Real Estate Investment Tips take the spotlight in this guide, offering a fresh perspective on navigating the world of real estate with savvy strategies that promise lucrative outcomes.

From understanding the importance of diversification to exploring various types of investments, this article dives deep into the realm of real estate investments, equipping you with the knowledge needed to make informed decisions.

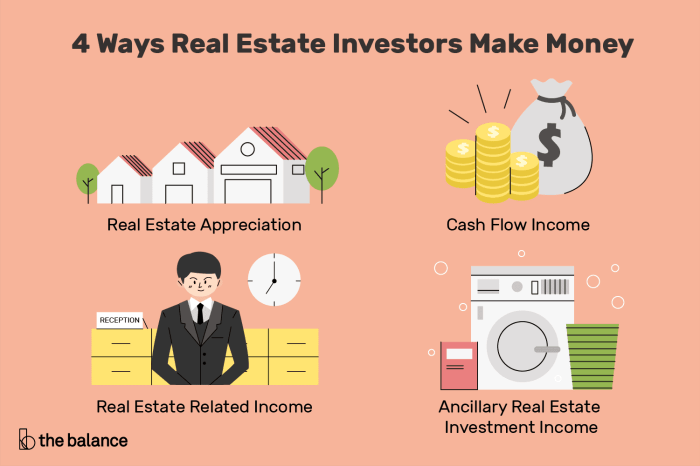

Importance of Real Estate Investment

Real estate investment is considered a valuable asset due to its potential for long-term financial growth and stability. Unlike other investment options, real estate offers tangible assets that can appreciate over time, providing a hedge against inflation and economic downturns.

Benefits of Diversifying an Investment Portfolio with Real Estate

Diversifying an investment portfolio with real estate can help spread risk across different asset classes. Real estate investments have historically shown low correlation with stocks and bonds, making them a valuable addition to a well-rounded portfolio. Additionally, real estate can provide a steady income stream through rental payments, further enhancing the overall return on investment.

Long-Term Financial Security through Real Estate

Real estate investments have the potential to generate long-term financial security by building equity over time. Property values tend to appreciate over the years, allowing investors to benefit from capital gains. Moreover, rental income can provide a reliable source of cash flow, especially during retirement years.

Generating Passive Income through Real Estate Investments

One of the key advantages of real estate investment is the ability to generate passive income. By renting out properties, investors can earn regular rental payments without actively working for it. This passive income stream can help supplement other sources of income and provide financial stability in the long run.

Types of Real Estate Investments: Real Estate Investment Tips

Residential, commercial, industrial, and retail real estate investments offer different opportunities and risks for investors. Understanding the advantages and disadvantages of each type is crucial in making informed decisions.

Residential Real Estate

Residential real estate involves properties used for living purposes, such as houses, apartments, and condominiums. One advantage is the potential for steady rental income, while a disadvantage could be the maintenance costs involved. Successful strategies include flipping houses for profit or renting out properties for passive income.

Commercial Real Estate

Commercial real estate includes office buildings, retail spaces, and warehouses. The advantage lies in higher rental yields and longer lease terms, but the risk of economic downturns affecting occupancy rates is a concern. Investing in shopping malls or office complexes can yield substantial returns if managed effectively.

Industrial Real Estate

Industrial real estate comprises properties like factories, distribution centers, and storage facilities. The advantage is the stable long-term leases with corporate tenants, but the disadvantage is the specialized knowledge required for managing industrial properties. Investing in logistics hubs or manufacturing plants can provide consistent cash flow and potential appreciation.

Retail Real Estate

Retail real estate involves properties like shopping centers, standalone stores, and restaurants. The advantage is the potential for high foot traffic and lucrative lease agreements, while the disadvantage is the vulnerability to changes in consumer trends. Successful strategies include investing in prime retail locations or diversifying tenant mix to mitigate risks.Choose the most suitable type of real estate investment based on your financial goals, risk tolerance, and investment horizon.

Diversification across different sectors can help spread risks and maximize returns in your real estate investment portfolio.

Factors to Consider Before Investing in Real Estate

When looking to invest in real estate, there are several crucial factors to consider to ensure a successful investment. From location to market trends, thorough due diligence, and understanding local regulations, each aspect plays a significant role in making informed decisions.

Importance of Location

The location of a property is one of the most critical factors to consider when investing in real estate. A prime location can significantly impact the property’s value and potential for appreciation over time. Factors such as proximity to amenities, schools, transportation, and future development plans can all influence the desirability of a location and its potential for long-term growth.

Market Trends and Economic Indicators

Before making a real estate investment, it is essential to analyze market trends and economic indicators. Understanding factors such as supply and demand, interest rates, employment rates, and economic growth can help predict the future performance of a property. Keeping an eye on market trends can provide valuable insights into the potential risks and opportunities associated with a particular investment.

Tips for Conducting Due Diligence

Conducting thorough due diligence before purchasing a property is crucial to avoid costly mistakes. This includes researching the property’s history, conducting property inspections, evaluating financial projections, and assessing potential risks. By taking the time to conduct comprehensive due diligence, investors can make informed decisions and mitigate potential risks associated with the investment.

Understanding Local Zoning Laws and Regulations

Understanding local zoning laws and regulations is essential when investing in real estate. Zoning laws dictate how a property can be used, the type of structures that can be built, and any restrictions or limitations on development. By familiarizing yourself with local zoning laws, investors can ensure compliance and avoid any legal issues that may arise in the future.

Financing Real Estate Investments

Real estate investments often require financing to make them a reality. There are several options available for financing real estate investments, each with its own benefits and considerations.

Traditional Mortgages, Real Estate Investment Tips

Traditional mortgages are a common way to finance real estate investments. These loans are typically obtained through banks or mortgage lenders and require a down payment, good credit score, and proof of income. The terms of the loan, such as the interest rate and repayment period, will vary depending on the lender and your financial situation.

Hard Money Loans

Hard money loans are another financing option for real estate investors. These loans are typically provided by private investors or companies and are secured by the property itself. Hard money loans usually have higher interest rates and shorter repayment terms than traditional mortgages, making them a more expensive option. However, they can be useful for investors who need quick financing or have less-than-perfect credit.

Partnerships

Partnerships are a creative way to finance real estate investments. By partnering with other investors or real estate professionals, you can pool resources and expertise to finance and manage properties together. Partnerships can help spread the risk and workload of real estate investments, but it’s important to have a clear partnership agreement in place to Artikel each party’s rights and responsibilities.

Improving Credit Scores for Better Financing Terms

Having a good credit score is essential for securing favorable financing terms for real estate investments. To improve your credit score, focus on paying bills on time, reducing debt, and checking your credit report regularly for errors. A higher credit score can help you qualify for lower interest rates and larger loan amounts, saving you money in the long run.

Leveraging in Real Estate Investments

Leveraging in real estate investments refers to using borrowed funds to increase the potential return on investment. By leveraging, investors can control a larger asset with a smaller amount of their own money. However, leveraging also increases risk, as any losses will be magnified. It’s important to carefully consider the risks and rewards of leveraging in real estate investments before proceeding.

Creative Financing Strategies

In addition to traditional financing options, real estate investors often use creative strategies to fund their investments. Some examples include seller financing, where the seller acts as the lender for the buyer, lease options, where the buyer leases the property with an option to purchase, and crowdfunding, where multiple investors contribute funds to finance a project. These creative financing strategies can provide alternative ways to fund real estate investments and tailor financing to specific needs.