Delving into the realm of compound interest investments, this introductory paragraph aims to provide a comprehensive overview of how this financial concept can significantly impact investment growth over time.

As we navigate through the different types of investment vehicles, strategies for maximizing returns, and potential risks associated with compound interest investments, a deeper understanding of this topic will unfold.

Understanding Compound Interest Investments

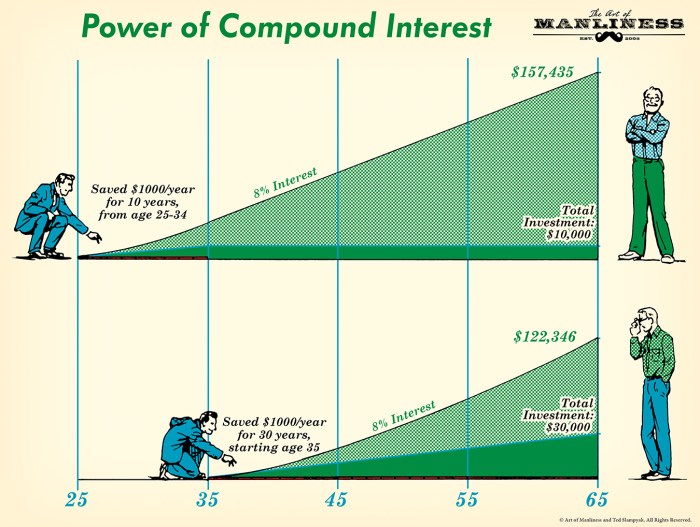

Compound interest investments refer to a type of investment where the interest earned on the initial principal amount is reinvested to generate additional interest in subsequent periods. This compounding effect allows investments to grow exponentially over time.

Compound interest works by calculating interest not only on the initial principal amount but also on the accumulated interest from previous periods. As a result, the total amount invested grows at an increasing rate, accelerating the growth of the investment over time.

In comparison to simple interest investments, where interest is only calculated on the initial principal amount, compound interest investments offer higher returns over the long term. This is because the reinvestment of interest allows the investment to grow faster and generate more significant returns.

Examples of how compound interest can grow investments over time can be seen in retirement savings accounts or long-term investment portfolios. By reinvesting the earned interest, investors can take advantage of the compounding effect to achieve their financial goals more efficiently and effectively.

Types of Compound Interest Investment Vehicles

Compound interest can be a powerful tool when it comes to investing your money. There are various types of investment vehicles that utilize compound interest to help grow your wealth over time. Understanding the differences between high-risk and low-risk investments is crucial in making informed decisions about where to put your money. Let’s explore the benefits and drawbacks of each type of compound interest investment, along with some real-life examples of successful investment vehicles.

High-Risk vs. Low-Risk Investments

When it comes to compound interest investments, risk is a key factor to consider. High-risk investments typically offer the potential for higher returns, but they also come with a greater chance of losing money. Examples of high-risk investments include individual stocks, options trading, and cryptocurrency. On the other hand, low-risk investments are more conservative and offer steady, albeit lower, returns. These can include bonds, index funds, and savings accounts.

Benefits and Drawbacks of High-Risk Investments

- Benefits:

- Potential for high returns

- Opportunity to grow wealth quickly

- Drawbacks:

- Higher chance of losing money

- Volatility in the market

Benefits and Drawbacks of Low-Risk Investments

- Benefits:

- Steady and predictable returns

- Less susceptible to market fluctuations

- Drawbacks:

- Lower potential for high returns

- May not keep pace with inflation

Real-Life Examples of Successful Investment Vehicles

One notable example of a successful compound interest investment vehicle is the S&P 500 index fund. By investing in a diversified portfolio of top companies in the stock market, investors can benefit from the power of compound interest over time. Another example is real estate investing, where properties can appreciate in value and generate rental income, leading to significant wealth accumulation.

Strategies for Maximizing Compound Interest Investments

Compound interest investments can be a powerful tool for growing wealth over time. By employing effective strategies, investors can maximize their returns and achieve their financial goals more efficiently. One key aspect of maximizing compound interest investments is to understand the importance of regular contributions and reinvesting returns to benefit from compounded growth. Additionally, building a diversified investment portfolio can help manage risk and optimize returns. Let’s delve into some strategies for maximizing compound interest investments.

Regular Contributions

Regular contributions are crucial for maximizing the benefits of compound interest investments. By consistently adding funds to your investment accounts, you can take advantage of compounding over a longer period. This practice helps accelerate the growth of your investments and allows you to benefit from the snowball effect of compound interest.

Reinvesting Returns for Compounded Growth

Reinvesting the returns generated from your investments is another effective strategy for maximizing compound interest. Instead of withdrawing the profits, consider reinvesting them back into your investment portfolio. By doing so, you increase the principal amount on which compound interest is calculated, leading to exponential growth over time.

Building a Diversified Investment Portfolio

Building a diversified investment portfolio is essential for managing risk and optimizing returns. Instead of putting all your money into a single investment, spread it across different asset classes such as stocks, bonds, real estate, and other investment vehicles. Diversification helps reduce the impact of market fluctuations on your overall portfolio and enhances long-term growth potential.

Risks and Considerations in Compound Interest Investments

Compound interest investments come with their own set of risks and considerations that investors need to be aware of in order to make informed decisions. Understanding these risks is crucial for maximizing returns and minimizing potential losses.

Inflation is a major risk factor that can significantly impact the returns on compound interest investments. As inflation erodes the purchasing power of money over time, the real value of the returns generated from investments may decrease. This means that even though the invested amount may grow over time with compound interest, the actual value of these returns in terms of purchasing power may be lower than expected.

It is important for investors to regularly monitor and adjust their compound interest investments over time to ensure that they are on track to meet their financial goals. Market conditions, economic factors, and changes in personal circumstances can all affect the performance of investments. By staying informed and making necessary adjustments, investors can mitigate potential risks and optimize their returns.

Strategies for mitigating risks in compound interest investments include diversification, which involves spreading investments across different asset classes to reduce exposure to any single risk factor. Additionally, maintaining a long-term investment horizon can help smooth out short-term fluctuations in the market and increase the likelihood of achieving consistent returns over time. It is also important to conduct thorough research and seek professional advice when making investment decisions to ensure that risks are properly assessed and managed.