How to trade forex like a pro sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset.

Currency trading, often referred to as forex trading, is a dynamic and complex market that requires skill and strategy to navigate successfully. Whether you’re a novice looking to dip your toes into the world of trading or an experienced trader seeking to up your game, mastering the art of forex trading like a pro is essential for success in this fast-paced arena.

Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, involves buying and selling currencies in the global marketplace. It is the largest financial market in the world, with trillions of dollars traded daily.

Basics of the Forex Market

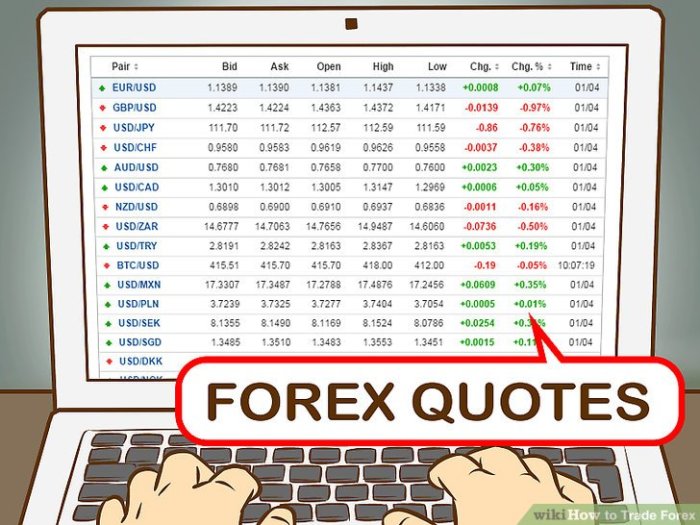

The forex market operates 24 hours a day, five days a week, allowing traders to participate from anywhere in the world. Currency pairs are traded, such as EUR/USD or GBP/JPY, where one currency is exchanged for another at an agreed-upon exchange rate.

- Market Participants: The main players in the forex market include banks, financial institutions, corporations, governments, and individual traders.

- Liquidity: The forex market is highly liquid, meaning there is a high volume of trading activity, making it easy to enter and exit positions.

- Volatility: Currency prices can fluctuate rapidly due to various factors, such as economic indicators, geopolitical events, and market sentiment.

- Risk Management: Traders use tools like stop-loss orders and position sizing to manage risk and protect their capital.

How Forex Trading Works

In forex trading, traders speculate on the price movements of currency pairs. They aim to profit from the fluctuations in exchange rates by buying low and selling high or selling high and buying low.

Buy low, sell high; Sell high, buy low – the key principle in forex trading.

- Technical Analysis: Traders use charts, indicators, and patterns to analyze price movements and identify potential trading opportunities.

- Fundamental Analysis: Traders also consider economic data, news events, and geopolitical developments to make informed trading decisions.

- Leverage: Forex trading allows traders to control larger positions with a smaller amount of capital, magnifying both profits and losses.

- Brokerage Accounts: Traders open brokerage accounts to access the forex market and execute trades through online trading platforms.

Essential Skills for Successful Forex Trading

To trade forex like a pro, it is essential to possess certain key skills that can help you navigate the complexities of the market and make informed trading decisions. These skills include a combination of technical knowledge, analytical abilities, and risk management strategies.

Importance of Risk Management in Forex Trading

Effective risk management is crucial in forex trading to protect your capital and minimize potential losses. By setting stop-loss orders, calculating position sizes based on risk tolerance, and diversifying your trades, you can mitigate the impact of unfavorable market movements and preserve your trading account.

Significance of Technical Analysis in Making Trading Decisions

Technical analysis plays a vital role in forex trading by helping traders identify trends, patterns, and potential entry and exit points in the market. By analyzing price charts, using technical indicators, and understanding key support and resistance levels, traders can make more informed decisions and improve their trading performance.

Developing a Trading Strategy

Creating a trading strategy in forex is crucial for success in the market. It involves defining your goals, risk tolerance, and time horizon.

Types of Trading Strategies

- Day Trading: Involves making multiple trades within a single day to profit from short-term price movements.

- Swing Trading: Focuses on capturing short to medium-term gains by holding positions for several days to weeks.

- Trend Trading: Aims to profit from the direction of the market trend over a longer period.

- Range Trading: Involves identifying support and resistance levels to trade within a price range.

Tips for Testing and Optimizing a Trading Strategy

- Backtesting: Use historical data to see how your strategy would have performed in the past.

- Paper Trading: Practice your strategy with a demo account before risking real money.

- Keep a Trading Journal: Record your trades, reasons for entering/exiting, and emotions to analyze your performance.

- Adjust and Refine: Continuously monitor and tweak your strategy based on market conditions and your results.

Risk Management Techniques

When trading forex, it is crucial to implement effective risk management techniques to protect your capital and minimize potential losses. By utilizing various strategies, such as setting stop-loss and take-profit levels, as well as proper position sizing, you can significantly improve your overall trading performance.

Setting Stop-Loss and Take-Profit Levels

- Setting stop-loss levels helps you define the maximum amount of loss you are willing to tolerate on a trade. This prevents emotional decision-making and ensures you exit a losing trade before it erodes your account balance.

- Take-profit levels are equally important as they help you lock in profits at a predetermined price point. This ensures that you capitalize on winning trades and prevent giving back gains due to market volatility.

Position Sizing

- Position sizing refers to the number of units or lots you trade in a single transaction. By calculating the appropriate position size based on your account size, risk tolerance, and stop-loss level, you can control the amount of risk exposure in each trade.

- Implementing proper position sizing helps you manage risk effectively by limiting the impact of losing trades on your overall account balance. It also allows you to diversify your trades and avoid overleveraging, which can lead to significant losses.

Choosing the Right Broker

When it comes to trading forex like a pro, choosing the right broker is crucial. Your broker will be your gateway to the forex market, so it’s essential to make an informed decision. Here are some factors to consider when selecting a forex broker:

Regulation and Security

Regulation and security should be at the top of your list when choosing a forex broker. Make sure the broker is regulated by a reputable financial authority in their country of operation. This ensures that they adhere to strict rules and guidelines, providing you with a level of protection.

- Check if the broker is registered with regulatory bodies like the CFTC (Commodity Futures Trading Commission) in the US or the FCA (Financial Conduct Authority) in the UK.

- Look for brokers that offer segregated accounts to keep your funds separate from the company’s operating funds.

- Consider the broker’s reputation and history of security breaches or fraudulent activities.

Comparing Broker Offerings

It’s important to compare different brokers and their offerings to find the best fit for your trading style and preferences. Here are some tips on how to compare brokers effectively:

- Look at the broker’s trading platform and make sure it is user-friendly and offers the tools and features you need for successful trading.

- Consider the broker’s fees and commissions, including spreads, swaps, and deposit/withdrawal charges.

- Evaluate the broker’s customer support services and responsiveness to inquiries or issues.

- Check the available trading instruments and markets offered by the broker to ensure they align with your trading goals.

Utilizing Fundamental Analysis

Fundamental analysis plays a crucial role in forex trading as it focuses on the underlying factors that drive the value of currencies. By analyzing economic indicators, news events, and other factors that affect the overall economy, traders can make more informed decisions.

Role of Economic Indicators and News Events

- Economic indicators such as GDP growth, employment rates, inflation, and interest rates can provide insight into the health of a country’s economy, influencing the value of its currency.

- News events, such as central bank announcements, geopolitical developments, and economic reports, can cause volatility in the forex market and impact currency prices.

Incorporating Fundamental Analysis into Trading Decisions

- Stay informed about economic data releases and news events that could affect the currencies you are trading.

- Consider the broader economic context and how it may impact currency pairs, such as trade balances, political stability, and monetary policy.

- Use a combination of fundamental analysis with technical analysis to get a comprehensive view of the market and make well-rounded trading decisions.

Mastering Technical Analysis: How To Trade Forex Like A Pro

Technical analysis is a crucial aspect of forex trading that involves analyzing historical price data to predict future price movements. By mastering technical analysis, traders can make informed decisions based on chart patterns, trends, and support/resistance levels.

Technical Analysis Tools, How to trade forex like a pro

- One of the most commonly used technical analysis tools in forex trading is moving averages. These indicators help traders identify trends and potential entry/exit points.

- Another important tool is the Relative Strength Index (RSI), which measures the speed and change of price movements. This can help traders determine overbought or oversold conditions.

- Bollinger Bands are also popular among forex traders as they help identify volatility and potential price breakouts.

Reading and Interpreting Forex Charts

- Forex charts come in different timeframes, such as daily, hourly, or even minute charts. Understanding these charts is essential for identifying trends and making trading decisions.

- Candlestick patterns are widely used in forex trading to predict price movements. By learning to interpret these patterns, traders can gain insights into market sentiment.

Trend Analysis and Support/Resistance Levels

- Identifying trends in forex markets is crucial for successful trading. Traders can use trendlines and moving averages to determine the direction of the market.

- Support and resistance levels are key price levels where the market tends to react. By recognizing these levels on a chart, traders can anticipate potential reversals or breakouts.