As bond investment tips take center stage, this opening passage delves into the importance of bond investments, types of bonds, factors to consider before investing, and strategies for successful bond investing. It provides a solid foundation for readers to navigate the complexities of bond investments with confidence and expertise.

Importance of Bond Investments

Investing in bonds is crucial for building a well-rounded and diversified investment portfolio. Bonds offer a unique set of benefits that can help investors achieve their financial goals.

Balancing Risk and Return

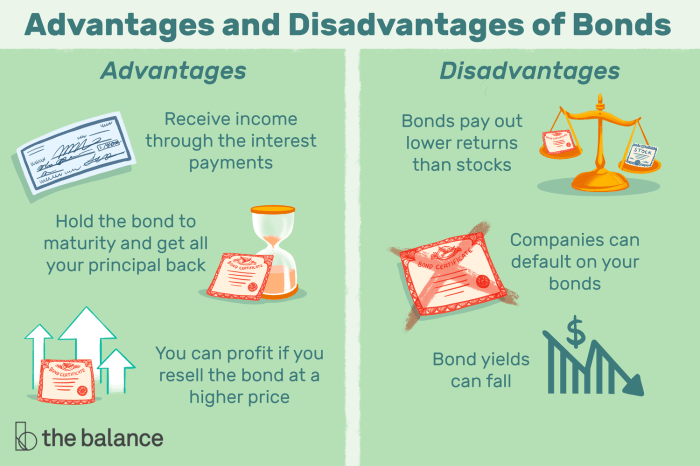

Bonds play a key role in balancing the risk and return profile of an investment strategy. While stocks are known for their potential high returns, they also come with higher volatility and risk. By including bonds in a portfolio, investors can reduce overall risk exposure and achieve a more stable return over time. Bonds typically have a lower correlation with stocks, which means they can help offset losses during market downturns.

Income and Stability

One of the main advantages of investing in bonds is the steady income they provide. Bonds pay interest regularly, providing investors with a predictable cash flow stream. This income can be especially valuable for retirees or those looking for a reliable source of passive income. Additionally, bonds are generally considered less volatile than stocks, offering stability to an investment portfolio during market fluctuations.

Types of Bonds

Government Bonds:

Government bonds are issued by the government to raise funds for various projects or government operations. These bonds are considered low-risk investments as they are backed by the full faith and credit of the government. Examples include U.S. Treasury bonds and bonds issued by other governments around the world.

Corporate Bonds:

Corporate bonds are issued by corporations to raise capital for business operations, expansions, or other purposes. These bonds typically offer higher yields than government bonds but come with higher risk. The creditworthiness of the issuing company plays a significant role in determining the risk associated with corporate bonds.

Municipal Bonds:

Municipal bonds are issued by state or local governments to fund public projects such as schools, highways, or utilities. These bonds are exempt from federal taxes and, in some cases, state and local taxes. Municipal bonds are considered relatively safe investments, especially when issued by financially stable municipalities.

Savings Bonds:

Savings bonds are issued by the U.S. Department of the Treasury and are considered one of the safest investments available. These bonds are non-marketable and can only be purchased at face value. Savings bonds typically have a fixed interest rate and are backed by the U.S. government.

Each type of bond has its own features and risks, making them suitable for different types of investors. Government bonds are ideal for conservative investors looking for a low-risk investment option. Corporate bonds may be suitable for investors willing to take on higher risk in exchange for potentially higher returns. Municipal bonds are often favored by investors seeking tax advantages. Savings bonds are a good option for those looking for a safe and stable investment with minimal risk.

Factors to Consider Before Investing in Bonds

When considering investing in bonds, there are several key factors that investors should take into account to make informed decisions and optimize their portfolios.

Credit Rating

The credit rating of a bond is a crucial factor to consider before investing. Bonds with higher credit ratings are generally considered less risky as they are issued by financially stable entities. On the other hand, bonds with lower credit ratings may offer higher yields but come with increased risk of default.

Interest Rate Environment

The prevailing interest rate environment can significantly impact bond investments. When interest rates rise, bond prices tend to fall, and vice versa. Investors should assess the current interest rate scenario and its potential impact on bond prices and yields before making investment decisions.

Maturity

The maturity of a bond refers to the period until the principal amount is repaid. Short-term bonds typically have lower yields but are less exposed to interest rate risk, while long-term bonds offer higher yields but are more sensitive to interest rate fluctuations. Investors should align the maturity of bonds with their investment goals and risk tolerance.

Liquidity

Liquidity is another important factor to consider before investing in bonds. Highly liquid bonds are easily tradable in the market, allowing investors to exit their positions quickly if needed. Illiquid bonds, on the other hand, may have limited buyers and sellers, which can impact the ease of trading and pricing.

Economic Conditions

Economic conditions, such as inflation, GDP growth, and unemployment rates, can influence bond prices and yields. Investors should stay informed about macroeconomic indicators and trends to anticipate how these factors may impact the performance of their bond investments.

Thorough Research

Conducting thorough research before selecting bonds for investment is essential. Investors should analyze the issuer’s financial health, market conditions, and other relevant factors to make informed decisions. Utilizing resources like credit reports, financial statements, and market analyses can help investors assess the risks and potential returns associated with different bond investments.

Strategies for Successful Bond Investing

When it comes to successful bond investing, having a well-thought-out strategy is crucial. Here are some key strategies to consider when building a diversified bond portfolio and managing interest rate risk.

Building a Diversified Bond Portfolio

Building a diversified bond portfolio involves spreading your investments across different types of bonds to reduce risk. Here are some strategies to achieve diversification:

- Invest in bonds with varying maturities: By investing in bonds with different maturity dates, you can spread out the risk of interest rate fluctuations.

- Diversify across sectors and industries: Investing in bonds from different sectors and industries can help mitigate the risk associated with any single sector experiencing difficulties.

- Consider international bonds: Investing in bonds from different countries can provide additional diversification benefits.

Bond Laddering

Bond laddering is a strategy where you invest in bonds with staggered maturity dates. This approach helps spread out reinvestment risk and allows you to take advantage of different interest rate environments. Here’s how bond laddering works:

As bonds in the ladder mature, you can reinvest the proceeds in new bonds at current market rates, potentially capturing higher yields in rising rate environments.

Managing Interest Rate Risk

Interest rate risk is a significant consideration for bond investors, as rising interest rates can lead to a decrease in bond prices. Here are some tips to manage interest rate risk effectively:

- Consider investing in floating rate bonds: These bonds have interest rates that adjust periodically based on a benchmark rate, helping to mitigate interest rate risk.

- Focus on short to intermediate-term bonds: Shorter-term bonds are less sensitive to interest rate changes compared to long-term bonds.

- Diversify your bond holdings: As mentioned earlier, diversification can help reduce the impact of interest rate changes on your overall portfolio.