Get ready to dive into the world of Annuities explained, where we break down complex financial jargon into a language everyone can understand. From understanding the basics to exploring the nitty-gritty details, this guide will have you covered every step of the way.

So, buckle up and let’s unravel the mysteries surrounding annuities in a way that’s both informative and fun!

What are Annuities?

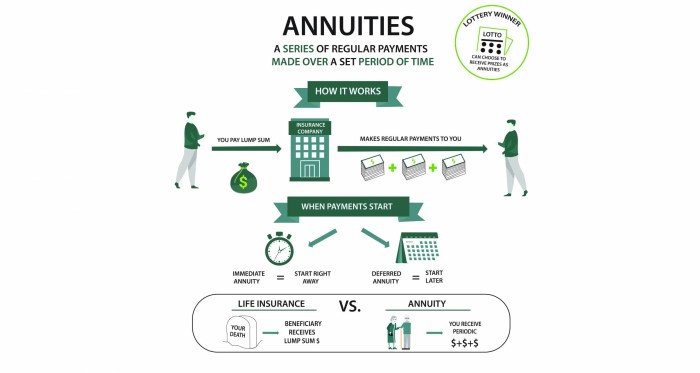

Annuities are financial products designed to provide a steady stream of income over a specified period, often used as a tool for retirement planning. They are typically sold by insurance companies and come in various forms to suit different financial goals and risk tolerances.

Types of Annuities

Annuities can be broadly categorized into two main types: fixed annuities and variable annuities.

- Fixed Annuities: These annuities offer a guaranteed payout to the annuitant over a fixed period or for life. The interest rate is usually predetermined by the insurance company, providing a stable income stream.

- Variable Annuities: In contrast, variable annuities allow the annuitant to invest in sub-accounts that are linked to the performance of underlying investments such as stocks and bonds. The payouts vary depending on the performance of these investments, offering the potential for higher returns but also greater risks.

How do Annuities Work?

Annuities work as a form of investment where an individual makes regular payments to an insurance company, and in return, the insurance company provides a stream of income in the future. This can be used as a way to save for retirement or receive regular payments over a specific period of time.

Investment Process

An individual can purchase an annuity by making a lump sum payment or through a series of payments over time. The insurance company then invests these funds to generate returns, which will determine the amount of income the individual will receive in the future.

- Annuities can be fixed, where the payments are predetermined, or variable, where the payments depend on the performance of the underlying investments.

- There are also immediate annuities, where payments start right away, and deferred annuities, where payments begin at a later date.

- Individuals can choose between different payout options, such as receiving payments for a set number of years or for the rest of their life.

Role of Insurance Companies

Insurance companies play a crucial role in offering annuities by managing the investments and assuming the risk of providing the guaranteed income stream. They use actuarial calculations to determine the amount of income that can be paid out based on factors such as life expectancy and interest rates.

Insurance companies provide a sense of security and stability to individuals looking to secure their financial future through annuities.

Types of Annuities

When it comes to annuities, there are three main types: fixed, variable, and indexed annuities. Each type has its own set of benefits and drawbacks, making them suitable for different financial goals and situations.

Fixed Annuities

Fixed annuities offer a guaranteed rate of return over a specific period, providing a stable source of income for retirees or those looking for steady growth. The main benefit of fixed annuities is the predictability of returns, making them a low-risk option for conservative investors. However, one drawback is that the returns may not keep up with inflation over time.

Variable Annuities

Variable annuities allow investors to choose from a selection of investment options, such as mutual funds, which can potentially lead to higher returns. The main benefit of variable annuities is the opportunity for growth, but this comes with higher risk due to market fluctuations. Additionally, variable annuities often come with higher fees compared to other annuity types.

Indexed Annuities

Indexed annuities offer returns based on the performance of a specific market index, such as the S&P 500. These annuities provide a way to participate in market gains while offering downside protection. The main benefit of indexed annuities is the potential for higher returns than fixed annuities, with less risk than variable annuities. However, indexed annuities may have caps on returns and participation rates, limiting the potential upside.

Overall, the choice between fixed, variable, and indexed annuities depends on your risk tolerance, investment goals, and financial situation. It’s essential to carefully consider your options and consult with a financial advisor to determine which type of annuity aligns best with your needs.

Annuity Payments

When it comes to annuities, understanding how the payments are calculated is crucial. Annuity payments are the periodic disbursements made to the annuitant by the insurance company. These payments are based on a variety of factors, including the initial investment, the type of annuity, the length of the payout period, and the annuitant’s life expectancy.

Calculation of Annuity Payments

Annuity payments are typically calculated using actuarial formulas that take into account the annuitant’s age, the amount of the initial investment, and the chosen payout option. One common method is the life expectancy method, which estimates how long the annuitant will live and adjusts the payments accordingly. Another method is the fixed period method, where payments are made for a specific number of years.

Frequency Options for Receiving Annuity Payments

Annuity payments can be received on a monthly, quarterly, semi-annual, or annual basis, depending on the annuitant’s preference. The frequency of payments can impact the total amount received over the payout period, with more frequent payments resulting in smaller individual payments.

Tax Implications of Annuity Payments

It’s important to consider the tax implications of annuity payments. In most cases, the portion of each annuity payment that represents earnings is subject to income tax. However, if the annuity was purchased with after-tax dollars, only the portion that represents earnings is taxable. Additionally, if the annuity is held within a qualified retirement account, such as an IRA or 401(k), the entire payment may be subject to income tax.

Annuity Fees and Charges

When it comes to annuities, understanding the various fees and charges associated with them is crucial. These fees can have a significant impact on the overall performance of your annuity and the returns you receive. Let’s take a closer look at some common fees and charges you may encounter and how they can affect your annuity.

Types of Annuity Fees

- Management Fees: These are ongoing fees charged by the insurance company for managing your annuity investments.

- Mortality and Expense Risk Fees: This fee covers the insurance risks involved in providing the annuity, including the cost of providing death benefits.

- Administrative Fees: These fees cover the administrative costs associated with maintaining your annuity account.

- Surrender Charges: If you withdraw money from your annuity before a certain period, you may incur surrender charges.

- Underlying Investment Fees: If your annuity is invested in mutual funds or other investments, you may also incur fees related to those investments.

Impact of Fees on Annuity Performance

High fees can eat into your returns over time, reducing the overall performance of your annuity. It’s essential to consider the impact of fees when choosing an annuity provider and understand how they can affect your long-term financial goals.

Comparing Fee Structures

| Annuity Provider | Management Fees | Administrative Fees | Surrender Charges |

|---|---|---|---|

| Provider A | 1% | $50/year | 5% for the first 5 years |

| Provider B | 0.75% | $75/year | 3% for the first 3 years |

| Provider C | 1.5% | $40/year | 6% for the first 6 years |