Kicking off with Passive income ideas, this is here to grab your attention and give you a sneak peek into the world of making money on the side. From real estate investments to online businesses, we’ve got you covered with the best ways to generate passive income.

Get ready to dive into the world of financial freedom and learn how to make your money work for you with these innovative ideas.

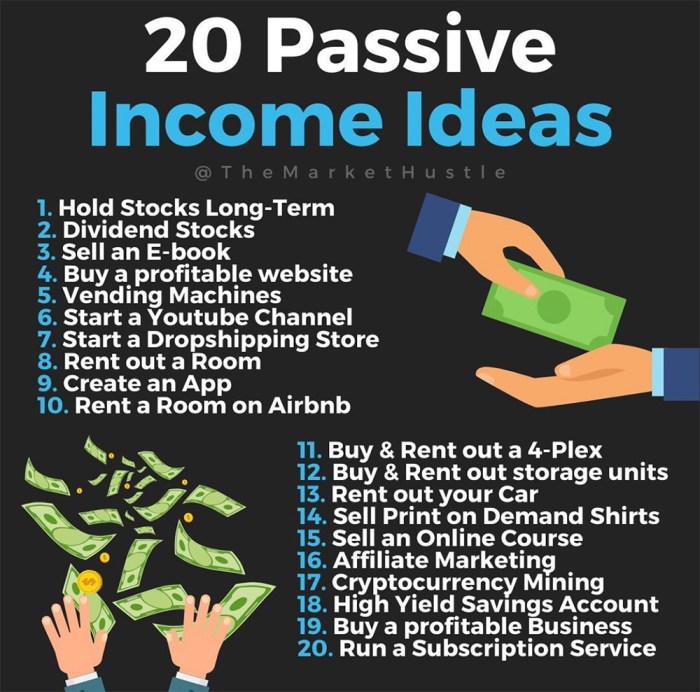

Passive Income Ideas

Passive income refers to earnings that are generated with minimal effort or time investment after the initial setup. This type of income allows individuals to make money while they sleep, travel, or focus on other activities. It is a valuable source of financial stability and can lead to long-term wealth accumulation.

Popular Passive Income Streams

- Dividend Stocks: Investing in dividend-paying stocks allows individuals to earn a portion of the company’s profits regularly.

- Rental Properties: Owning rental properties can provide a steady stream of income through monthly rent payments.

- Peer-to-Peer Lending: Investing in P2P lending platforms enables individuals to earn interest on loans made to others.

- Affiliate Marketing: Promoting products or services and earning a commission for each sale made through your referral.

Benefits of Generating Passive Income

- Financial Freedom: Passive income can provide financial security and allow individuals to pursue their passions without worrying about money.

- Diversification: Having multiple passive income streams helps individuals diversify their sources of income, reducing financial risk.

- Flexibility: Passive income streams can be managed remotely, offering flexibility in terms of location and work hours.

- Wealth Building: Building passive income streams over time can lead to wealth accumulation and long-term financial success.

Real Estate Investments

Investing in real estate can be a lucrative source of passive income. By purchasing properties and renting them out or fixing them up to sell for a profit, individuals can generate ongoing revenue without having to actively work for it.

Rental Properties vs. Fix-and-Flip Strategies

- Rental Properties:

- Owning rental properties involves leasing them out to tenants in exchange for monthly rent payments.

- This strategy provides a steady stream of passive income over time, as long as the properties are well-maintained and occupied.

- Landlords are responsible for property management, maintenance, and dealing with tenant issues.

- Fix-and-Flip Strategies:

- Fix-and-flip involves purchasing distressed properties, renovating them, and selling them for a profit.

- This strategy can generate a lump sum of income in a shorter period compared to rental properties.

- However, it requires more active involvement in finding, renovating, and selling the properties.

Challenges and Benefits of Investing in Real Estate for Passive Income

- Challenges:

- Market fluctuations can impact property values and rental demand.

- Property maintenance and management can be time-consuming and costly.

- Dealing with difficult tenants or unexpected repairs can be stressful.

- Benefits:

- Real estate investments have the potential for long-term appreciation in value.

- Passive income from rental properties can provide financial stability and cash flow.

- Diversifying a portfolio with real estate can offer protection against market volatility.

Stock Market Investments: Passive Income Ideas

Investing in the stock market can be a great way to generate passive income. One popular strategy is to focus on dividend-paying stocks, which provide regular income through the dividends paid out by the companies.

Dividend-Paying Stocks for Passive Income, Passive income ideas

- Dividend-paying stocks are shares of companies that distribute a portion of their profits to shareholders on a regular basis.

- Investing in these stocks can provide a steady stream of passive income without having to sell the shares.

- Reinvesting dividends can compound your returns over time, leading to even more passive income in the future.

- It’s important to research and choose companies with a history of consistent dividend payments and sustainable growth.

Index Funds and ETFs for Passive Income

- Index funds and Exchange-Traded Funds (ETFs) are investment funds that track a specific index, such as the S&P 500.

- These funds offer diversification by investing in a wide range of stocks, reducing individual stock risk.

- Investing in index funds and ETFs can provide passive income through dividends and capital appreciation.

- They are a low-cost and convenient way for beginners to start investing in the stock market.

Tips for Beginners in Stock Market Investing

- Start with research and education to understand the basics of stock market investing.

- Consider starting with index funds and ETFs to build a diversified portfolio without the need for individual stock selection.

- Focus on long-term investing and avoid frequent trading, as it can lead to higher fees and lower returns.

- Consult with a financial advisor or use online resources to help guide your investment decisions.

Online Business

In today’s digital age, online businesses have become a popular choice for generating passive income. With the right strategies and tools, you can create a successful online business that brings in money even while you sleep.Affiliate marketing is one of the most popular online business models for generating passive income. This involves promoting products or services from other companies and earning a commission for every sale made through your referral.

By building a strong online presence and attracting a large audience, you can maximize your earnings through affiliate marketing.

Affiliate Marketing

- Choose a niche that you are passionate about and has a high demand in the market.

- Join affiliate programs of reputable companies that offer products or services related to your niche.

- Create valuable content such as blog posts, videos, or social media posts that promote these products or services to your audience.

- Focus on building trust with your audience to increase conversions and maximize your passive income potential.

Importance of Valuable Content

- Quality content is key to attracting and retaining your audience for your online business.

- Engaging and informative content can drive traffic to your website or social media platforms, increasing your chances of earning passive income through affiliate marketing or other revenue streams.

- Regularly update your content and stay relevant to ensure continued success in your online business ventures.

Peer-to-Peer Lending

Peer-to-peer lending is a form of investing where individuals lend money to others through online platforms, bypassing traditional financial institutions like banks. This type of investment allows individuals to earn passive income through the interest generated on the loans they provide to borrowers.

Risks and Benefits of Peer-to-Peer Lending Platforms

- Benefits:

- Higher returns compared to conventional savings accounts.

- Diversification of investment portfolio.

- Ability to choose borrowers based on risk profile.

- Risks:

- Potential default by borrowers leading to loss of principal.

- Lack of liquidity as funds are tied up for the loan term.

- Risk of platform insolvency affecting investor funds.

Tips for Maximizing Returns through Peer-to-Peer Lending

- Research platforms and choose reputable ones with a track record of successful loans.

- Diversify investments across multiple loans to spread risk.

- Understand the risk profile of borrowers and assess their ability to repay.

- Regularly monitor investments and reinvest returns to maximize compounding interest.

- Consider using automated investing tools to streamline the investment process.