates: Borrowers can often secure loans at lower interest rates compared to traditional financial institutions.

- Fast approval process: Peer-to-peer lending platforms typically have quicker approval processes, allowing borrowers to access funds promptly.

- Accessibility: Peer-to-peer lending provides an opportunity for individuals with limited credit history to secure loans.

- Flexible terms: Borrowers have the flexibility to negotiate terms directly with individual investors, offering more personalized loan options.

Benefits for Investors

- Higher returns: Investors can potentially earn higher returns compared to traditional investment options like savings accounts or CDs.

- Diversification: Peer-to-peer lending allows investors to diversify their portfolios by investing in multiple loans across different risk profiles.

- Control: Investors have control over which loans they choose to invest in, allowing them to tailor their investment strategy based on their risk tolerance.

- Passive income: Peer-to-peer lending offers a passive income stream for investors, as they earn interest on the loans they fund.

Comparison with Traditional Lending

- Efficiency: Peer-to-peer lending platforms often have streamlined processes, offering a more efficient borrowing and investing experience compared to traditional banks.

- Transparency: Peer-to-peer lending provides transparency in terms of fees, interest rates, and loan terms, giving borrowers and investors more clarity.

- Personalization: Peer-to-peer lending allows for more personalized loan options and investment choices, catering to individual needs and preferences.

- Risk management: Investors in peer-to-peer lending have the ability to diversify their investments, reducing overall risk compared to traditional investment options.

Risks associated with Peer-to-peer lending

Peer-to-peer lending, while offering numerous benefits, also comes with its own set of risks that both borrowers and investors need to be aware of in order to make informed decisions.

Risks for Borrowers

Peer-to-peer lending can present risks for borrowers, including:

- High interest rates: Borrowers may face higher interest rates compared to traditional bank loans, which can increase the overall cost of borrowing.

- Lack of regulation: Peer-to-peer platforms may have fewer regulations compared to traditional financial institutions, exposing borrowers to potential scams or unfair lending practices.

- Default risk: There is always a risk of borrowers defaulting on their loans, which can negatively impact their credit score and financial stability.

Risks for Investors

Investors participating in peer-to-peer lending also face certain risks, such as:

- Default risk: Just like borrowers, investors are exposed to the risk of borrowers defaulting on their loans, leading to potential loss of investment.

- Platform risk: The platform itself may face financial difficulties or regulatory issues, affecting investors’ ability to recover their funds.

- Liquidity risk: Unlike traditional investments, peer-to-peer loans may not be easily liquidated, making it difficult for investors to access their funds when needed.

Strategies to Mitigate Risks

To mitigate risks in peer-to-peer lending, borrowers and investors can consider the following strategies:

- Diversification: Spreading out investments or loan requests across multiple borrowers can help reduce the impact of defaults on overall returns.

- Due diligence: Conduct thorough research on borrowers or platforms before committing funds to ensure credibility and reliability.

- Risk assessment: Evaluate the risk profile of borrowers or investments based on factors such as credit score, financial stability, and payment history.

- Monitoring: Regularly monitor loan performance and platform stability to quickly address any red flags or potential issues.

Regulation and Legal considerations

When it comes to peer-to-peer lending, there are important regulatory and legal considerations that both borrowers and investors need to be aware of. Understanding the regulatory framework governing peer-to-peer lending is crucial to ensure compliance and protect the interests of all parties involved.

Regulatory Framework

The regulatory framework for peer-to-peer lending varies from country to country. In general, regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the UK oversee peer-to-peer lending platforms to ensure they comply with relevant laws and regulations. These regulations are in place to protect investors and borrowers, prevent fraud, and maintain the stability of the financial system.

Legal Considerations

Borrowers and investors engaging in peer-to-peer lending should be aware of the legal considerations involved. This includes understanding the terms and conditions of the lending platform, the rights and responsibilities of both parties, and the legal recourse available in case of disputes or defaults. It is important to carefully review and understand the legal agreements before participating in peer-to-peer lending to avoid any potential legal issues.

Compliance Requirements

Peer-to-peer lending platforms are required to comply with certain regulations to operate legally. These compliance requirements may include obtaining necessary licenses, conducting due diligence on borrowers, implementing risk management practices, and providing transparent information to investors. By adhering to these compliance requirements, peer-to-peer lending platforms can ensure a fair and secure lending environment for all participants.