Beginning with financial markets basics, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Financial markets play a crucial role in the global economy, serving as the backbone of various financial activities. Understanding the fundamentals of financial markets is essential for investors, businesses, and policymakers alike. In this guide, we will delve into the key aspects of financial markets basics, shedding light on their functions, participants, instruments, regulations, risk-return dynamics, market efficiency, and pricing mechanisms.

Introduction to Financial Markets Basics

Financial markets are platforms where buyers and sellers trade financial securities, commodities, and other fungible items at low transaction costs. These markets play a crucial role in the economy by facilitating the flow of capital between investors and borrowers. There are various types of financial markets, each serving different purposes and catering to specific financial instruments.

Stock Market

The stock market is where shares of publicly traded companies are bought and sold. Investors can purchase ownership in a company by buying stocks, which represent a claim on the company’s assets and earnings. Stock prices fluctuate based on market demand and supply, as well as the performance of the company.

Bond Market

The bond market, also known as the debt market, is where organizations and governments issue debt securities to investors in exchange for capital. Bonds are essentially loans made by investors to the issuer, who promises to repay the borrowed amount with interest over a specified period. Bond prices are influenced by interest rates and credit ratings.

Forex Market

The foreign exchange market, or forex market, is where currencies are traded. It is the largest and most liquid financial market globally, with trillions of dollars exchanged daily. Participants in the forex market include banks, corporations, governments, and retail investors. Currency prices fluctuate based on various factors, including economic indicators, geopolitical events, and market sentiment.

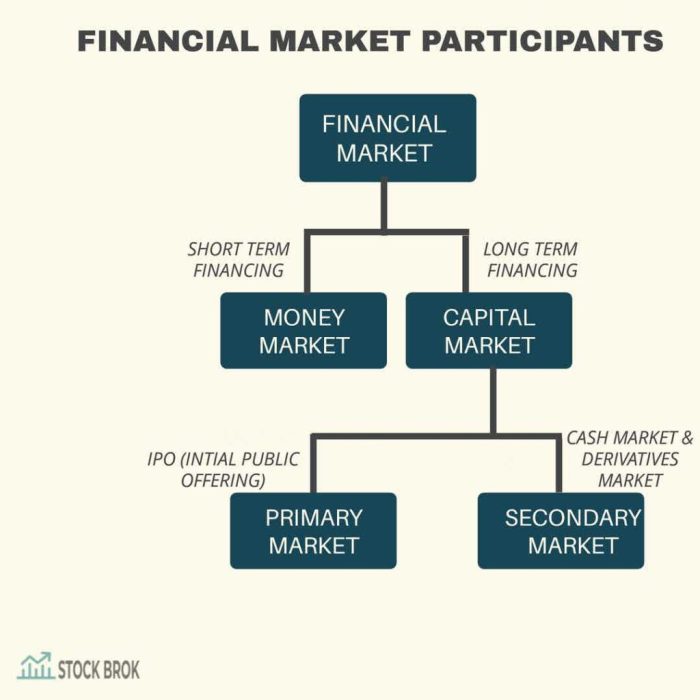

Participants in Financial Markets

Financial markets are composed of various key players who interact to facilitate the flow of capital and securities. These participants include investors, issuers, and intermediaries, each playing a crucial role in the functioning of financial markets.

Investors

Investors are individuals or institutions who provide capital by purchasing financial securities such as stocks, bonds, and derivatives. They aim to earn a return on their investments through dividends, interest, or capital appreciation. Investors include retail investors, institutional investors, hedge funds, and pension funds.

Issuers

Issuers are entities that offer financial securities to raise capital. They can be corporations, governments, or municipalities seeking funds for various purposes. Issuers issue stocks, bonds, and other securities to investors in exchange for capital. The securities represent ownership or debt obligations of the issuer.

Intermediaries

Intermediaries are financial institutions that facilitate transactions between investors and issuers. They provide various services such as brokerage, underwriting, market making, and advisory services. Intermediaries include banks, investment firms, brokerage houses, and insurance companies. They help match buyers and sellers, provide liquidity, and ensure smooth functioning of financial markets.

These participants interact within financial markets through buying and selling securities, raising capital, managing risks, and providing financial services. Investors provide funds to issuers, who in turn deploy the capital for business operations or projects. Intermediaries facilitate the flow of capital and securities, ensuring efficiency and transparency in the market transactions. Overall, the collaboration of investors, issuers, and intermediaries is essential for the functioning and growth of financial markets.

Financial Instruments

Financial instruments are assets that can be traded in financial markets, representing a claim on the issuer. They can be categorized into different types such as stocks, bonds, and derivatives.

Stocks

Stocks, also known as equities, represent ownership in a company. When an individual buys a stock, they become a shareholder and have a claim on the company’s assets and earnings. Stocks are traded on stock exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq.

Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When an investor purchases a bond, they are essentially lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are traded in the bond market.

Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset, index, or rate. Common types of derivatives include options, futures, and swaps. Derivatives are used for hedging, speculation, and arbitrage purposes. They are traded on specialized exchanges or over-the-counter (OTC) markets.

Market Structure and Regulation

The structure of financial markets is typically divided into two main categories: the primary market and the secondary market. In the primary market, securities are issued for the first time, allowing companies to raise capital directly from investors. On the other hand, the secondary market is where already issued securities are bought and sold among investors, providing liquidity to the market.

Regulatory bodies play a crucial role in overseeing financial markets to ensure fair and efficient operations. These bodies establish rules and regulations that govern the behavior of market participants, such as investors, brokers, and exchanges. By monitoring and enforcing compliance with these regulations, regulatory bodies aim to protect investors, maintain market integrity, and prevent fraud and misconduct.

Market regulation is essential for maintaining fairness and stability in financial markets. It helps to prevent market manipulation, insider trading, and other unethical practices that could undermine investor confidence. Additionally, regulations promote transparency, disclosure, and accountability, contributing to a level playing field for all participants. Overall, market regulation is vital for safeguarding the interests of investors and preserving the integrity of the financial system.

Risk and Return in Financial Markets

Risk and return are fundamental concepts in the context of financial markets. Risk refers to the potential for loss or uncertainty in an investment, while return is the gain or profit that an investor expects to receive from that investment. The relationship between risk and return is a crucial factor that investors consider when making investment decisions.

Risk and Return Relationship

In general, there is a positive relationship between risk and return in financial markets. This means that investments with higher levels of risk tend to offer higher potential returns, while investments with lower risk typically yield lower returns. This relationship is often referred to as the risk-return tradeoff.

- Investors are typically rewarded for taking on higher levels of risk by the possibility of earning greater returns.

- Conversely, investments with lower risk levels offer more stable returns but may have lower potential for growth.

- Understanding this relationship is essential for investors to make informed decisions based on their risk tolerance and investment goals.

Assessing and Managing Risk in Financial Markets

Investors use various methods to assess and manage risk in financial markets to protect their investments and optimize their returns.

- Diversification: Investors can reduce risk by spreading their investments across different asset classes, industries, and geographic regions. This helps minimize the impact of negative events on any single investment.

- Risk Tolerance: Understanding one’s risk tolerance is crucial in determining the appropriate level of risk to take on in an investment portfolio. Investors with a higher risk tolerance may be willing to invest in riskier assets with potentially higher returns.

- Risk Management Tools: Investors can also use risk management tools such as stop-loss orders, options, and futures contracts to mitigate potential losses in their investments.

Market Efficiency and Pricing

Market efficiency refers to the degree to which prices of financial assets reflect all available information. The Efficient Market Hypothesis (EMH) is a theory that states that financial markets are efficient and that asset prices fully reflect all available information.

Forms of Market Efficiency

- Weak Form Efficiency: This form suggests that all past price information is already reflected in current prices, making it impossible to consistently achieve higher returns through technical analysis.

- Semi-Strong Form Efficiency: In this form, all publicly available information is reflected in asset prices. This means that fundamental analysis cannot consistently produce excess returns.

- Strong Form Efficiency: This form implies that all public and private information is already reflected in asset prices. This makes it impossible to achieve excess returns even with insider information.

Pricing in Financial Markets

Prices in financial markets are determined by the interaction of buyers and sellers based on their expectations, beliefs, and available information. Market participants analyze various factors such as company performance, economic indicators, and geopolitical events to determine the value of assets. The continuous buying and selling activity in the market leads to price discovery, where the equilibrium price is established based on supply and demand dynamics.