Delving into Mutual funds vs. ETFs, this introduction immerses readers in a unique and compelling narrative, providing a detailed comparison of these investment options. Mutual funds and ETFs are popular choices for investors seeking diversification and growth. Understanding the differences and similarities between them is crucial for making informed investment decisions.

Overview of Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are investment vehicles that pool together money from multiple investors to invest in a diversified portfolio of assets. Both options offer individual investors a way to access a wide range of securities without having to purchase them individually.

Mutual Funds

Mutual funds are professionally managed investment funds that collect money from investors to invest in a diversified portfolio of stocks, bonds, or other securities. These funds are managed by professional portfolio managers who make decisions on behalf of the investors to achieve the fund’s investment objectives.

ETFs

ETFs are similar to mutual funds in that they also pool together money from investors to invest in a diversified portfolio of assets. However, unlike mutual funds, ETFs are traded on stock exchanges like individual stocks. This means that their prices fluctuate throughout the trading day based on supply and demand.

Key Similarities

- Both mutual funds and ETFs offer diversification by allowing investors to invest in a variety of securities through a single investment.

- Investors in both mutual funds and ETFs can benefit from professional management of the portfolio, which can help in achieving investment objectives.

- Both mutual funds and ETFs provide liquidity to investors, allowing them to buy and sell shares on the open market.

Investment Strategies

When it comes to investment strategies, both mutual funds and ETFs offer a variety of approaches for investors to consider. Understanding these strategies is crucial for making informed decisions about where to allocate your funds.

Investment Strategies of Mutual Funds

Mutual funds typically follow one of several investment strategies, including:

- Active Management: In this approach, fund managers make specific investment decisions aiming to outperform the market. They conduct research, analyze market trends, and adjust the fund’s holdings accordingly.

- Passive Management: Also known as index investing, this strategy aims to replicate the performance of a specific market index. The fund’s holdings mirror the index components, with minimal buying and selling.

- Value Investing: This strategy involves identifying undervalued securities and investing in them with the expectation that their value will increase over time.

- Growth Investing: On the other hand, growth investing focuses on companies with strong potential for future growth, typically investing in sectors like technology and healthcare.

Investment Strategies of ETFs

ETFs also utilize various investment strategies, such as:

- Passive Management: Like mutual funds, ETFs can track specific indexes, providing investors with exposure to a particular market segment without the need for active management.

- Smart Beta: Some ETFs follow rules-based strategies that aim to outperform traditional market-cap weighted indexes by focusing on factors like dividends, volatility, or momentum.

- Thematic Investing: ETFs with thematic strategies concentrate on specific trends, industries, or global themes, allowing investors to capitalize on emerging opportunities.

- Active ETFs: While less common, some ETFs are actively managed, with fund managers making investment decisions to achieve specific objectives or outperform the market.

Comparison of Investment Strategies

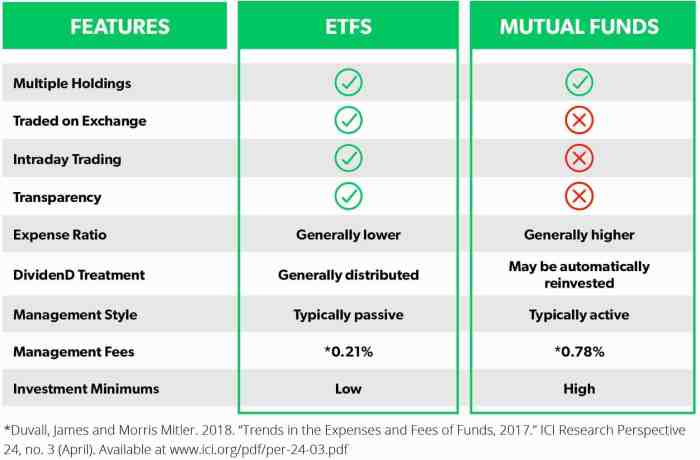

When comparing mutual funds and ETFs in terms of investment strategies, it’s essential to note that while both can offer active and passive management options, ETFs tend to be more cost-effective due to lower expense ratios. Additionally, ETFs provide intraday trading flexibility, unlike mutual funds that are traded at the end of the day. Each investment vehicle has its advantages and disadvantages, so investors should consider their financial goals and risk tolerance when choosing between mutual funds and ETFs.

Liquidity and Trading

When it comes to investing in mutual funds and ETFs, understanding liquidity and trading is essential for investors to make informed decisions.

Liquidity in Mutual Funds

In mutual funds, liquidity refers to the ease with which investors can buy or sell their shares. Mutual funds are priced at the end of each trading day based on the net asset value (NAV) of the underlying securities. Investors can place buy or sell orders throughout the trading day, but the actual transaction will occur at the NAV price calculated at the end of the day. This means that investors may not always get the exact price they see at the time of placing their order.

Liquidity in ETFs

ETFs, on the other hand, trade on stock exchanges throughout the trading day like individual stocks. This means that investors can buy or sell ETF shares at market prices whenever the stock exchange is open. The liquidity of ETFs is higher compared to mutual funds because of this intra-day trading feature. The price of an ETF is determined by supply and demand in the market, which can sometimes lead to the price deviating from the net asset value of the underlying securities.

Trading Process for Mutual Funds versus ETFs

– Mutual Funds:

- Investors place buy or sell orders with the fund company or through a broker.

- Transactions are processed at the end of the trading day at the NAV price.

- Investors may be subject to sales charges or redemption fees depending on the fund.

– ETFs:

- Investors buy or sell ETF shares on stock exchanges through a brokerage account.

- Transactions occur at market prices throughout the trading day.

- Investors may pay a commission to their broker for buying or selling ETF shares.

Costs and Fees

When it comes to investing in mutual funds and ETFs, investors need to be aware of the various costs and fees associated with each type of investment. These costs can have a significant impact on overall returns and should be carefully considered before making any investment decisions.

Costs and Fees of Mutual Funds

Mutual funds typically come with several costs and fees that investors should be aware of. These may include:

- Expense Ratio: This is the fee charged by the mutual fund company to cover operating expenses. It is expressed as a percentage of the fund’s assets and can vary depending on the fund.

- Load Fees: Some mutual funds charge load fees, which are sales charges either when purchasing (front-end load) or selling (back-end load) shares of the fund.

- Transaction Fees: Investors may also incur transaction fees when buying or selling shares of a mutual fund.

- Management Fees: These fees are paid to the fund manager for managing the fund’s investments.

Costs and Fees of ETFs

ETFs generally have lower costs and fees compared to mutual funds. Some of the costs and fees associated with investing in ETFs include:

- Expense Ratio: Just like mutual funds, ETFs have an expense ratio that covers operating expenses. However, ETFs tend to have lower expense ratios than mutual funds.

- Commission Fees: Investors typically pay a commission fee to a broker when buying or selling shares of an ETF. However, some brokers offer commission-free ETF trading.

- Bid-Ask Spread: ETF investors may also incur costs through the bid-ask spread, which is the difference between the price at which you can buy and sell an ETF.

Comparison of Cost Structures

In general, ETFs tend to have lower costs and fees compared to mutual funds. This is mainly due to the passive management style of most ETFs, which results in lower management fees. Additionally, ETFs are traded on exchanges like stocks, which can lead to lower transaction costs compared to mutual funds. However, it’s essential for investors to consider all costs and fees associated with both types of investments before making a decision.

Tax Efficiency

When it comes to investing in mutual funds and ETFs, tax efficiency is an important consideration for investors. Understanding how these investment vehicles are taxed can help investors make informed decisions about their portfolios.

Mutual funds are subject to capital gains taxes when the fund manager sells securities within the fund, resulting in capital gains distributions to investors. These distributions are typically taxed at the investor’s individual tax rate, whether short-term or long-term capital gains. Additionally, mutual funds may also distribute dividends, which are also taxable to investors.

On the other hand, ETFs are generally more tax-efficient than mutual funds due to their unique structure. ETFs are bought and sold on an exchange like a stock, which means investors can control when they realize capital gains by when they buy or sell their shares. This can help reduce the tax burden on investors compared to mutual funds, where capital gains are distributed based on the fund manager’s decisions.

Tax Implications of Mutual Funds

Mutual funds are known for their tax inefficiency due to frequent trading within the fund, resulting in capital gains distributions to investors. These capital gains are taxable to investors at their individual tax rates, potentially leading to higher tax liabilities.

- Mutual funds distribute capital gains to investors, which are taxed at the investor’s individual tax rate.

- Dividends from mutual funds are also taxable to investors at their individual tax rates.

- Investors have little control over the timing of capital gains distributions, which can result in unexpected tax liabilities.

Tax Implications of ETFs

ETFs are generally more tax-efficient than mutual funds due to their structure as exchange-traded securities. Investors have more control over when they realize capital gains by when they buy or sell ETF shares, which can help reduce tax liabilities.

- ETFs are bought and sold on an exchange, giving investors control over when they realize capital gains.

- Capital gains in ETFs are typically taxed at the investor’s individual tax rate, but investors have more flexibility in timing these gains.

- ETFs may also be structured to minimize capital gains distributions, further enhancing tax efficiency for investors.

Comparison of Tax Implications

When comparing the tax implications of investing in mutual funds versus ETFs, ETFs generally offer greater tax efficiency for investors. The ability to control when capital gains are realized in ETFs can help reduce tax liabilities compared to mutual funds, where capital gains distributions are at the discretion of the fund manager.

Overall, considering the tax efficiency of mutual funds and ETFs is an important aspect of portfolio management, as minimizing tax liabilities can enhance overall investment returns for investors.