Understanding financial ratios is crucial for assessing a company’s financial health and making informed decisions. This guide delves into the importance of financial ratios, how to calculate and interpret them, their limitations, and their role in decision-making processes. Dive into the world of financial analysis with us as we explore this intricate topic.

Financial ratios serve as vital tools in evaluating a company’s performance, providing valuable insights into its operations and financial standing. From liquidity to solvency, each category offers a unique perspective that aids in understanding the overall financial position of a business.

Importance of Financial Ratios

Financial ratios play a crucial role in analyzing a company’s financial health by providing valuable insights into its performance, profitability, liquidity, and solvency. These ratios help investors, analysts, and stakeholders make informed decisions by evaluating the company’s financial position and comparing it to industry benchmarks.

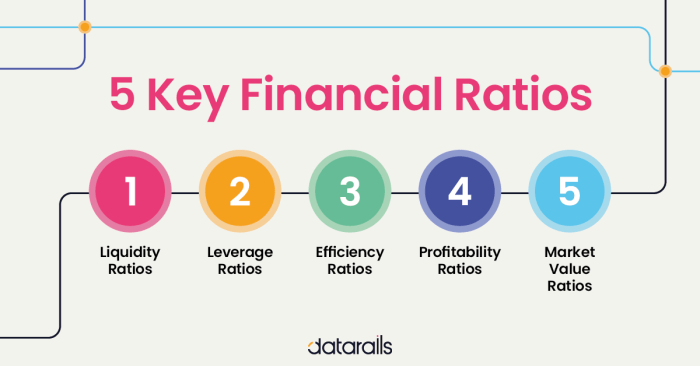

Key Financial Ratios and Significance

Financial ratios can be categorized into different types, including profitability ratios (e.g., return on equity, gross margin), liquidity ratios (e.g., current ratio, quick ratio), and solvency ratios (e.g., debt to equity ratio, interest coverage ratio). Each ratio serves a specific purpose in assessing different aspects of the company’s financial performance.

- Profitability ratios measure the company’s ability to generate profits relative to its revenue and assets. A higher return on equity indicates efficient use of shareholders’ funds, while a higher gross margin reflects strong pricing power.

- Liquidity ratios evaluate the company’s ability to meet short-term obligations without facing financial distress. A higher current ratio suggests better liquidity and financial flexibility, while a quick ratio provides a more conservative measure by excluding inventory from current assets.

- Solvency ratios assess the company’s long-term financial stability and ability to meet its debt obligations. A lower debt to equity ratio indicates lower financial risk, while a higher interest coverage ratio signifies the company’s ability to cover interest expenses with operating income.

Role of Financial Ratios in Decision-Making

Financial ratios help investors and stakeholders assess a company’s performance by providing valuable information for decision-making. By analyzing these ratios, investors can compare companies within the same industry, identify trends over time, and evaluate the company’s financial health before making investment decisions. Stakeholders can also use financial ratios to monitor the company’s performance, identify areas of improvement, and make strategic decisions to enhance profitability and sustainability.

Categories of Financial Ratios

Financial ratios are categorized into four main categories: liquidity, profitability, solvency, and efficiency. Each category provides unique insights into a company’s financial position, helping investors, analysts, and stakeholders evaluate the overall health and performance of the business.

Liquidity

Liquidity ratios assess a company’s ability to meet its short-term obligations and manage cash flow effectively. The main liquidity ratios include the current ratio, quick ratio, and cash ratio. These ratios indicate whether a company has enough liquid assets to cover its current liabilities and operate smoothly without facing financial distress.

Profitability

Profitability ratios evaluate a company’s ability to generate profits relative to its revenue, assets, and equity. Key profitability ratios include the gross profit margin, net profit margin, return on assets (ROA), and return on equity (ROE). These ratios help investors gauge the efficiency of a company in utilizing its resources to generate profits and create value for shareholders.

Solvency

Solvency ratios focus on a company’s long-term financial health and its ability to meet long-term obligations. Debt to equity ratio, interest coverage ratio, and debt ratio are common solvency ratios used to assess a company’s leverage and financial stability. These ratios provide insights into the company’s ability to repay its long-term debt and stay solvent in the long run.

Efficiency

Efficiency ratios measure how effectively a company utilizes its assets and liabilities to generate revenue and manage expenses. Inventory turnover ratio, accounts receivable turnover ratio, and asset turnover ratio are examples of efficiency ratios that help assess operational efficiency and asset management. These ratios highlight the company’s ability to generate sales, collect payments, and optimize resource utilization.

Calculating Financial Ratios

Financial ratios are crucial tools used by investors, analysts, and managers to evaluate a company’s financial performance and health. Calculating these ratios involves using data from financial statements to provide insights into various aspects of a company’s operations.

Common Financial Ratios Formulas

- The current ratio is calculated by dividing current assets by current liabilities. It indicates a company’s ability to cover short-term obligations.

Current Ratio = Current Assets / Current Liabilities

- The Return on Equity (ROE) ratio measures a company’s profitability by showing how much profit a company generates with shareholders’ equity.

ROE = Net Income / Shareholders’ Equity

- The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity, reflecting its capital structure.

Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

Step-by-Step Guide to Compute Financial Ratios

- Collect the necessary financial statements, including the balance sheet, income statement, and cash flow statement.

- Identify the values needed for the specific ratio calculation.

- Apply the formula for the desired ratio using the values obtained from the financial statements.

- Calculate and interpret the result to assess the company’s financial health and performance.

Importance of Accurate Financial Data

Accurate financial data is essential for calculating reliable financial ratios. Inaccurate or incomplete data can lead to misleading ratios, impacting decision-making processes. It is crucial to ensure the integrity and accuracy of financial information to derive meaningful insights from ratio analysis.

Interpreting Financial Ratios

Financial ratios provide valuable insights into a company’s financial health and performance. Interpreting these ratios correctly is essential for making informed decisions regarding investments, lending, or overall business strategy.

When assessing a company’s performance, it is crucial to understand what different values of ratios indicate about its financial health. For example, a high current ratio may suggest that a company has more than enough short-term assets to cover its liabilities, indicating good liquidity. On the other hand, a low debt-to-equity ratio may signal that a company is not heavily reliant on debt for financing its operations, indicating financial stability.

Changes in ratios over time can also provide valuable information about a company’s strengths or weaknesses. For instance, a declining gross profit margin could indicate decreasing profitability, while an increasing return on assets may suggest improved efficiency in asset utilization.

Examples of Changes in Ratios

- Decreasing quick ratio over time may indicate worsening liquidity issues.

- An increasing debt-to-equity ratio could signal higher financial risk due to increased debt levels.

- Rising inventory turnover ratio may suggest better inventory management and faster sales cycles.

Limitations of Financial Ratios

Financial ratios are powerful tools for analyzing the financial health of a company, but they do have limitations that need to be considered when interpreting the results. These limitations can affect the accuracy and reliability of the analysis, as well as the overall understanding of the financial position of the company.

There are several factors that may impact the effectiveness of financial ratios as the sole method of financial analysis. One of the main limitations is that financial ratios are based on historical data, which may not accurately reflect the current financial situation of the company. Economic conditions, industry trends, and other external factors can also influence the accuracy of financial ratios.

Impact of Historical Data

Financial ratios are calculated using historical financial data, which may not capture the most current financial position of a company. This can be particularly problematic during periods of rapid change or economic uncertainty. For example, if a company has recently undergone a major restructuring or acquisition, the historical data used to calculate financial ratios may no longer be relevant.

Industry Specific Factors

Different industries have varying financial structures and operating models, which can make it challenging to compare financial ratios across different sectors. For example, a high debt-to-equity ratio may be common and acceptable in one industry, while in another industry it may indicate financial distress. This makes it important to consider industry norms and benchmarks when interpreting financial ratios.

External Factors Impacting Interpretation

External factors such as changes in regulations, economic conditions, or competitive landscape can also impact the interpretation of financial ratios. For example, a sudden increase in interest rates could have a significant impact on the debt levels of a company, affecting key ratios like the debt-to-equity ratio. It is essential to consider these external factors when analyzing financial ratios to ensure a more accurate assessment of the company’s financial health.

Using Financial Ratios for Decision-Making

Financial ratios play a crucial role in decision-making processes, especially when it comes to investment decisions, company comparisons, strategic planning, and forecasting. By analyzing these ratios, investors and stakeholders can gain valuable insights into the financial health and performance of a company, which ultimately aids in making informed decisions.

Utilizing Financial Ratios in Investment Decisions

Financial ratios are essential tools for investors as they provide a snapshot of a company’s financial position and performance. For example, ratios like Return on Investment (ROI), Price-Earnings Ratio (P/E), and Debt-to-Equity Ratio help investors assess the profitability, valuation, and leverage of a company before making investment decisions.

Comparing Companies within the Same Industry

Financial ratios enable investors and analysts to compare companies within the same industry to identify strengths, weaknesses, and potential investment opportunities. For instance, comparing liquidity ratios, profitability ratios, and efficiency ratios of competitors helps in determining which company is more financially stable and efficient in utilizing its resources.

Role of Financial Ratios in Strategic Planning and Forecasting

Financial ratios are integral in strategic planning and forecasting as they provide valuable insights into a company’s financial performance over time. By analyzing trends in ratios like Return on Assets (ROA), Gross Margin Ratio, and Quick Ratio, companies can make informed decisions regarding resource allocation, growth strategies, and future financial projections.