Risk tolerance assessment is a crucial aspect of financial planning, guiding individuals in making informed investment decisions based on their unique preferences and circumstances. By delving into the intricacies of risk tolerance assessment, we uncover a world of factors that shape our financial choices and ultimately impact our investment portfolios.

From defining risk tolerance assessment to exploring various methods and factors influencing it, this guide aims to provide a deep understanding of the subject, shedding light on why it is essential for individuals seeking financial stability and growth.

What is Risk Tolerance Assessment?

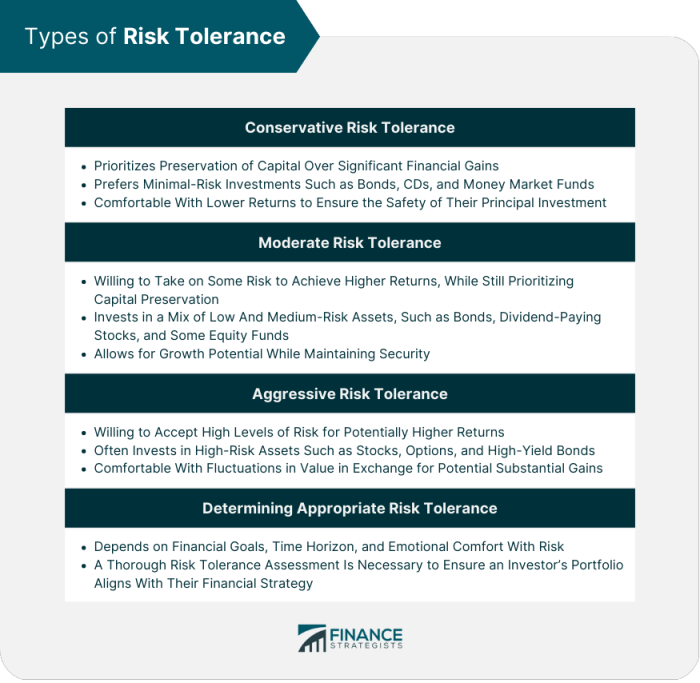

Risk Tolerance Assessment is a crucial tool used in financial planning to evaluate an individual’s willingness and ability to take on risk when making investment decisions. It helps individuals understand their comfort level with potential losses and fluctuations in the value of their investments. By assessing risk tolerance, financial advisors can recommend suitable investment options that align with an individual’s risk profile.

Importance of Risk Tolerance Assessment

Risk Tolerance Assessment plays a vital role in financial planning as it ensures that investment decisions are in line with an individual’s financial goals and risk preferences. By understanding how much risk an individual is willing to take, financial advisors can create a diversified investment portfolio that matches their risk tolerance level.

Factors Influencing Risk Tolerance

- Age: Younger individuals may have a higher risk tolerance as they have more time to recover from potential losses.

- Financial Goals: Short-term goals may require a more conservative approach, while long-term goals may allow for higher risk investments.

- Income Stability: Individuals with stable income may be more willing to take on risk compared to those with fluctuating income.

- Knowledge and Experience: Experienced investors may have a higher risk tolerance due to their understanding of the market and investment strategies.

Methods for Assessing Risk Tolerance

Risk tolerance assessment is a crucial step in financial planning and investment management. There are various methods used to evaluate an individual’s risk tolerance, each with its own advantages and limitations. In this section, we will explore different approaches to assessing risk tolerance and compare quantitative and qualitative methods.

Quantitative Approaches

Quantitative methods for assessing risk tolerance involve numerical calculations and statistical analysis to determine an individual’s risk profile. These methods typically rely on mathematical models and algorithms to quantify risk preferences based on factors such as investment goals, time horizon, and financial situation. One common quantitative approach is the use of risk tolerance questionnaires that assign a numerical score to assess an individual’s risk tolerance level. These questionnaires may include questions about investment knowledge, risk perception, and willingness to take risks.

Qualitative Approaches

Qualitative methods for assessing risk tolerance focus on understanding an individual’s attitudes, values, and beliefs about risk. Unlike quantitative approaches, qualitative methods rely on subjective judgments and qualitative data to evaluate risk preferences. This can involve in-depth interviews, discussions, and behavioral observations to gain insights into an individual’s risk mindset. Qualitative approaches provide a more holistic view of risk tolerance by considering emotional factors and personal experiences that may influence risk-taking behavior.

Comparison and Contrast

Quantitative approaches to risk tolerance assessment provide a standardized and structured method for evaluating risk preferences, making it easier to compare results across individuals. However, these methods may oversimplify complex risk attitudes and fail to capture the full range of factors that influence risk tolerance. On the other hand, qualitative approaches offer a more nuanced understanding of risk attitudes but can be subjective and challenging to quantify.

Commonly Used Tools and Questionnaires

Several tools and questionnaires are commonly used for risk tolerance assessment, combining both quantitative and qualitative elements. Examples include the Riskalyze tool, which uses a proprietary algorithm to calculate an individual’s Risk Number based on their responses to a series of questions. Another popular tool is the FinaMetrica Risk Profiling System, which assesses risk tolerance through a series of psychometric tests and behavioral analysis.

Factors Affecting Risk Tolerance

Age, financial goals, investment experience, market conditions, and economic factors all play a significant role in determining an individual’s risk tolerance level. Understanding how these factors can impact risk tolerance is crucial for making informed investment decisions.

Age

Age is a key factor that influences risk tolerance. Generally, younger individuals are more willing to take on higher levels of risk as they have more time to recover from any potential losses. As individuals approach retirement age, their risk tolerance tends to decrease as they seek to preserve their wealth and ensure a stable income during retirement.

Financial Goals

An individual’s financial goals also affect their risk tolerance. Those with long-term financial goals, such as saving for retirement or funding a child’s education, may be more willing to take on higher levels of risk to achieve potentially higher returns. On the other hand, individuals with short-term financial goals, such as purchasing a home in the near future, may have a lower risk tolerance to protect their capital.

Investment Experience

Investment experience plays a crucial role in determining risk tolerance. Individuals with more experience in investing may have a higher risk tolerance as they are familiar with market fluctuations and have a better understanding of the risks involved. In contrast, individuals with limited investment experience may have a lower risk tolerance and prefer more conservative investment options.

Market Conditions and Economic Factors

Market conditions and economic factors can significantly impact risk tolerance levels. During periods of economic uncertainty or market volatility, individuals may become more risk-averse and opt for safer investment options to protect their capital. Conversely, during periods of economic growth and stability, individuals may be more willing to take on higher levels of risk to capitalize on potential returns.

Changes Over Time and Circumstances

It’s important to note that risk tolerance is not static and can change over time and under different circumstances. Life events such as marriage, starting a family, or experiencing a financial setback can all influence an individual’s risk tolerance. Additionally, as individuals gain more investment experience or reassess their financial goals, their risk tolerance may evolve accordingly.

Importance of Understanding Risk Tolerance

Understanding risk tolerance is crucial when it comes to making investment decisions that align with an individual’s financial goals and preferences. It involves assessing how much risk an individual is willing and able to take on in their investment portfolio.

Alignment of Investment Decisions

By understanding one’s risk tolerance, investors can ensure that their investment choices match their comfort level with risk. This alignment helps in creating a well-suited investment strategy that maximizes the potential for returns while considering the individual’s risk preferences.

Consequences of Ignoring or Misjudging Risk Tolerance

- Ignoring or misjudging risk tolerance can lead to investing in assets that are too risky or too conservative for an individual’s comfort level.

- This mismatch can result in increased stress, emotional decision-making, and potential financial losses if the investments do not align with the investor’s risk tolerance.

- It can also lead to a lack of diversification in the investment portfolio, exposing the individual to higher levels of risk than they can handle.

Well-Balanced Investment Portfolio

A proper risk tolerance assessment can help in constructing a well-balanced investment portfolio that considers the individual’s financial goals, time horizon, and risk appetite. By diversifying investments across different asset classes based on risk tolerance, investors can achieve a portfolio that balances risk and potential returns effectively.