As Comparing investment vehicles takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

Investment vehicles play a crucial role in shaping financial portfolios, offering various options for individuals to grow their wealth. Understanding the different types, risks, liquidity, and tax implications is paramount in making informed investment decisions.

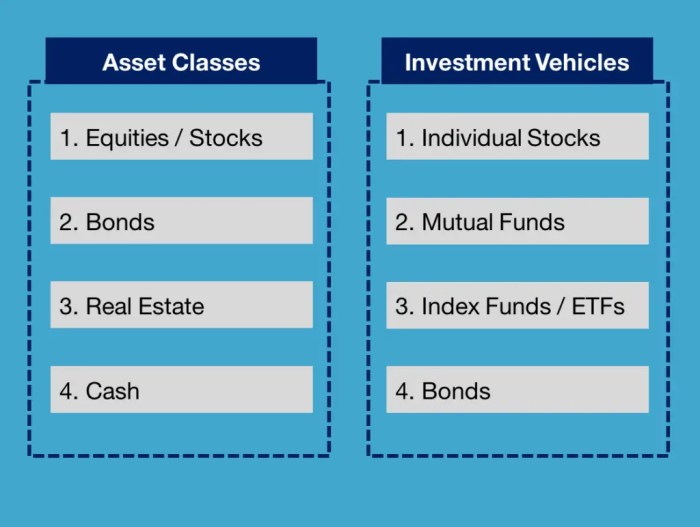

Types of Investment Vehicles

Investment vehicles are assets or instruments that individuals or institutions can use to invest their money with the expectation of generating a return. There are several types of investment vehicles available to investors, each with its own characteristics and potential benefits. Let’s explore some of the most common types:

Stocks

Stocks represent ownership in a company and are bought and sold on stock exchanges. Investors purchase shares of a company’s stock in the hope that the value will increase over time, allowing them to sell the shares at a profit. Stocks are considered to be higher risk investments compared to other vehicles like bonds due to their volatility. Examples of popular stocks include Apple Inc., Amazon.com Inc., and Microsoft Corporation.

Bonds

Bonds are debt securities issued by governments or corporations to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are generally considered to be lower risk investments compared to stocks, making them a popular choice for conservative investors. Examples of popular bonds include U.S. Treasury bonds, corporate bonds, and municipal bonds.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They are managed by professional fund managers who make investment decisions on behalf of the fund’s shareholders. Mutual funds offer investors the opportunity to invest in a wide range of securities with relatively low initial investment amounts. Examples of popular mutual funds include Vanguard Total Stock Market Index Fund, Fidelity Contrafund, and PIMCO Total Return Fund.

Real Estate

Real estate investments involve buying, owning, and managing properties with the goal of generating rental income or capital appreciation. Real estate can be a tangible asset like residential or commercial properties, as well as indirect investments through real estate investment trusts (REITs) or real estate crowdfunding platforms. Real estate investments can provide diversification to a portfolio and serve as a hedge against inflation. Examples of popular real estate investments include rental properties, REITs like Simon Property Group, and real estate crowdfunding platforms like Fundrise.

Risk and Return Profiles

Investors often face the trade-off between risk and return when choosing among different investment vehicles. Understanding how risk and return profiles vary can help investors make informed decisions to achieve their financial goals.

Factors Influencing Risk and Return

- Asset Class: Different investment vehicles belong to various asset classes such as stocks, bonds, real estate, and commodities. Each asset class carries its own risk and return characteristics based on market conditions and economic factors.

- Time Horizon: The length of time an investor plans to hold an investment can influence the risk and return potential. Generally, longer investment horizons are associated with higher potential returns but also higher volatility.

- Diversification: Diversifying a portfolio by investing in a mix of assets can help reduce overall risk. By spreading investments across different asset classes and industries, investors can mitigate the impact of market fluctuations on their returns.

- Market Conditions: External factors such as interest rates, inflation, geopolitical events, and market sentiment can impact the risk and return profiles of investment vehicles. Investors need to stay informed about current market conditions to make strategic investment decisions.

Assessing Risk and Return

- Historical Performance: Examining the historical performance of an investment vehicle can provide insights into its past risk and return characteristics. However, past performance is not a guarantee of future results.

- Risk Tolerance: Understanding one’s risk tolerance is crucial in determining the appropriate mix of investments. Investors with a higher risk tolerance may be willing to accept greater fluctuations in returns for the potential of higher profits.

- Sharpe Ratio: The Sharpe ratio is a measure that evaluates the risk-adjusted return of an investment. It considers both the return generated and the volatility experienced, providing a more comprehensive view of risk and return compared to standalone metrics.

- Consulting with Financial Advisors: Seeking guidance from financial advisors or professionals can help investors assess the risk and return potential of different investment options. Advisors can provide personalized recommendations based on an investor’s financial goals, risk tolerance, and time horizon.

Liquidity and Accessibility

Liquidity refers to how quickly and easily an investment can be converted into cash without significantly impacting its price. Accessibility, on the other hand, pertains to how readily an investor can access their funds invested in a particular vehicle.

Liquidity Across Investment Vehicles

Different investment vehicles offer varying levels of liquidity. For example, publicly traded stocks and bonds are generally considered highly liquid as they can be bought and sold easily on the stock market. On the other hand, real estate or certain types of alternative investments like private equity or hedge funds may have limited liquidity as they require more time and effort to sell or cash out.

Accessibility to Funds

Accessibility to funds can vary depending on the investment vehicle chosen. For instance, mutual funds typically offer daily liquidity, allowing investors to redeem their shares and access their funds relatively quickly. In contrast, investments like annuities or certain retirement accounts may have restrictions or penalties for early withdrawals, limiting accessibility to the invested funds.

Examples of High Liquidity vs. Limited Accessibility

- High Liquidity:

- Publicly traded stocks

- Exchange-traded funds (ETFs)

- Mutual funds

- Limited Accessibility:

- Real estate investments

- Private equity

- Hedge funds

Tax Implications

Investors must consider the tax implications of different investment vehicles when making financial decisions. The way investments are taxed can significantly impact the overall return and profitability of an investment portfolio.

Taxation of Different Investment Vehicles

- Stocks: When investors sell stocks for a profit, they are typically subject to capital gains tax. Dividends received from stocks are also taxed, but at a different rate compared to capital gains.

- Bonds: Interest income from bonds is usually taxed at ordinary income tax rates. However, certain types of bonds, such as municipal bonds, may be exempt from federal taxes.

- Real Estate: Rental income from real estate properties is subject to income tax. Additionally, capital gains tax applies when selling a property for a profit.

- Retirement Accounts: Contributions to traditional retirement accounts are tax-deductible, but withdrawals are taxed as ordinary income. Roth retirement accounts offer tax-free withdrawals in retirement.

Comparing Tax Advantages and Disadvantages

- Stocks: Capital gains from stocks held for over a year are taxed at a lower rate, providing a tax advantage for long-term investors. However, dividends are taxed at ordinary income tax rates.

- Bonds: While interest income from bonds is taxed at ordinary income rates, certain bonds like municipal bonds may offer tax-free income for investors in higher tax brackets.

- Real Estate: The tax advantages of real estate investing include deductions for mortgage interest, property taxes, and depreciation. However, capital gains tax can erode profits when selling a property.

- Retirement Accounts: Traditional retirement accounts offer tax-deferred growth, allowing investments to grow tax-free until withdrawal. Roth accounts provide tax-free withdrawals in retirement but do not offer upfront tax deductions.

Optimizing Tax Situation through Investment Choices

Investors can optimize their tax situation by strategically choosing the right investment vehicle based on their financial goals and tax bracket. For example, high-income earners may benefit from investing in municipal bonds to minimize tax liabilities, while individuals in lower tax brackets may find traditional retirement accounts more advantageous for tax deferral.