Delving into Dividend investing strategies, this introduction immerses readers in a unique and compelling narrative that explores the intricacies of dividend investing. From understanding the significance of dividend investments to navigating various strategies, this overview sets the stage for a comprehensive discussion on maximizing returns through strategic investment approaches.

Overview of Dividend Investing Strategies

Dividend investing involves purchasing stocks or other securities that pay out dividends regularly to investors. These dividends are a portion of the company’s earnings that are distributed to shareholders as a reward for holding onto the stock.

Dividend investing strategies are crucial for investors looking to build a well-rounded portfolio. By incorporating dividend-paying stocks, investors can benefit from a regular income stream in the form of dividends, which can provide stability and consistency to their overall returns.

Importance of Dividend Investing Strategies

Dividend investing strategies play a significant role in enhancing the performance of an investment portfolio. Here are some key reasons why dividend investing is important:

- Income Generation: Dividend-paying stocks provide investors with a steady stream of income, making them ideal for those seeking regular cash flow.

- Long-Term Growth: Companies that consistently pay dividends are often financially stable and have strong growth potential, making them attractive investments for long-term growth.

- Portfolio Diversification: Dividend-paying stocks can help diversify a portfolio, reducing risk and providing a hedge against market volatility.

By incorporating dividend investments, investors can benefit from both income generation and capital appreciation, making it a valuable strategy for building wealth over time.

Types of Dividend Investing Strategies

Dividend investing strategies can vary based on the objectives and preferences of investors. Three common types of dividend investing strategies include dividend growth, high yield, and value dividend strategies.

Dividend Growth Strategy

A dividend growth strategy focuses on investing in companies that have a history of consistently increasing their dividend payouts over time. These companies typically have strong fundamentals and stable cash flows, allowing them to raise dividends regularly.

- Characteristics:

- Stable and growing dividend payouts

- Emphasis on companies with strong financial health

- Long-term investment horizon

Example companies suitable for a dividend growth strategy include Johnson & Johnson, Coca-Cola, and Procter & Gamble.

High Yield Strategy

A high yield strategy involves investing in companies that offer high dividend yields relative to their stock price. These companies may not necessarily have a history of dividend growth but provide attractive income opportunities for investors.

- Characteristics:

- Focus on high dividend yield stocks

- May involve higher risk due to potential dividend cuts

- Suitable for income-oriented investors

Examples of companies suitable for a high yield strategy include AT&T, Exxon Mobil, and Altria Group.

Value Dividend Strategy

A value dividend strategy combines elements of value investing with a focus on dividend-paying stocks. Investors following this strategy seek companies that are undervalued by the market but also offer attractive dividend yields.

- Characteristics:

- Emphasis on undervalued stocks with potential for capital appreciation

- Seeking companies with sustainable dividend payouts

- Long-term investment approach

Companies suitable for a value dividend strategy include IBM, Chevron, and Pfizer.

Factors to Consider in Dividend Investing

When selecting dividend stocks for investment, there are several key factors that investors should consider to make informed decisions. These factors play a crucial role in determining the potential returns and risks associated with dividend investing. Understanding these factors can help investors build a well-balanced dividend portfolio and achieve their investment goals.

Impact of Economic Conditions on Dividend Investing

Economic conditions have a significant impact on dividend investing strategies. During periods of economic growth, companies tend to increase their profits and may raise their dividend payouts. Conversely, in times of economic downturn, companies may struggle to maintain dividend payments or even cut them to preserve cash flow. Therefore, investors need to consider the overall economic environment and its potential impact on the companies they are investing in.

Role of Dividend Yield, Payout Ratio, and Dividend Growth

- Dividend Yield: The dividend yield is a key metric that indicates the percentage of a company’s stock price that is paid out in dividends annually. A high dividend yield may seem attractive, but investors should also consider whether the yield is sustainable and backed by the company’s earnings.

- Payout Ratio: The payout ratio is the proportion of a company’s earnings that are paid out as dividends. A lower payout ratio indicates that the company has room to increase dividends in the future, while a high payout ratio may signal potential risks in sustaining dividend payments.

- Dividend Growth: Consistent dividend growth is a positive sign for investors, as it indicates that the company is generating sufficient profits to increase dividend payments over time. Companies with a history of dividend growth are often favored by income investors seeking reliable returns.

Risks and Challenges in Dividend Investing

When it comes to dividend investing, there are certain risks and challenges that investors need to be aware of in order to make informed decisions and mitigate potential losses. Market volatility, changes in interest rates, and company-specific factors can all impact the performance of dividend stocks.

Market Volatility and Dividend Stocks

Market volatility can have a significant impact on dividend stocks, as sharp fluctuations in stock prices can affect the dividend yield and stability. During periods of market uncertainty or economic downturns, companies may cut or suspend their dividends in order to preserve cash flow and protect their financial stability. This can result in a decrease in income for investors who rely on dividends for regular payouts.

To mitigate the risks associated with market volatility, investors can diversify their dividend-focused portfolio across different sectors and industries. By spreading investments across a variety of companies, investors can reduce the impact of adverse events on any single stock or sector. Additionally, focusing on companies with a history of consistent dividend payments and strong financial fundamentals can help minimize the effects of market volatility on dividend income.

Interest Rate Changes and Dividend Stocks

Changes in interest rates can also pose risks for dividend investors, as rising interest rates can make dividend stocks less attractive compared to other investment options. When interest rates increase, fixed-income securities like bonds become more appealing to investors seeking stable income streams. This can lead to a decrease in demand for dividend stocks, causing their prices to fall and dividend yields to become less competitive.

To navigate the challenges posed by interest rate changes, investors can consider investing in dividend stocks with a track record of increasing dividends over time. Companies that have a history of raising dividends consistently are more likely to attract investors even in a rising interest rate environment. Additionally, monitoring interest rate trends and adjusting the portfolio allocation accordingly can help investors stay ahead of market changes and protect their dividend income.

Company-Specific Risks in Dividend Investing

In addition to external factors like market volatility and interest rate changes, investors also need to be aware of company-specific risks that can impact dividend stocks. Factors such as poor financial performance, management issues, and competitive pressures can all affect a company’s ability to maintain or grow its dividend payments.

To manage company-specific risks, investors should conduct thorough research and analysis before investing in dividend stocks. Evaluating a company’s financial health, dividend payout ratio, and growth prospects can help investors identify companies that are well-positioned to sustain their dividend payments over the long term. Staying informed about industry trends and monitoring company developments can also help investors make timely decisions and adjust their portfolio as needed.

Building a Diversified Dividend Portfolio

Diversification is a key strategy in building a successful dividend portfolio. By spreading your investments across different sectors and asset classes, you can reduce risk and potentially increase returns. Here are some steps to help you build a diversified dividend portfolio:

Importance of Sector Allocation in Dividend Investing

Sector allocation is crucial in dividend investing as different sectors perform differently under various market conditions. By diversifying across sectors, you can mitigate the risk of sector-specific downturns affecting your overall portfolio. It is essential to spread your investments across sectors such as healthcare, technology, consumer goods, and energy to ensure a well-balanced portfolio.

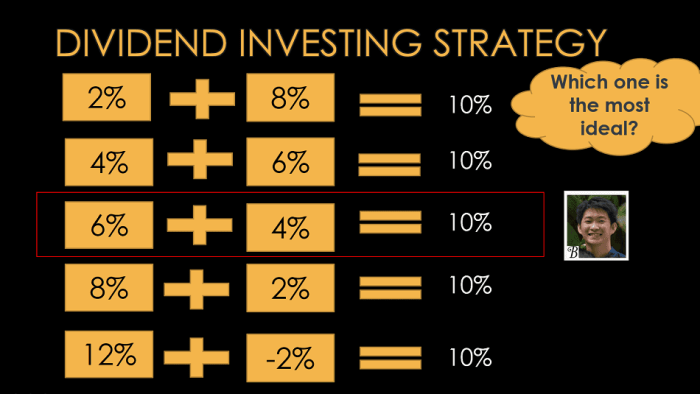

Tips on Balancing High Yield and Dividend Growth Stocks

Balancing high yield and dividend growth stocks is essential to maintain a healthy dividend portfolio. High yield stocks provide immediate income but may have limited growth potential, while dividend growth stocks offer a lower yield but have the potential for higher capital appreciation. To strike a balance, consider allocating a portion of your portfolio to both types of stocks. This way, you can benefit from both immediate income and long-term growth potential.

Reinvesting Dividends and Compounding

When it comes to dividend investing strategies, reinvesting dividends and taking advantage of compounding play a crucial role in enhancing long-term returns. By reinvesting the dividends received from your investments back into the same assets, you can benefit from the power of compounding over time.

Benefits of Dividend Reinvestment Plans (DRIPs)

- DRIPs allow investors to automatically reinvest their cash dividends into additional shares of the underlying stock without incurring any trading fees.

- This reinvestment of dividends helps in accumulating more shares over time, leading to a larger position and potentially higher dividend payouts in the future.

- DRIPs also promote a disciplined approach to investing by encouraging regular contributions and taking advantage of dollar-cost averaging.

Examples of Compounding in Dividend Investing

- Let’s consider an investor who owns 100 shares of a dividend-paying stock that yields 4% annually. If the investor reinvests the dividends back into the same stock, the number of shares owned will increase over time due to compounding.

- As the number of shares grows, the dividend payments received will also increase, leading to higher dividend income. This cycle of reinvesting dividends, accumulating more shares, and receiving higher payouts is the power of compounding at work.

- Over the long term, this compounding effect can significantly boost the total return on investment and accelerate wealth accumulation for the investor.