Kicking off with growth vs value stocks, this opening paragraph is designed to captivate and engage the readers, setting the tone scientific with objective tone style that unfolds with each word.

As we delve into the realm of investing, exploring the differences between growth and value stocks becomes paramount in understanding the dynamics of the stock market. From historical performance to investment strategies, this discussion aims to shed light on the nuances of these two prominent stock categories.

Growth vs Value Stocks Overview

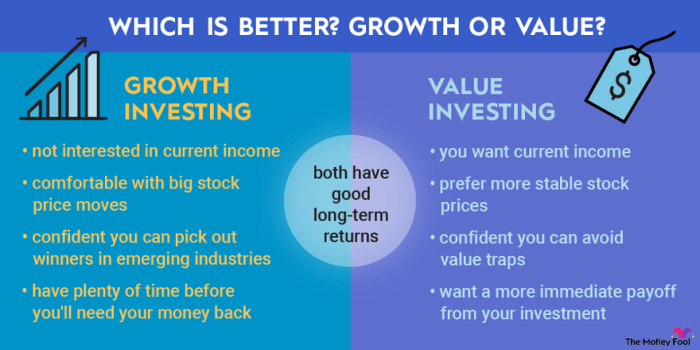

When it comes to investing in the stock market, two popular categories of stocks are growth stocks and value stocks. Understanding the key differences between these two types of stocks is essential for investors looking to build a diversified portfolio.

Growth stocks are shares of companies that are expected to increase in value at a faster rate than the average market. These companies typically have high earnings growth potential and reinvest their profits back into the business for expansion. On the other hand, value stocks are shares of companies that are currently undervalued by the market and are trading at a lower price compared to their intrinsic value. These companies may have stable earnings and dividends, making them attractive to value investors.

Examples of Growth and Value Stocks

- Examples of growth stocks include technology companies like Amazon, Facebook, and Tesla, which have shown exponential growth in recent years.

- On the other hand, examples of value stocks can be found in sectors like utilities, financials, and consumer staples. Companies like Johnson & Johnson, Coca-Cola, and Exxon Mobil are often considered value stocks.

Historical Performance of Growth vs Value Stocks

Historically, growth stocks have outperformed value stocks during periods of economic expansion and bull markets. This is because investors are willing to pay a premium for the high growth potential of these companies. However, during market downturns and recessions, value stocks have shown resilience and tend to outperform growth stocks. This is due to their stability and lower valuation, which makes them less susceptible to market volatility.

Characteristics of Growth Stocks

Growth stocks are a type of investment that typically represent companies with above-average growth potential. These stocks are known for their ability to generate capital gains rather than dividends, as they reinvest their earnings back into the company to fuel further growth.

Factors that Drive Growth in Growth Stocks

- Revenue Growth: Growth stocks often exhibit strong revenue growth, indicating a growing customer base or increased market share.

- Earnings Growth: Companies with growth stocks typically experience high earnings growth rates, reflecting their ability to generate profits.

- Innovation and Technology: Growth stocks are commonly found in industries that are driven by innovation and technological advancements, such as the technology sector.

- Market Expansion: Companies with growth stocks may be expanding into new markets or industries, driving overall growth.

Examples of Industries Where Growth Stocks are Commonly Found

- Technology: Companies in the technology sector, such as software developers and cloud computing firms, often exhibit characteristics of growth stocks due to their innovative products and services.

- Biotechnology: Biotech companies that are engaged in research and development of new drugs or medical technologies are considered growth stocks, as they have the potential for significant growth based on successful product development.

- Renewable Energy: With the increasing focus on sustainability and environmental concerns, companies in the renewable energy sector, like solar and wind power companies, are often classified as growth stocks due to their potential for expansion and market penetration.

Characteristics of Value Stocks

Value stocks are characterized by certain key qualities that distinguish them from growth stocks. These stocks are typically perceived to be undervalued by the market and are considered to have strong fundamentals relative to their stock price.

When looking at value stocks, investors often consider the following factors that make a stock a value stock:

Factors that Make a Stock a Value Stock

- Low Price-to-Earnings (P/E) Ratio: Value stocks often have a lower P/E ratio compared to the overall market or growth stocks. This indicates that the stock is trading at a lower price relative to its earnings.

- High Dividend Yield: Value stocks tend to have higher dividend yields, making them attractive to income-seeking investors.

- Price-to-Book (P/B) Ratio: Value stocks typically have a lower P/B ratio, suggesting that the stock is trading at a discount to its book value.

- Stable and Mature Companies: Value stocks are often associated with established companies in traditional industries that may not experience rapid growth but have stable earnings.

Examples of Industries Where Value Stocks are Commonly Found

Value stocks are commonly found in industries such as:

- Utilities: Companies in the utility sector are often considered value stocks due to their stable cash flows and relatively low volatility.

- Financial Services: Banks and insurance companies are frequent examples of value stocks, as they tend to have consistent earnings and pay dividends.

- Consumer Staples: Companies that produce essential consumer goods like food, beverages, and household products are often categorized as value stocks.

Investment Strategies for Growth Stocks

When it comes to investing in growth stocks, there are several strategies that investors can consider to maximize their returns. These strategies are based on analyzing the potential growth of a company and its ability to generate substantial returns in the future.

Growth at a Reasonable Price (GARP) Strategy

The Growth at a Reasonable Price (GARP) strategy involves identifying companies that exhibit strong growth potential but are also trading at a reasonable valuation. Investors using this strategy look for companies that are expected to grow their earnings at an above-average rate compared to the market but are not overly expensive based on traditional valuation metrics. This strategy seeks to strike a balance between growth and valuation to mitigate risks while capturing potential upside.

Momentum Investing

Momentum investing is another strategy that can be applied to growth stocks. This strategy involves identifying stocks that have exhibited strong price momentum in the past and betting on the continuation of that trend. Investors using this strategy believe that stocks that have performed well in the past are likely to continue outperforming in the future. However, it is important to note that momentum investing can be risky, as it relies on trends that may reverse unexpectedly.

Long-Term Buy and Hold Strategy

The long-term buy and hold strategy involves investing in growth stocks with the intention of holding them for an extended period, typically years or even decades. This strategy is based on the belief that high-quality growth companies will continue to expand their business and generate substantial returns over the long term. Investors using this strategy focus on fundamental analysis to identify companies with the potential for sustained growth and competitive advantages in their industry.

Risks Associated with Investing in Growth Stocks

Investing in growth stocks can be rewarding, but it also comes with its own set of risks. Some of the risks associated with growth stocks include high volatility, as these stocks tend to be more sensitive to market fluctuations. Additionally, growth stocks are often more expensive relative to their earnings or assets, which means there is a higher valuation risk if the company fails to meet growth expectations. It is important for investors to carefully assess these risks and consider diversification to mitigate potential losses.

Investment Strategies for Value Stocks

Value stocks are typically characterized by being undervalued in the market compared to their intrinsic worth. Investors often look for these undervalued gems to potentially capitalize on their future growth. Here are some investment strategies commonly used for value stocks:

1. Fundamental Analysis

Fundamental analysis is a key strategy when it comes to investing in value stocks. Investors analyze financial statements, earnings reports, and other fundamental indicators to assess the true value of a stock. By focusing on metrics like price-to-earnings ratio, price-to-book ratio, and dividend yield, investors can identify value stocks that are trading below their intrinsic value.

2. Contrarian Investing

Contrarian investors seek out value stocks that are currently out of favor with the market. They believe that these temporary setbacks present buying opportunities, as the market may eventually recognize the true value of these stocks. Contrarian investing requires patience and a contrarian mindset to go against the prevailing market sentiment.

3. Margin of Safety

Investors looking to invest in value stocks often consider the concept of margin of safety. This involves buying stocks at a significant discount to their intrinsic value to provide a cushion against potential downside risk. By having a margin of safety, investors aim to protect themselves in case the stock price drops further.

4. Long-Term Perspective

Value investing is typically a long-term strategy. Investors who focus on value stocks often have a long-term perspective, looking to hold onto their investments for an extended period to allow the market to recognize the true value of the stock. This approach requires patience and discipline to withstand short-term market fluctuations.

5. Diversification

Diversification is a key risk management strategy when investing in value stocks. By spreading investments across different value stocks in various industries, investors can reduce the impact of any single stock underperforming. Diversification helps to mitigate risk and potentially enhance returns over the long run.

Investing in value stocks can offer attractive opportunities for investors looking to capitalize on undervalued assets. However, it’s important to be aware of the risks associated with investing in value stocks.