Yo, diving into the world of financial hedging strategies is like navigating a maze of risk and reward. From futures to options, companies are playing a high-stakes game to secure their bag. Get ready to learn the ins and outs of this financial chess match.

In this article, we’ll break down the different types of financial instruments used for hedging, explore techniques to manage foreign exchange risks, and uncover the secrets behind successful risk management strategies.

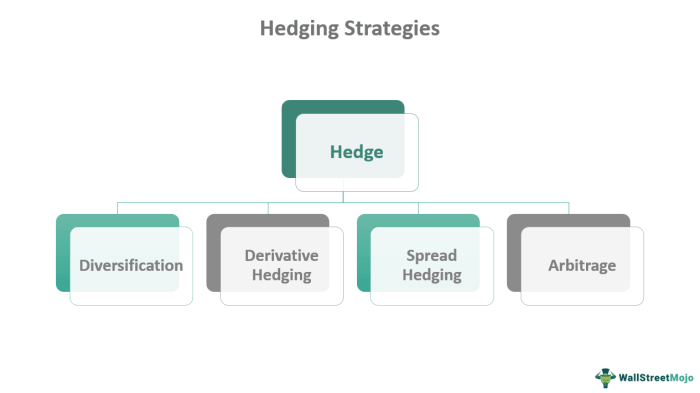

Overview of Financial Hedging Strategies

Financial hedging strategies are risk management techniques used by companies to protect themselves against potential financial losses. These strategies involve taking positions in the market that offset the risk of adverse price movements in an asset or liability. By hedging, companies can reduce the impact of market volatility and uncertainty on their financial performance.

Importance of Financial Hedging Strategies

Financial hedging strategies are crucial for businesses operating in industries exposed to fluctuations in commodity prices, interest rates, foreign exchange rates, and other market variables. By implementing hedging strategies, companies can stabilize their cash flows, protect profit margins, and ensure financial stability in the face of market uncertainties.

- Hedging against currency risk: Companies that engage in international trade can use currency hedging to protect themselves against adverse movements in exchange rates. For example, a U.S. company importing goods from Europe can hedge against the risk of a strengthening Euro by entering into a forward contract to buy Euros at a fixed exchange rate.

- Hedging against commodity price risk: Companies in industries such as agriculture, energy, and mining can use commodity futures contracts to hedge against price fluctuations. For instance, an airline company can hedge against rising fuel prices by entering into a futures contract to buy jet fuel at a predetermined price.

- Interest rate hedging: Companies with variable-rate debt or investments can use interest rate swaps or options to protect themselves against changes in interest rates. By hedging interest rate risk, companies can lock in favorable borrowing costs and avoid sudden increases in interest expenses.

Types of Financial Hedging Instruments

When it comes to financial hedging, there are several common instruments that are used to mitigate risk and protect investments. These instruments include futures, options, swaps, and forwards.

Futures

Futures are contracts that obligate the buyer to purchase an asset or the seller to sell an asset at a predetermined price on a specified future date. They are standardized and traded on exchanges, providing a high level of liquidity. Futures are often used to hedge against price fluctuations in commodities, currencies, or financial instruments.

Options

Options give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame. Unlike futures, options provide flexibility as the holder can choose whether to exercise the option based on market conditions. Options can be used to hedge against potential losses while allowing for potential gains.

Swaps, Financial hedging strategies

Swaps are agreements between two parties to exchange cash flows or other financial instruments over a specified period. Common types of swaps include interest rate swaps and currency swaps. Swaps are customized contracts that allow parties to manage risks associated with interest rate fluctuations, exchange rate movements, or other variables.

Forwards

Forwards are similar to futures but are traded over-the-counter (OTC) rather than on exchanges. They involve a customized agreement between two parties to buy or sell an asset at a future date at an agreed-upon price. Forwards are flexible and can be tailored to specific needs but may have higher counterparty risk compared to exchange-traded futures.Each type of financial hedging instrument has its own advantages and disadvantages.

Futures and options offer liquidity and standardized contracts but may involve margin requirements and expiration dates. Swaps provide customization but require counterparty risk management. Forwards offer flexibility but may lack transparency and liquidity. It is essential for investors to carefully consider their risk tolerance, investment goals, and market conditions when choosing the most suitable hedging instrument.

Hedging Techniques for Foreign Exchange Risk

When it comes to managing foreign exchange risk, companies employ various strategies to protect themselves against currency fluctuations. This is crucial for businesses engaged in international trade or investments.

Forward Contracts for Hedging

One common technique used by companies to hedge against foreign exchange risk is through the use of forward contracts. These contracts allow businesses to lock in an exchange rate for a future date, reducing the uncertainty associated with currency movements.

- Forward contracts help companies mitigate potential losses due to adverse exchange rate movements.

- By fixing the exchange rate in advance, businesses can better plan and budget for future transactions.

- However, if the actual exchange rate at the time of settlement is more favorable than the contracted rate, the company may miss out on potential gains.

Currency Options for Hedging

Another popular hedging technique is the use of currency options. These financial instruments give companies the right, but not the obligation, to exchange currencies at a predetermined rate within a specified period.

- Currency options provide flexibility to companies as they can choose whether or not to exercise the option based on market conditions.

- Companies pay a premium for these options, which acts as a cost for the hedging benefit they receive.

- If the exchange rate moves in a favorable direction, the company can simply choose not to exercise the option and benefit from the favorable rate in the market.

Examples of Successful and Unsuccessful Cases

Successful hedging of foreign exchange risk can lead to significant cost savings and protection of profits for companies. On the other hand, unsuccessful hedging strategies can result in financial losses and missed opportunities.

For example, a company that accurately predicted a weakening of a foreign currency and locked in a favorable exchange rate through a forward contract would be considered a successful case of hedging.

Conversely, a company that purchased currency options at a high premium but did not benefit from any favorable exchange rate movements during the option period would be deemed an unsuccessful case of hedging.

Risk Management Strategies with Hedging: Financial Hedging Strategies

Financial hedging plays a crucial role in a broader risk management framework by helping companies protect themselves against various risks such as market volatility, currency fluctuations, and interest rate changes. By using hedging strategies, companies can minimize the impact of these risks on their financial performance and overall stability.

Integration of Hedging Strategies with Overall Risk Management Practices

Companies integrate hedging strategies with overall risk management practices by first identifying their exposure to different types of risks. Once the risks are identified, companies can then determine the most appropriate hedging instruments and techniques to mitigate these risks effectively. It is essential for companies to align their hedging strategies with their overall risk management objectives to ensure a comprehensive approach to managing risks.

- Companies should regularly assess their risk exposure and adjust their hedging strategies accordingly to stay responsive to changing market conditions.

- Integration of hedging strategies with overall risk management practices enables companies to maintain a balanced and diversified approach to risk management.

- Effective communication and coordination between different departments within the organization are crucial for successful integration of hedging strategies with overall risk management practices.

Best Practices for Incorporating Financial Hedging into Risk Management Strategies

When incorporating financial hedging into risk management strategies, companies should consider the following best practices to ensure optimal risk mitigation and financial stability:

- Establish clear risk management objectives and align hedging strategies with these objectives to ensure consistency and effectiveness.

- Regularly review and evaluate the performance of hedging strategies to identify any inefficiencies or areas for improvement.

- Ensure that all stakeholders within the organization understand the rationale behind the hedging strategies and their role in supporting overall risk management goals.

- Utilize a combination of hedging instruments and techniques to create a diversified risk management approach and minimize reliance on any single strategy.