Delve into the world of investment research with a focus on best practices. Explore the key aspects that drive informed decision-making and discover the methods and techniques that lead to successful outcomes.

Gain insights into the nuances of data collection, analysis techniques, risk assessment, and effective reporting to enhance your investment research skills.

Understanding Investment Research

Investment research is the process of gathering, analyzing, and interpreting information to evaluate potential investment opportunities. It involves studying various financial assets, market trends, economic indicators, and company performance to make informed investment decisions.

Importance of Investment Research

Investment research is crucial for investors as it helps them make informed decisions based on thorough analysis rather than relying on speculation or emotions. By conducting research, investors can assess the risks and potential returns associated with different investment options, ultimately increasing the likelihood of achieving their financial goals.

- Identifying opportunities: Investment research allows investors to identify undervalued assets or emerging trends that have the potential for high returns.

- Managing risks: By analyzing the financial health of companies, market conditions, and economic factors, investors can better assess and manage risks associated with their investments.

- Optimizing portfolio: Research helps investors diversify their portfolio effectively by selecting a mix of assets that align with their investment objectives and risk tolerance.

Key Elements of Effective Investment Research

Effective investment research involves several key elements that contribute to making well-informed decisions.

- Market Analysis: Understanding market trends, economic conditions, and industry dynamics is essential for evaluating the potential performance of investments.

- Company Research: Analyzing financial statements, management team, competitive positioning, and growth prospects of a company provides insights into its future potential.

- Risk Assessment: Evaluating the risks associated with an investment, including market risk, credit risk, and liquidity risk, helps investors make risk-adjusted decisions.

- Valuation Techniques: Utilizing various valuation methods such as discounted cash flow (DCF), price-to-earnings (P/E) ratio, and comparable company analysis helps determine the intrinsic value of an asset.

Data Collection Methods

Investment research heavily relies on data collection methods to gather information that can inform investment decisions. The accuracy and credibility of the data collected are crucial for making informed choices and minimizing risks in the investment process.

Different Sources for Gathering Investment Research Data

- Primary Sources: These are firsthand sources of data obtained directly from companies, industry experts, government reports, and official documents.

- Secondary Sources: These sources involve information gathered from intermediary sources such as financial publications, research reports, and databases.

- Tertiary Sources: Tertiary sources compile and summarize information from primary and secondary sources, providing a broader overview of the data.

Compare Traditional and Modern Data Collection Methods Used in Investment Research

Traditional data collection methods in investment research often involved manual processes, such as reading physical documents, conducting surveys, and attending conferences. On the other hand, modern data collection methods leverage technology and automation for data gathering, including web scraping, machine learning algorithms, and data analytics tools.

Discuss the Importance of Data Accuracy and Credibility in Investment Research

Data accuracy and credibility are paramount in investment research as they form the foundation for decision-making. Inaccurate or unreliable data can lead to flawed analysis and misguided investment choices, potentially resulting in financial losses. It is essential to verify the sources of data and ensure their credibility to make well-informed investment decisions.

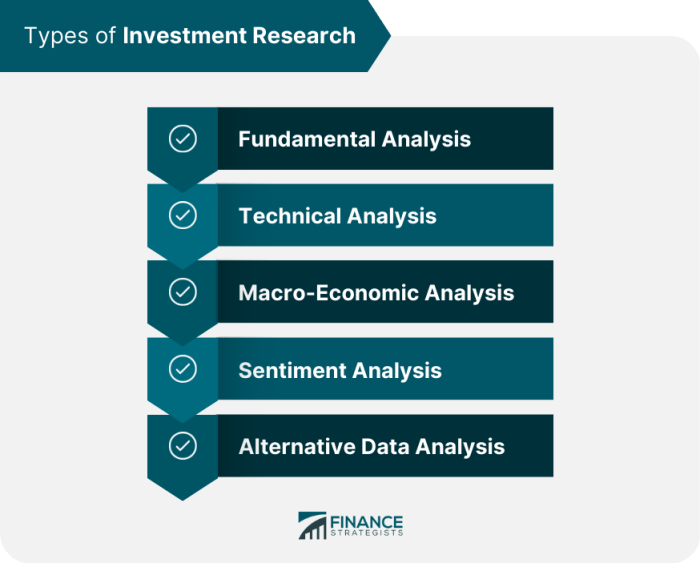

Analysis Techniques

Investment research involves various analysis techniques to interpret data and draw conclusions that guide investment decision-making. These techniques help investors evaluate the potential risks and returns of different investment opportunities.

Quantitative Analysis

Quantitative analysis involves using mathematical and statistical methods to analyze financial data. This includes calculating ratios, such as the price-to-earnings ratio or return on investment, to assess the financial health and performance of a company. For example, investors may use quantitative analysis to compare the financial metrics of different stocks to identify undervalued or overvalued investments.

Qualitative Analysis

Qualitative analysis focuses on non-quantifiable factors, such as company management, industry trends, and competitive positioning. This analysis helps investors understand the qualitative aspects that may impact an investment’s potential success. For instance, qualitative analysis can involve assessing a company’s brand reputation or evaluating the regulatory environment in which it operates.

Technical Analysis

Technical analysis involves analyzing past market data, such as price and volume, to forecast future price movements. This analysis relies on charts and technical indicators to identify trends and patterns that can help predict future price movements. For example, technical analysts may use moving averages or support and resistance levels to make buy or sell decisions.

Scenario Analysis

Scenario analysis involves evaluating how investments may perform under different scenarios or market conditions. By considering various possible outcomes, investors can assess the potential risks and rewards associated with an investment. For instance, investors may conduct scenario analysis to assess how a stock may perform in a recession or during a period of economic growth.

Sensitivity Analysis

Sensitivity analysis helps investors understand how changes in certain variables, such as interest rates or input costs, can impact investment returns. By conducting sensitivity analysis, investors can assess the vulnerability of their investments to different external factors. For example, sensitivity analysis can help investors determine how changes in interest rates may affect the profitability of a bond investment.

Risk Assessment

Risk assessment is a crucial element in investment research, as it allows investors to evaluate the potential risks associated with various investment opportunities. By identifying and analyzing risks, investors can make more informed decisions and develop strategies to mitigate these risks.

Best Practices for Evaluating Risks

- Conduct thorough due diligence on the investment opportunity, including analyzing financial statements, market trends, and the competitive landscape.

- Consider the macroeconomic factors that could impact the investment, such as interest rates, inflation, and geopolitical events.

- Assess the company’s management team and their track record, as well as any regulatory or legal risks that may exist.

- Utilize risk assessment tools and models to quantify and prioritize risks based on their potential impact and likelihood of occurrence.

Influence of Risk Assessment on Research Outcomes

Risk assessment plays a significant role in shaping the outcomes of investment research. By accurately identifying and evaluating risks, researchers can provide more realistic projections and recommendations to investors. Understanding the potential risks allows investors to make more informed decisions and adjust their investment strategies accordingly.

Strategies for Mitigating Risks

- Diversify your investment portfolio to spread risk across different asset classes and industries.

- Implement stop-loss orders or other risk management techniques to limit potential losses.

- Stay informed about market trends and news that could impact your investments, and be prepared to adjust your strategy accordingly.

- Consider using hedging strategies, such as options or futures contracts, to protect your portfolio from adverse market movements.

Reporting and Documentation

When it comes to investment research, reporting and documentation play a crucial role in conveying findings and recommendations to stakeholders. A well-structured and comprehensive report is essential for decision-making and transparency in the investment process.

Components of a Comprehensive Investment Research Report

- Executive Summary: A concise overview of the research findings and recommendations.

- Introduction: Background information on the research objective and scope.

- Methodology: Description of data collection methods, analysis techniques, and risk assessment processes.

- Findings: Presentation of key insights and results derived from the research.

- Recommendations: Actionable suggestions based on the research outcomes.

- Risk Assessment: Evaluation of potential risks associated with the investment.

- Appendices: Additional supporting data, charts, and graphs.

Importance of Clear and Concise Documentation

Clear and concise documentation is crucial in investment research to ensure that stakeholders can easily understand and interpret the findings. It helps in reducing ambiguity, facilitating decision-making, and establishing credibility.

Tips for Effectively Communicating Research Findings to Stakeholders

- Use simple and straightforward language to explain complex concepts.

- Highlight key findings and recommendations for quick reference.

- Utilize visual aids such as charts and graphs to enhance understanding.

- Provide context and background information to support your conclusions.

- Be prepared to answer questions and provide additional information as needed.