Delving into the realm of Budgeting techniques, this guide offers a detailed exploration of strategies and methods essential for effective financial planning. From zero-based budgeting to the envelope system, readers will gain insights into optimizing their financial health through meticulous budgeting practices.

The subsequent section will delve into specific budgeting techniques, shedding light on their nuances and benefits in achieving financial stability.

Overview of Budgeting Techniques

Budgeting techniques play a crucial role in personal finance by helping individuals effectively manage their income and expenses. By creating a budget and utilizing various techniques, individuals can gain better control over their finances, reduce debt, save for the future, and achieve their financial goals.

Popular Budgeting Techniques

- The 50/30/20 Rule: This technique suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: With this technique, every dollar of income is assigned to a specific expense, savings, or debt repayment, leaving no money unallocated.

- Envelope System: Involves allocating cash into different envelopes for various spending categories, helping individuals stay within budget limits.

- Pay Yourself First: This technique prioritizes saving a portion of income before paying bills or other expenses, ensuring savings goals are met.

Zero-Based Budgeting

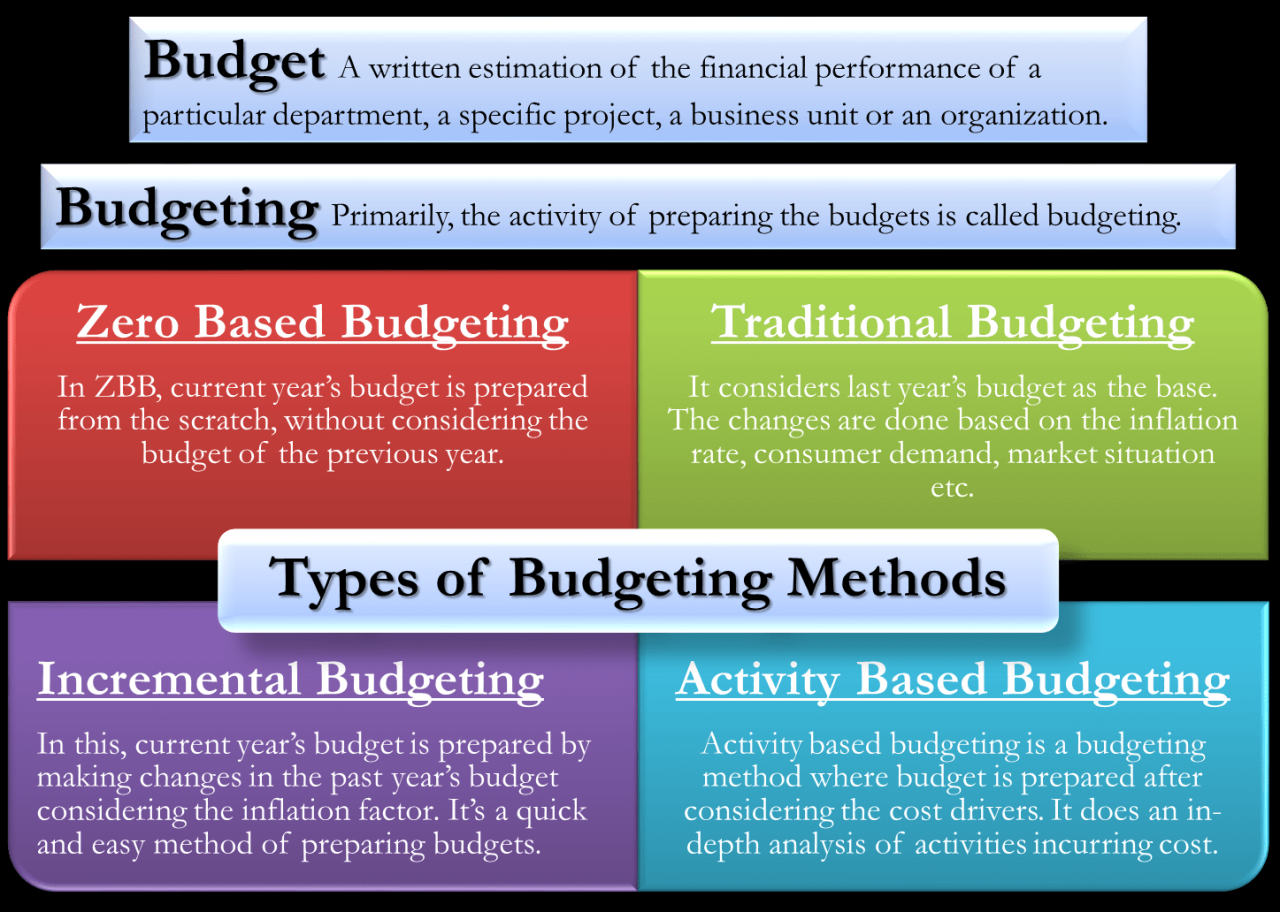

Zero-Based Budgeting is a budgeting technique where every expense must be justified for each new budget period, as if starting from zero. This differs from traditional budgeting methods where previous budgets are adjusted incrementally.

Steps to Create a Zero-Based Budget

To create a zero-based budget, follow these steps:

- Identify and list all expenses

- Assign a priority level to each expense

- Allocate funds based on priority, starting from the most essential expenses

- Review and adjust the budget as needed

Benefits and Drawbacks of Zero-Based Budgeting

- Benefits:

- Forces a thorough review of expenses

- Promotes cost efficiency

- Encourages better resource allocation

- Drawbacks:

- Time-consuming process

- May require more effort to implement compared to traditional budgeting

- Can be challenging to prioritize expenses accurately

Envelope System

The envelope system is a budgeting technique where you allocate a specific amount of cash to different spending categories and place that cash in separate envelopes. This method helps individuals control their spending and stay within budget by physically seeing how much money is available for each category.

How the Envelope System Works

The envelope system works by following these steps:

- Create categories for your expenses such as groceries, entertainment, transportation, etc.

- Determine the amount of money you want to allocate to each category for a specific period, like a week or a month.

- Withdraw cash equal to the total amount budgeted for all categories.

- Label separate envelopes with the name of each category and put the allocated cash inside.

- Throughout the period, only spend money from the corresponding envelope for each category.

- Once an envelope is empty, you cannot spend any more money on that category until the next budgeting period.

By using the envelope system, you are forced to stick to your budget and avoid overspending as you physically see the money running out in each envelope.

Tips for Implementing the Envelope System

- Be realistic when setting your budget amounts for each category to ensure you can cover your expenses.

- Regularly review your spending and adjust your budget categories as needed to reflect your actual needs.

- Keep your envelopes in a secure place to prevent loss or theft of your budgeted cash.

- Consider using different colored envelopes for each category to make it easier to distinguish between them.

- Use any leftover cash from one category to either save or reallocate to another category where you may need more funds.

50/30/20 Rule

The 50/30/20 rule is a popular budgeting technique that suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Income Allocation Breakdown

The breakdown of the 50/30/20 rule is as follows:

– 50% for Needs: This category includes essential expenses such as rent/mortgage, utilities, groceries, transportation, and insurance.

– 30% for Wants: This category covers discretionary spending on non-essential items like dining out, entertainment, shopping, and vacations.

– 20% for Savings and Debt Repayment: This portion is allocated towards savings, emergency fund, retirement contributions, and paying off debts.

Structuring Budget Using 50/30/20 Rule

To apply the 50/30/20 rule to your budget, follow these steps:

1. Calculate your after-tax income.

2. Allocate 50% of your income towards needs, ensuring that essential expenses are covered.

3. Allocate 30% of your income towards wants, allowing for discretionary spending on non-essential items.

4. Allocate 20% of your income towards savings and debt repayment, prioritizing building savings and reducing debts.

By following the 50/30/20 rule, individuals can achieve a balanced approach to budgeting, ensuring that their financial priorities are met while still allowing for personal spending on wants.

Pay Yourself First

When it comes to budgeting, the concept of “pay yourself first” emphasizes the importance of prioritizing savings before any other expenses. This means setting aside a portion of your income for savings or investments as soon as you receive it, rather than saving whatever is left after spending.

Impact on Financial Health

By prioritizing savings through the “pay yourself first” mentality, individuals can significantly impact their overall financial health. This approach ensures that saving becomes a non-negotiable part of one’s budget, helping to build a financial cushion for emergencies, future goals, and retirement.

Strategies for Implementation

- Automate Savings: Set up automatic transfers from your checking account to your savings or investment accounts to ensure that a portion of your income is saved before you have a chance to spend it.

- Establish Clear Goals: Define specific savings goals, such as an emergency fund, a down payment for a house, or retirement savings, to give purpose to your savings and motivate you to stick to the “pay yourself first” principle.

- Adjust Budget Accordingly: Make saving a priority in your budget by allocating a fixed percentage or amount to savings first, and then adjusting your spending on other expenses accordingly.

- Track Progress: Regularly monitor your savings growth and reassess your budget to ensure that you are consistently paying yourself first and making progress towards your financial goals.

Tracking Expenses

Tracking expenses is a crucial aspect of budgeting as it allows individuals to have a clear understanding of where their money is being spent. By monitoring expenses, individuals can identify areas where they may be overspending and make necessary adjustments to stay within their budget.

Methods for Tracking Expenses

- Manual Tracking: This method involves recording expenses in a notebook or spreadsheet. It requires discipline and consistency but provides a detailed overview of spending habits.

- Expense Tracking Apps: Utilizing mobile apps like Mint, YNAB, or PocketGuard can automate expense tracking by linking bank accounts and categorizing expenses. These apps also provide insights into spending patterns.

- Receipt Tracking: Keeping all receipts and reviewing them periodically can help individuals track cash transactions and accurately record expenses.

Analyzing Expense Patterns

By analyzing expense patterns, individuals can make informed decisions when creating or adjusting their budget. Understanding where the majority of expenses are going can help prioritize spending and identify areas where cuts can be made.

For example, if a significant portion of income is spent on dining out, individuals may decide to cook more meals at home to save money.

Emergency Fund

An emergency fund is a crucial component of any budgeting plan as it serves as a financial safety net to cover unexpected expenses or financial emergencies without derailing your overall budget.

Role of an Emergency Fund

An emergency fund provides a buffer against unforeseen circumstances such as medical emergencies, sudden job loss, car repairs, or home maintenance issues. By having an emergency fund in place, you can avoid going into debt or dipping into your long-term savings to cover these unexpected costs.

Determining the Appropriate Amount

Financial experts typically recommend saving three to six months’ worth of living expenses in an emergency fund. To determine the exact amount for your fund, calculate your monthly expenses including rent/mortgage, utilities, groceries, debt payments, and other essential costs. Multiply this total by the number of months you aim to save for in your emergency fund.

Strategies for Building and Maintaining

– Set a specific savings goal for your emergency fund and treat it as a non-negotiable expense in your budget.

– Automate your savings by setting up automatic transfers from your checking account to your emergency fund.

– Cut back on non-essential expenses and redirect those funds towards your emergency fund.

– Consider using windfalls such as tax refunds or bonuses to boost your emergency fund quickly.

– Regularly review and adjust the amount in your emergency fund as your expenses or income change.