Benefits of a Roth IRA sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. As we delve into the world of Roth IRAs, we uncover a treasure trove of advantages that can significantly impact your financial future.

Exploring the intricacies of tax benefits, investment options, withdrawal rules, and legacy planning, this guide aims to equip you with the knowledge needed to make informed decisions about your retirement savings strategy.

What is a Roth IRA?

Roth IRA, or Roth Individual Retirement Account, is a type of retirement savings account that allows individuals to contribute after-tax income, which then grows tax-free. Unlike traditional IRAs where contributions are made with pre-tax dollars, Roth IRAs offer tax-free withdrawals during retirement, making them a popular choice for many investors.

Differences from Traditional IRA

A key difference between a Roth IRA and a traditional IRA is how they are taxed. With a traditional IRA, contributions are made with pre-tax dollars, reducing your taxable income in the year of contribution. However, withdrawals during retirement are taxed at ordinary income tax rates. On the other hand, contributions to a Roth IRA are made with after-tax dollars, so they do not provide an immediate tax break. But the withdrawals in retirement, including earnings, are tax-free as long as certain conditions are met.

Eligibility Criteria

- To open a Roth IRA, individuals must have earned income.

- There are income limits for Roth IRA contributions, with the ability to contribute phasing out at certain income levels.

- For 2021, single filers must have a modified adjusted gross income (MAGI) below $140,000 to make full contributions, with a phase-out starting at $125,000. For married couples filing jointly, the limits are $208,000 and $198,000, respectively.

- There is no age limit for contributions to a Roth IRA, unlike traditional IRAs where contributions must stop at age 70 ½.

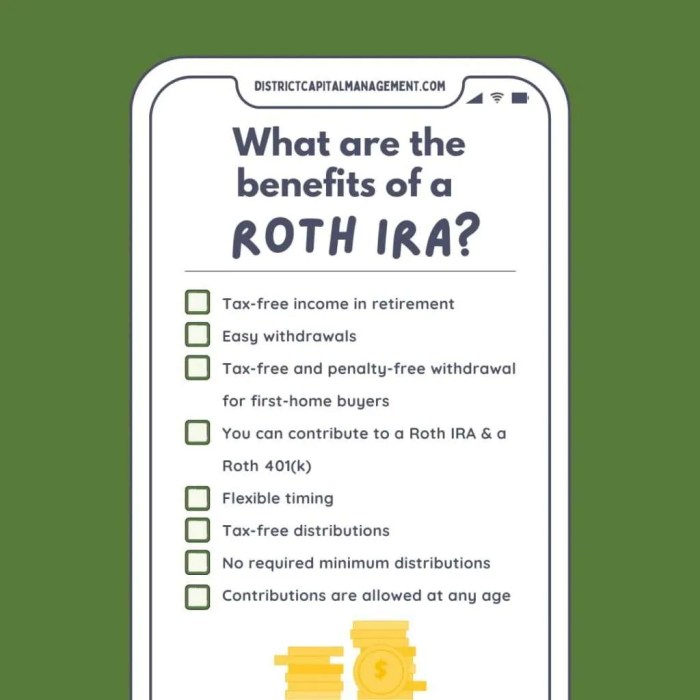

Tax Benefits of a Roth IRA

Contributing to a Roth IRA comes with several tax advantages that can help individuals save money over the long term. One of the key benefits is that contributions to a Roth IRA are made with after-tax dollars, meaning that individuals do not receive a tax deduction for their contributions. However, the real tax benefits come into play when it comes time to withdraw funds from the account.

When it comes to withdrawals from a Roth IRA, the earnings and contributions can be withdrawn tax-free as long as certain conditions are met. This is a significant advantage compared to traditional retirement accounts, such as a 401(k) or a traditional IRA, where withdrawals are typically taxed as ordinary income. Additionally, Roth IRAs do not have required minimum distributions (RMDs) during the account holder’s lifetime, unlike traditional IRAs which mandate withdrawals starting at a certain age.

Comparison with Other Retirement Accounts

- Roth IRA vs. Traditional IRA: While contributions to a traditional IRA may be tax-deductible, withdrawals are taxed as ordinary income. On the other hand, Roth IRA contributions are not tax-deductible, but qualified withdrawals are tax-free.

- Roth IRA vs. 401(k): Both Roth IRAs and 401(k) plans offer tax advantages, but they differ in terms of contribution limits, employer matching, and withdrawal rules. With a 401(k), contributions are made with pre-tax dollars, while Roth IRA contributions are made with after-tax dollars.

Investment Options in a Roth IRA

When it comes to investing within a Roth IRA, individuals have a variety of options to choose from. These investment choices allow account holders to potentially grow their retirement savings over time through different avenues.

Types of Investment Choices

- Stocks: Investing in individual stocks allows for potential high returns, but also comes with higher risk.

- Bonds: Bonds provide a more stable investment option with regular interest payments.

- Mutual Funds: Mutual funds pool together money from multiple investors to invest in a diversified portfolio of assets.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks.

- Real Estate Investment Trusts (REITs): REITs allow investors to access real estate investments without owning physical properties.

Diversifying Roth IRA Investments

Diversification is key to managing risk within a Roth IRA. By spreading investments across different asset classes like stocks, bonds, and real estate, individuals can reduce the impact of volatility in any one sector. For example, an individual could have a mix of stocks, bonds, and mutual funds in their Roth IRA to achieve diversification.

Growth Potential of Investments

Investments held in a Roth IRA have the potential to grow over time due to compounding returns. As earnings within the account are not taxed, the growth of investments can accelerate. For instance, if an individual invests in a mix of stocks and bonds within their Roth IRA, they can benefit from both capital appreciation and interest payments, leading to potential long-term growth of their retirement savings.

Withdrawal Rules and Penalties

When it comes to withdrawing funds from a Roth IRA, there are specific rules and penalties that investors need to be aware of in order to make informed decisions regarding their retirement savings.

Early Withdrawal Penalties

- Withdrawals of earnings from a Roth IRA before the age of 59½ may be subject to both income tax and a 10% early withdrawal penalty.

- This penalty is in addition to any applicable income tax on the withdrawn amount.

- It’s important to note that contributions to a Roth IRA (not earnings) can be withdrawn penalty-free at any time, as they have already been taxed.

Exceptions and Penalty Exemptions

- There are certain exceptions to the early withdrawal penalty, such as using the funds for qualified first-time home purchases, higher education expenses, unreimbursed medical expenses, or in the event of total and permanent disability.

- Additionally, withdrawals due to death or certain qualified reservist distributions may also be exempt from the early withdrawal penalty.

- It’s essential to understand these exceptions and exemptions to avoid unnecessary penalties and ensure that withdrawals are made in accordance with the regulations governing Roth IRAs.

Legacy Planning with a Roth IRA

When it comes to legacy planning, a Roth IRA can be a powerful tool for passing on wealth to beneficiaries. Unlike traditional IRAs, Roth IRAs offer unique advantages in terms of inheritance and estate planning.

One of the key benefits of leaving a Roth IRA to beneficiaries is that they can inherit the account tax-free. This means that the beneficiaries are not required to pay income tax on the distributions they receive from the inherited Roth IRA. This can result in significant tax savings for the beneficiaries, allowing them to maximize the value of the assets they receive.

Benefits of Leaving a Roth IRA to Beneficiaries

- Beneficiaries can enjoy tax-free distributions: Inherited Roth IRAs allow beneficiaries to receive distributions without incurring income tax, providing a valuable source of tax-free income.

- Flexibility in distribution options: Beneficiaries have the flexibility to choose how they receive distributions from the inherited Roth IRA, based on their individual financial needs and goals.

- Potential for continued growth: By inheriting a Roth IRA, beneficiaries have the opportunity to continue the tax-advantaged growth of the assets within the account, potentially increasing their value over time.

Rules Surrounding Inherited Roth IRAs

- Required minimum distributions (RMDs): Beneficiaries of inherited Roth IRAs are generally required to take RMDs based on their life expectancy, but these distributions are tax-free.

- Timing of distributions: Beneficiaries have options for when to take distributions from the inherited Roth IRA, with the ability to stretch out the distributions over their lifetime to maximize tax benefits.

- Non-spouse beneficiaries: Non-spouse beneficiaries have different rules for inheriting Roth IRAs compared to spouses, including options for rollovers and transfers.