With steps to financial freedom at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a journey towards financial independence. It delves into the essential aspects of understanding financial freedom, managing debt, creating multiple income streams, investing for the future, planning for retirement, and building wealth through savings.

The content provides a detailed roadmap for individuals looking to take control of their finances and secure a stable financial future.

Understanding Financial Freedom

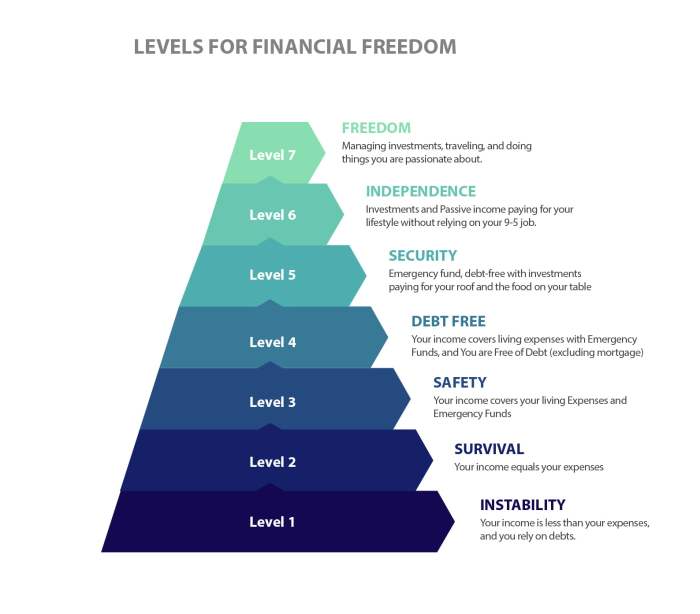

Financial freedom refers to the ability to make decisions about your money without being restricted by financial constraints. It means having enough resources to cover your expenses, achieve your goals, and live the life you desire without worrying about financial burdens.

Setting financial goals is crucial in achieving financial freedom as it provides a roadmap to follow and helps you stay focused on your objectives. Whether it’s saving for a house, retiring early, or starting a business, having clear goals allows you to track your progress and make necessary adjustments along the way.

Budgeting plays a significant role in achieving financial freedom as it helps you manage your income, expenses, and savings effectively. By creating a budget and tracking your spending, you can identify areas where you can cut back, save more, and allocate funds towards your financial goals.

Having an emergency fund is essential for financial freedom as it provides a safety net during unexpected situations such as job loss, medical emergencies, or car repairs. An emergency fund allows you to cover unforeseen expenses without derailing your financial progress or going into debt.

Managing Debt

Debt management is a crucial aspect of achieving financial freedom. By understanding the different types of debt, strategies for paying it off, debt-to-income ratio, and tips for avoiding debt traps, individuals can take control of their financial situation and work towards a debt-free future.

Types of Debt

- Credit Card Debt: High-interest debt accumulated through credit card purchases.

- Student Loans: Loans taken out for educational purposes, often with varying interest rates.

- Mortgages: Loans used to purchase a home, typically with long repayment periods.

- Personal Loans: Borrowed money that must be repaid with interest, often used for various personal expenses.

Strategies for Paying Off Debt

- Create a Budget: Track income and expenses to allocate funds towards debt repayment.

- Snowball Method: Pay off debts from smallest to largest to build momentum.

- Avalanche Method: Prioritize debts with the highest interest rates to save on interest costs.

- Debt Consolidation: Combine multiple debts into a single loan with lower interest rates.

Debt-to-Income Ratio

The debt-to-income ratio is a financial metric used to assess an individual’s ability to manage debt. It is calculated by dividing total monthly debt payments by gross monthly income and is expressed as a percentage.

Debt-to-Income Ratio = (Total Monthly Debt Payments / Gross Monthly Income) x 100%

Tips for Avoiding Debt Traps

- Live Below Your Means: Avoid overspending and prioritize saving over unnecessary expenses.

- Emergency Fund: Build an emergency fund to cover unexpected expenses and avoid relying on credit.

- Avoid Impulse Purchases: Take time to consider purchases and differentiate between needs and wants.

- Monitor Credit Score: Regularly check credit reports to address any discrepancies and maintain a good credit score.

Creating Multiple Income Streams

Creating multiple income streams is a crucial strategy for achieving financial freedom. By diversifying your sources of income, you can reduce financial risk and increase your overall earning potential. One key aspect of creating multiple income streams is generating passive income, which allows you to earn money without actively working for it. This can provide you with greater financial security and flexibility in the long run.

Benefits of Diversifying Income Sources

- Diversifying income sources reduces reliance on a single source of income, making you less vulnerable to economic downturns or job loss.

- It can increase your overall earning potential and help you reach your financial goals faster.

- By creating multiple income streams, you can explore different opportunities for growth and wealth accumulation.

Examples of Side Hustles or Investments for Extra Income

- Starting a freelance business or offering services in your area of expertise.

- Investing in stocks, real estate, or other assets that generate passive income.

- Monetizing a hobby or passion by selling products or services online.

Investing for the Future

Investing for the future is a crucial step in securing long-term financial stability. By putting your money into various investment options, you can potentially grow your wealth over time and achieve your financial goals.

Different Investment Options

- Stocks: Investing in individual company stocks can offer high returns but also comes with higher risks.

- Bonds: Bonds are considered safer investments than stocks and provide a fixed income over time.

- Real Estate: Real estate investments can generate rental income and appreciate in value over the long term.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities.

Building a Well-Diversified Portfolio

Having a well-diversified investment portfolio is essential to manage risk and maximize returns. By spreading your investments across different asset classes, industries, and regions, you can reduce the impact of volatility on your overall portfolio.

Risk Tolerance in Investing

Understanding your risk tolerance is crucial when investing for the future. Your risk tolerance determines how much volatility you can stomach in your investments. It is important to align your investment choices with your risk tolerance to ensure you can stay invested during market fluctuations.

Planning for Retirement

Retirement planning plays a crucial role in achieving financial freedom as it allows individuals to secure their future by setting aside funds for their post-employment years. By planning for retirement early on, individuals can ensure a comfortable and stress-free life after they stop working.

Retirement Savings Options

- 401(k): A retirement savings plan sponsored by an employer where employees can contribute a portion of their pre-tax earnings towards their retirement fund. Employers may also match a portion of the contributions.

- IRA (Individual Retirement Account): A personal retirement account that allows individuals to make contributions on a tax-deferred basis, with different types such as Traditional IRA and Roth IRA offering varying tax advantages.

- Pension Plans: Defined benefit plans provided by some employers guarantee a specific amount of income during retirement based on years of service and salary.

Calculating Retirement Needs and Setting Savings Goals

- Calculate your retirement needs based on factors like desired retirement age, life expectancy, expected expenses, inflation rate, and healthcare costs.

- Set savings goals by determining how much you need to save each month to reach your retirement target, taking into account your current savings, investments, and expected returns.

- Consider using retirement calculators or seeking advice from financial advisors to ensure you are on track to meet your retirement goals.

Maximizing Retirement Savings and Benefits

- Take advantage of employer-sponsored retirement plans and contribute enough to receive the full employer match, maximizing your contributions to benefit from compound interest over time.

- Diversify your retirement portfolio by investing in a mix of stocks, bonds, and other assets to reduce risk and increase potential returns.

- Regularly review and adjust your retirement plan as needed, especially with changes in income, expenses, or investment performance, to stay on track towards a financially secure retirement.

Building Wealth Through Savings

Saving money regularly is a crucial step in building wealth over time. It provides a financial safety net, helps achieve financial goals, and creates a foundation for future investments. By saving consistently, individuals can take advantage of compounding interest and grow their wealth steadily.

The Importance of Saving Money Regularly

- Regular saving habits instill discipline and financial responsibility.

- Emergency funds can be built to cover unexpected expenses.

- Financial goals such as buying a home, starting a business, or retirement can be achieved through systematic saving.

Tips for Automating Savings and Making it a Habit

- Set up automatic transfers from your checking account to a savings account each month.

- Create a budget that includes a savings goal and treat it like a fixed expense.

- Avoid temptations by having a separate savings account that is not easily accessible.

The Concept of Compounding Interest and its Impact on Wealth Accumulation

Saving money in interest-bearing accounts allows individuals to earn interest not only on their initial deposit but also on the interest already earned. This compounding effect accelerates wealth accumulation over time, making saving an effective strategy for long-term financial growth.

The Difference Between Saving and Investing for Wealth Building

Saving involves setting aside a portion of income for future use, typically in low-risk accounts like savings accounts or certificates of deposit. Investing, on the other hand, involves putting money into assets with the expectation of generating a return, such as stocks, bonds, or real estate. While saving is essential for financial security, investing offers greater potential for wealth growth but comes with higher risk.