Delving into compound interest calculator, this introduction immerses readers in a unique and compelling narrative that explores the intricacies of compound interest and how calculators play a vital role in financial planning.

Compound interest is a fundamental concept in finance that can have a significant impact on investments and savings. Understanding how compound interest works and utilizing a calculator can empower individuals to make informed financial decisions.

What is Compound Interest?

Compound interest is the interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. This means that interest is earned on both the initial amount of money (the principal) and on the interest accumulated over time.

For example, if you invest $1000 in a savings account with an annual interest rate of 5%, the compound interest will allow your investment to grow not only based on the $1000 you initially deposited but also on the interest that your money earns each year. This compounding effect leads to exponential growth of your investment over time.

Difference between Compound Interest and Simple Interest

Simple Interest

Simple interest is calculated only on the principal amount of a loan or deposit. The interest remains the same throughout the entire period, and there is no compounding involved.

Compound Interest

Compound interest, on the other hand, involves the reinvestment of interest earned back into the principal amount, resulting in interest being calculated on an increasing principal balance. This leads to higher returns compared to simple interest, especially over longer periods.

In essence, compound interest allows for the exponential growth of an investment or debt over time, while simple interest remains constant throughout the duration of the loan or deposit.

Importance of Using a Compound Interest Calculator

Using a compound interest calculator is essential for effective financial planning and decision-making. This tool offers several advantages that can greatly benefit individuals seeking to grow their wealth and secure their financial future.

Accurate Calculations for Informed Decision-making

Utilizing a compound interest calculator ensures precise and reliable calculations, enabling individuals to make informed decisions regarding their investments and savings. By inputting variables such as initial investment amount, interest rate, compounding frequency, and time period, users can accurately determine the future value of their investments. This accuracy is crucial for setting realistic financial goals and developing a strategic plan to achieve them.

Visualization of Growth Potential

One of the key advantages of using a compound interest calculator is the ability to visualize the growth potential of investments over time. By adjusting the input variables, users can see how small changes in factors like interest rate or compounding frequency can significantly impact the final amount. This visual representation helps individuals understand the power of compounding and motivates them to make smart financial choices.

Comparison of Investment Options

Another benefit of a compound interest calculator is the ability to compare different investment options quickly and effectively. By running multiple scenarios with varying parameters, individuals can assess which investment strategy offers the highest returns and aligns with their risk tolerance. This comparative analysis empowers users to choose the most suitable investment option based on their financial goals and preferences.

Planning for Retirement and Long-term Goals

For individuals planning for retirement or other long-term financial goals, a compound interest calculator is an invaluable tool. By projecting the growth of investments over several years or decades, users can determine how much they need to save regularly to achieve their desired financial milestones. This long-term perspective enables better planning and ensures individuals are on track to meet their future financial needs.

Features of a Compound Interest Calculator

Compound interest calculators are powerful tools that help individuals and businesses understand how their investments can grow over time. These calculators typically include key features that enable users to input various variables and obtain accurate calculations based on the principles of compound interest.

Key Features

- Principal Amount: This feature allows users to input the initial amount of money invested or borrowed.

- Interest Rate: Users can specify the annual interest rate, which determines the rate at which the investment grows over time.

- Compounding Frequency: Different calculators offer options to select the compounding frequency, such as annually, semi-annually, quarterly, monthly, or daily.

- Time: Users can input the total time period for which the investment will grow, typically in years.

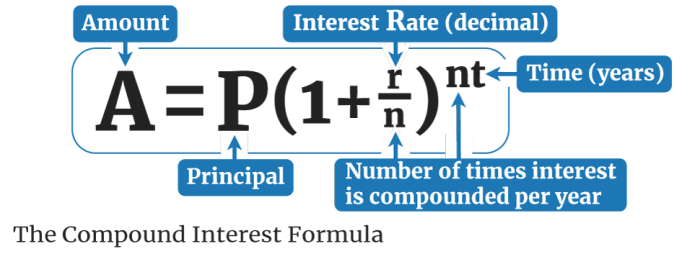

Compound interest is calculated using the formula: A = P(1 + r/n)^(nt), where A is the future value of the investment, P is the principal amount, r is the annual interest rate, n is the number of compounding periods per year, and t is the time the money is invested for.

Types of Compound Interest Calculators

- Basic Calculators: These calculators provide simple interfaces for inputting the principal amount, interest rate, compounding frequency, and time to calculate the future value of the investment.

- Advanced Calculators: Some calculators may offer additional features like inflation adjustments, tax considerations, and varying interest rates over time for more complex financial scenarios.

- Online Tools: There are various compound interest calculators available online, ranging from basic web-based calculators to sophisticated financial planning tools that can generate detailed investment projections.

How to Use a Compound Interest Calculator

When using a compound interest calculator, it is essential to input the correct data to obtain accurate results. Here is a step-by-step guide on how to effectively use a compound interest calculator:

Inputting Data

To calculate compound interest, you will need to input the following data into the calculator:

- Principal Amount: This is the initial amount of money you are investing or borrowing.

- Interest Rate: The annual interest rate expressed as a percentage.

- Compounding Period: The frequency at which interest is compounded, such as annually, semi-annually, quarterly, or monthly.

- Time: The number of years the money will be invested or borrowed.

Interpreting Results

Once you have inputted all the necessary data, the compound interest calculator will generate the following results:

- Future Value: The total amount of money accumulated after a specific period, including both the principal and the interest.

- Interest Earned: The total amount of interest earned on the principal amount over the specified time period.

It is crucial to double-check your input data before calculating compound interest to ensure the accuracy of the results.