Embarking on the journey of planning for healthcare costs in retirement involves a meticulous analysis of various factors that can significantly impact financial stability during this phase of life. From understanding the intricacies of healthcare expenses to devising strategies for effective budgeting, this topic delves into crucial aspects that retirees need to consider for a secure future.

As we delve deeper into the specifics of healthcare costs in retirement, a wealth of information awaits to equip you with the knowledge necessary to navigate this critical aspect of financial planning.

Understanding Healthcare Costs in Retirement

Healthcare costs in retirement refer to the expenses incurred by individuals for medical services and treatments after they have stopped working. These costs can include doctor visits, prescription medications, surgeries, and long-term care.

Impact of Inflation on Healthcare Expenses

Healthcare expenses are subject to the effects of inflation, causing the cost of medical services and treatments to increase over time. This means that retirees may need to budget for higher healthcare costs as they age.

Common Healthcare Services Needed During Retirement

- Regular check-ups and preventive care

- Prescription medications

- Specialist consultations

- Emergency medical services

- Physical therapy or rehabilitation

Potential Unexpected Healthcare Costs for Retirees

- Medical emergencies or accidents

- Chronic health conditions requiring ongoing treatment

- Long-term care needs, such as nursing home or assisted living expenses

- Dental care or vision services not covered by insurance

- Out-of-pocket expenses for uncovered medical procedures

Factors Affecting Healthcare Costs

Location, existing health conditions, lifestyle choices, and insurance coverage all play significant roles in determining healthcare expenses during retirement.

Location Influence on Healthcare Expenses

The location where retirees choose to live can have a substantial impact on their healthcare costs. Urban areas often offer a wider range of healthcare providers and facilities, which may result in higher costs compared to rural areas. Additionally, the cost of living in different regions can affect healthcare expenses, as some areas have higher medical service costs overall.

Impact of Existing Health Conditions

Retirees with pre-existing health conditions may face higher healthcare costs due to the need for ongoing treatments, medications, and specialist care. Managing chronic illnesses can be expensive, especially if frequent doctor visits or hospitalizations are required.

Role of Lifestyle Choices in Managing Healthcare Expenses

Adopting a healthy lifestyle can help retirees reduce healthcare costs in retirement. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can lower the risk of developing costly health conditions. Preventive care and early intervention can also lead to savings in the long run.

Importance of Insurance Coverage in Planning for Healthcare Costs

Having adequate insurance coverage is crucial for managing healthcare expenses in retirement. Medicare, supplemental insurance, and long-term care policies can provide financial protection against unexpected medical costs. Understanding the coverage options available and choosing the right plans based on individual healthcare needs is essential for effective cost management.

Strategies for Planning for Healthcare Costs

Planning for healthcare costs in retirement is crucial to ensure financial security and peace of mind during your golden years. There are several strategies you can implement to effectively manage and cover healthcare expenses in retirement.

Benefits of Health Savings Accounts (HSAs) for Retirement Planning

Health Savings Accounts (HSAs) are a valuable tool for saving money tax-free to cover medical expenses. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are also tax-free. By maximizing your contributions to an HSA throughout your working years, you can build a significant fund to use towards healthcare costs in retirement.

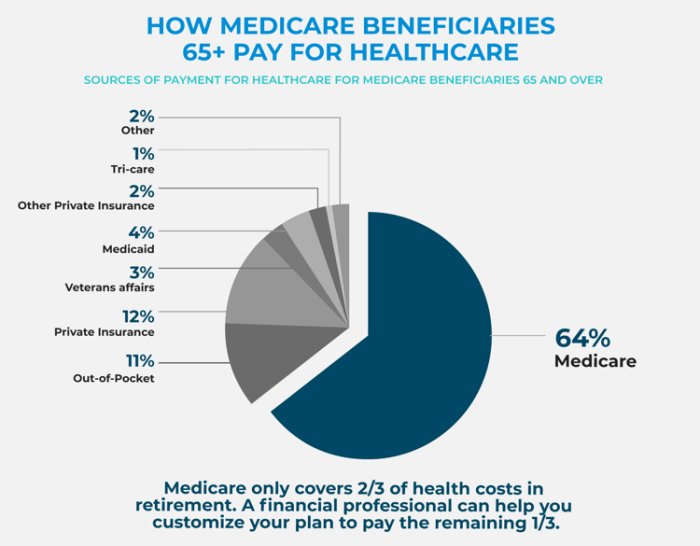

Role of Medicare in Covering Healthcare Costs for Retirees

Medicare is a federal health insurance program that covers eligible individuals aged 65 and older. While Medicare provides essential coverage for hospital stays, doctor visits, and prescription drugs, it may not cover all healthcare expenses. It’s important to understand the different parts of Medicare (Part A, B, C, and D) and consider supplemental insurance options to fill in any coverage gaps.

Comparison of Different Long-Term Care Options and Financial Implications

Long-term care is a significant expense that many retirees may face as they age. It’s essential to explore different long-term care options, such as nursing homes, assisted living facilities, and home healthcare services, to determine the best fit for your needs and budget. Long-term care insurance can help offset the high costs of long-term care and protect your retirement savings from being depleted.

Tips for Optimizing Retirement Savings to Cover Healthcare Expenses

To ensure you have enough savings to cover healthcare expenses in retirement, consider implementing the following tips:

– Start saving early and consistently towards healthcare costs.

– Maximize contributions to retirement accounts, such as 401(k)s and IRAs.

– Create a budget specifically for healthcare expenses and adjust it as needed.

– Stay healthy and active to reduce the risk of medical conditions that may require expensive treatments.

– Consult with a financial advisor to create a comprehensive retirement plan that includes healthcare costs.

By incorporating these strategies into your retirement planning, you can better prepare for the inevitable healthcare expenses that come with aging. Remember, proactive planning now can help alleviate financial stress and ensure a comfortable and secure retirement.

Implementing a Healthcare Cost Budget

Implementing a healthcare cost budget in retirement is crucial to ensure financial stability and peace of mind. By designing a sample budget and organizing expenses into categories, retirees can effectively manage their healthcare costs and be prepared for unexpected medical emergencies.

Sample Budget Design

Creating a sample budget for healthcare costs involves outlining all potential expenses related to medical care. This can include insurance premiums, co-payments, prescription medications, routine check-ups, dental care, vision care, and any other healthcare-related expenses. By estimating these costs based on current expenses and projected needs, retirees can develop a comprehensive budget to guide their spending.

Adjusting for Unexpected Medical Emergencies

It is essential to account for unexpected medical emergencies when planning a healthcare cost budget. Setting aside a contingency fund or including a buffer in the budget can help cover unforeseen healthcare expenses, such as emergency room visits, hospital stays, or unexpected treatments. By preparing for the unexpected, retirees can ensure they are financially protected in the event of a medical crisis.

Annual Budget Review

Creating a timeline for reviewing and revising the healthcare cost budget annually is recommended to ensure it remains accurate and effective. As healthcare costs and needs may change over time, retirees should reassess their budget each year to account for any adjustments in expenses or coverage. By regularly reviewing and updating the budget, retirees can stay on track with their healthcare expenses and make necessary changes to maintain financial stability in retirement.