Best ways to achieve financial independence: Tips for a secure future. Let’s dive into the ultimate guide to financial freedom, where we explore budgeting, debt management, investment, career growth, and more. Get ready to take charge of your financial destiny!

Importance of Financial Independence

Financial independence is the ability to live comfortably without relying on external sources of income. It means having enough savings and investments to cover expenses and maintain your desired lifestyle. Achieving financial independence is crucial for long-term financial stability as it provides a sense of security and freedom.

Benefits of Financial Independence

- Peace of mind: Knowing that you have enough resources to support yourself and your family can reduce stress and anxiety.

- Flexibility: Financial independence allows you to make choices based on your priorities and values, rather than financial constraints.

- Retirement: Being financially independent means you can retire comfortably and enjoy your golden years without worrying about money.

- Opportunities: With financial independence, you can take advantage of new opportunities, pursue your passions, and invest in your personal growth.

- Generational wealth: Building wealth and achieving financial independence can create a legacy for future generations.

Budgeting and Saving Strategies

Budgeting and saving are crucial components in achieving financial independence. By effectively managing expenses and consistently saving money, individuals can work towards their goal of financial freedom.

Effective Budgeting Techniques

- Track your expenses: Keep a record of all your expenses to identify where your money is going.

- Create a budget: Allocate specific amounts for different categories such as housing, groceries, utilities, and entertainment.

- Avoid unnecessary spending: Cut back on non-essential items and focus on prioritizing your needs over wants.

- Use budgeting apps: Utilize technology to help you track your spending and stick to your budget.

Tips for Consistent Saving

- Pay yourself first: Set aside a portion of your income for savings before spending on anything else.

- Automate your savings: Arrange for automatic transfers to your savings account to ensure regular contributions.

- Set savings goals: Have specific targets to work towards, whether it’s for emergencies, retirement, or other financial milestones.

- Cut down on expenses: Look for ways to reduce your spending and redirect those funds towards savings.

Importance of Emergency Funds

Having an emergency fund is crucial in achieving financial independence as it provides a safety net during unexpected situations. Aim to save at least three to six months’ worth of living expenses in an easily accessible account to cover any unforeseen financial challenges without derailing your long-term goals.

Debt Management

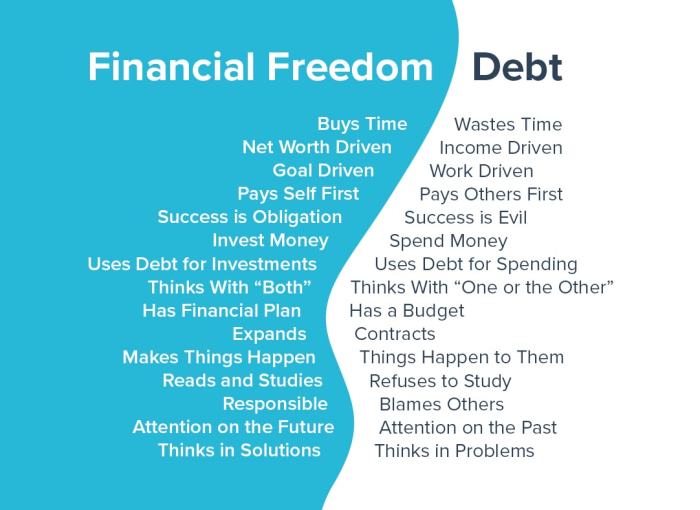

When it comes to achieving financial independence, effectively managing and paying off debt is crucial. Debt can be a major obstacle on the path to financial freedom, so it’s essential to have a plan in place to reduce and eliminate it.

Strategies for Debt Reduction

- Create a budget: Start by tracking your expenses and income to see where your money is going. This will help you identify areas where you can cut back to allocate more funds towards debt repayment.

- Snowball method: Focus on paying off the smallest debt first while making minimum payments on larger debts. Once the smallest debt is paid off, roll that payment into the next smallest debt, creating a snowball effect.

- Debt consolidation: Consider consolidating high-interest debts into a lower-interest loan to make repayment more manageable.

Avoiding Debt Traps

- Avoid overspending: Stick to your budget and avoid unnecessary purchases to prevent accumulating more debt.

- Emergency fund: Build an emergency fund to cover unexpected expenses and avoid relying on credit cards or loans in times of financial need.

- Avoid payday loans: These high-interest, short-term loans can lead to a cycle of debt that is difficult to break free from.

Investment and Passive Income: Best Ways To Achieve Financial Independence

Investment and passive income play a crucial role in achieving financial independence. By strategically investing your money and creating passive income streams, you can grow your wealth and secure your financial future.

Different Investment Options, Best ways to achieve financial independence

- Stock Market: Investing in individual stocks or exchange-traded funds (ETFs) can provide long-term growth potential.

- Real Estate: Owning rental properties or real estate investment trusts (REITs) can generate passive income through rental payments or property appreciation.

- Bonds: Investing in bonds can provide a steady stream of income through interest payments.

- Mutual Funds: Diversified mutual funds allow you to invest in a variety of assets with professional management.

Importance of Passive Income Streams

- Passive income streams can provide financial stability and security, allowing you to generate income without actively working.

- They can help you achieve financial independence by covering your expenses and allowing you to pursue other interests or investments.

- Diversifying your income sources through passive streams can protect you from financial setbacks or job loss.

Tips for Creating a Diversified Investment Portfolio

- Allocate your investments across different asset classes to reduce risk and maximize returns.

- Rebalance your portfolio regularly to ensure that your investments align with your financial goals and risk tolerance.

- Consider your investment timeline and goals when selecting investment options to build a diversified portfolio tailored to your needs.

Career Development and Income Growth

Advancing in your career is a key factor in increasing your income and achieving financial independence. By focusing on continuous learning and skill development, you can boost your earning potential and open up new opportunities for growth.

Strategies for Advancing in Your Career

- Set clear career goals and create a plan to achieve them.

- Seek out mentorship and networking opportunities to learn from others in your field.

- Take on new challenges and projects to showcase your skills and dedication.

Importance of Continuous Learning and Skill Development

- Invest in professional development courses and certifications to stay current in your industry.

- Attend workshops, conferences, and seminars to expand your knowledge and network.

- Embrace new technologies and trends to remain competitive in the job market.

Tips for Negotiating Better Salaries and Benefits

- Research salary benchmarks for your position and industry to have a clear understanding of your worth.

- Highlight your achievements and contributions during salary negotiations to demonstrate your value to the company.

- Negotiate not just for a higher salary, but also for benefits like healthcare, retirement savings, and professional development opportunities.