Embark on a journey into the realm of retirement savings plans, where financial security and future planning intersect. Discover the key aspects of different retirement options and how they can shape your golden years.

As we delve deeper, we will uncover the intricacies of various retirement savings plans, shedding light on the importance of early planning and strategic investment choices.

Importance of Retirement Savings Plans

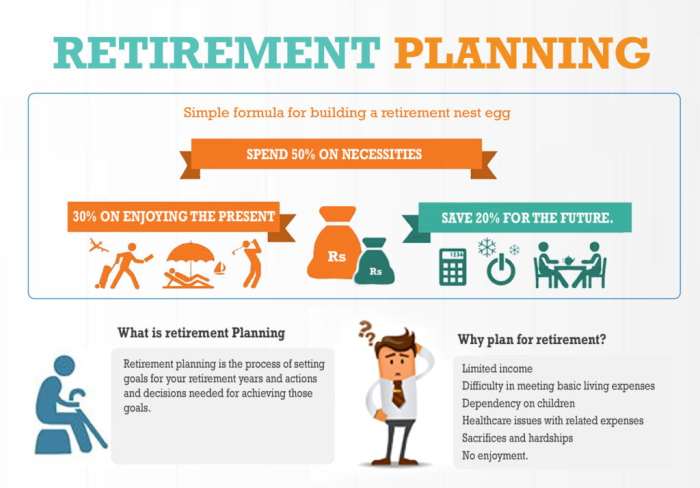

Having a retirement savings plan is crucial for ensuring financial security during the later stages of life. It allows individuals to maintain their standard of living and cover expenses when they are no longer working.

Benefits of Starting a Retirement Savings Plan Early

Starting a retirement savings plan early offers numerous advantages, including:

- Compound interest: By starting early, individuals can take advantage of compound interest, allowing their savings to grow exponentially over time.

- Longer investment horizon: Starting early provides a longer investment horizon, which can help mitigate market fluctuations and increase overall returns.

- Lower required contributions: Beginning to save for retirement early means that individuals can save smaller amounts each month while still achieving their financial goals.

Statistics on Retirement Preparedness

Unfortunately, many people are not adequately prepared for retirement. According to recent studies:

- Approximately 42% of Americans have less than $10,000 saved for retirement.

- Only 32% of Americans are very confident that they will have enough money to retire comfortably.

- 56% of Americans have not calculated how much they need to save for retirement.

Types of Retirement Savings Plans

When planning for retirement, individuals have several options to choose from when it comes to saving for the future. Some of the most common types of retirement savings plans include 401(k), IRA, Roth IRA, and pension plans. Each of these plans has unique features and benefits that cater to different needs and preferences.

401(k) Plans

401(k) plans are employer-sponsored retirement plans that allow employees to contribute a portion of their salary to a tax-advantaged investment account. Employers may also match a percentage of the employee’s contributions, providing additional savings. These plans offer a wide range of investment options and are portable, meaning employees can take their savings with them if they change jobs.

IRA (Individual Retirement Account)

IRAs are personal retirement accounts that individuals can open independently. Contributions to a traditional IRA are tax-deductible, and earnings grow tax-deferred until withdrawal. Roth IRAs, on the other hand, are funded with after-tax dollars, but withdrawals in retirement are tax-free. IRAs offer flexibility in investment choices and are not tied to employment, making them suitable for self-employed individuals or those without access to employer-sponsored plans.

Roth IRA

Roth IRAs are a type of individual retirement account that offers tax-free growth and withdrawals in retirement. Contributions to a Roth IRA are made with after-tax dollars, meaning that withdrawals in retirement are not subject to income tax. This makes Roth IRAs an attractive option for individuals who anticipate being in a higher tax bracket during retirement.

Pension Plans

Pension plans, also known as defined benefit plans, are retirement plans where employers promise a specified monthly benefit to employees upon retirement. These plans are funded by the employer and provide a reliable source of income in retirement. Pension plans are becoming less common in the private sector but are still prevalent in government and certain industries.

Employer-Sponsored Retirement Plans Examples

- Company A offers a 401(k) plan with a matching contribution of up to 5% of the employee’s salary.

- Company B provides a traditional IRA option for employees with a wide range of investment choices.

- Company C offers a Roth IRA as part of its retirement benefits package, allowing employees to contribute post-tax dollars towards their retirement savings.

How to Start a Retirement Savings Plan

When it comes to starting a retirement savings plan, there are several key steps to consider in order to ensure a secure financial future for your retirement years.

Setting Up a Retirement Savings Account

One of the first steps in starting a retirement savings plan is to open a retirement savings account. This account can be a 401(k), IRA, Roth IRA, or another type of retirement account offered by your employer or financial institution. It is important to carefully review the terms and conditions of each account to understand the contribution limits, tax implications, and investment options available.

Importance of Setting Retirement Goals

Setting retirement goals is crucial when starting a savings plan as it helps you determine how much money you will need to save in order to maintain your desired lifestyle during retirement. By setting specific and measurable goals, you can create a roadmap for your savings plan and track your progress over time. Consider factors such as your desired retirement age, expected expenses, and any additional sources of income.

Choosing the Right Investment Options

When choosing investment options for your retirement plan, it is important to consider your risk tolerance, time horizon, and financial goals. Diversifying your investments across different asset classes can help mitigate risk and maximize returns over the long term. Consider consulting with a financial advisor to help you select the right mix of investments based on your individual circumstances and preferences.

Strategies for Maximizing Retirement Savings

When it comes to maximizing your retirement savings, there are several strategies you can implement to ensure a financially secure future. From increasing contributions to diversifying investments, here are some key tactics to help you make the most of your retirement savings plan.

Increasing Contributions to Retirement Accounts

One effective way to boost your retirement savings is to increase your contributions to your retirement accounts. This can be achieved by maximizing your annual contributions to your 401(k) or IRA. Take advantage of any employer matching contributions to maximize the benefits of your retirement accounts.

Diversifying Investments Within a Retirement Savings Plan

Diversification is crucial when it comes to retirement savings. By spreading your investments across different asset classes such as stocks, bonds, and real estate, you can reduce risk and increase the potential for returns. Consider consulting a financial advisor to help you create a diversified investment portfolio that aligns with your retirement goals.

Adjusting Retirement Savings Strategies Based on Age and Financial Goals

As you progress through different stages of life, it’s important to adjust your retirement savings strategies accordingly. Younger individuals may opt for more aggressive investment options with higher growth potential, while older individuals may prioritize more conservative investments to protect their savings. Regularly review and reassess your retirement savings plan to ensure it aligns with your age and financial goals.