Beginning with Impact of credit scores on loans, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Credit scores are a crucial factor in determining one’s ability to secure loans, affecting everything from approval processes to interest rates. This article delves into the intricate relationship between credit scores and borrowing, shedding light on the various aspects that come into play.

Importance of Credit Scores

Credit scores play a crucial role in the loan application process as they provide lenders with an indication of an individual’s creditworthiness. A credit score reflects a person’s credit history and their ability to manage debt, making it a key factor in determining whether a loan application will be approved.

Influence on Loan Approval

Credit scores significantly influence the approval or rejection of loan applications. Lenders use credit scores to assess the risk of lending money to an individual. A higher credit score indicates a lower risk borrower, making it more likely for the loan application to be approved. On the other hand, a lower credit score may lead to a rejection or result in higher interest rates.

Relationship with Interest Rates

Credit scores also impact the interest rates offered on loans. Borrowers with high credit scores are typically offered lower interest rates as they are considered less risky. Conversely, individuals with lower credit scores may be charged higher interest rates to compensate for the perceived risk of default. This relationship highlights the importance of maintaining a good credit score to secure favorable loan terms and save money in the long run.

Factors Affecting Credit Scores

Credit scores are influenced by various factors that reflect an individual’s financial behavior and creditworthiness. Understanding these key factors is crucial in managing and improving one’s credit score.

Payment History

Maintaining a positive payment history is one of the most critical factors that impact credit scores. Late payments, defaults, and bankruptcies can significantly lower a credit score. On the other hand, making timely payments on credit accounts and loans can boost a credit score.

- Examples of actions that can improve credit scores related to payment history include:

- Making on-time payments for credit card bills, loans, and other financial obligations.

- Set up automatic payments or reminders to ensure payments are made promptly.

- Address any past due accounts and work towards bringing them current.

- Regularly monitor credit reports to identify any errors or discrepancies in payment history.

Types of Loans Affected

When it comes to loans, credit scores play a crucial role in determining the interest rates, loan amounts, and approval chances for borrowers. Different types of loans are impacted by credit scores in various ways, influencing the overall cost and terms of the loan.

Mortgages vs. Personal Loans

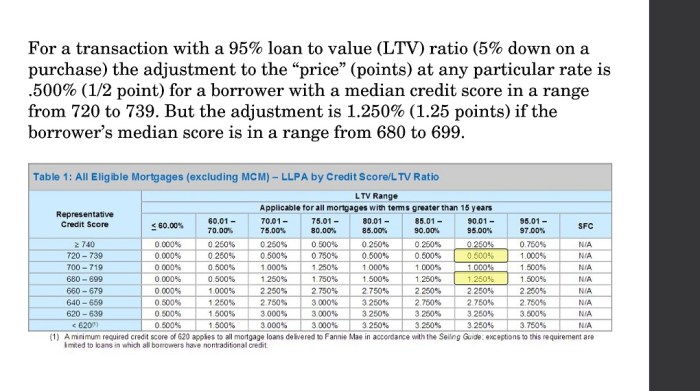

Mortgages and personal loans are two common types of loans where credit scores have a significant impact. For mortgages, a higher credit score typically results in lower interest rates, as borrowers with good credit are considered less risky by lenders. On the other hand, personal loans may have more flexibility in terms of credit score requirements, but a higher credit score can still lead to better interest rates and loan terms.

Auto Loans and Student Loans

Credit scores also play a crucial role in auto loans and student loans. For auto loans, borrowers with higher credit scores are more likely to qualify for lower interest rates and better loan terms. On the contrary, borrowers with lower credit scores may face higher interest rates and stricter approval requirements. Similarly, in the case of student loans, credit scores can impact the interest rates and eligibility for certain loan programs, affecting the overall cost of borrowing for students.

Strategies to Improve Credit Scores

Improving your credit score is essential for better loan opportunities and financial well-being. By following these strategies, individuals can boost their credit scores effectively.

1. Pay bills on time

- Timely payment of bills, including credit card bills, loan payments, and utility bills, is crucial for improving credit scores.

- Aim to pay the full amount by the due date to avoid late payments and negative impacts on your credit score.

2. Reduce credit card balances

- Lowering credit card balances can have a positive effect on your credit score.

- Try to keep your credit utilization ratio below 30% by paying off balances or requesting a credit limit increase.

3. Check your credit report regularly

- Monitor your credit report for errors or inaccuracies that could be negatively impacting your credit score.

- Dispute any discrepancies and ensure that your credit report reflects accurate information.

4. Avoid opening multiple new accounts

- Opening too many new credit accounts in a short period can lower your credit score.

- Be selective about applying for new credit and consider the potential impact on your credit score.

5. Maintain a mix of credit types

- Having a diverse mix of credit, such as credit cards, loans, and a mortgage, can positively impact your credit score.

- Manage different types of credit responsibly to demonstrate creditworthiness to lenders.