With Types of life insurance at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling scientific with objective tone style filled with unexpected twists and insights.

The content of the second paragraph that provides descriptive and clear information about the topic

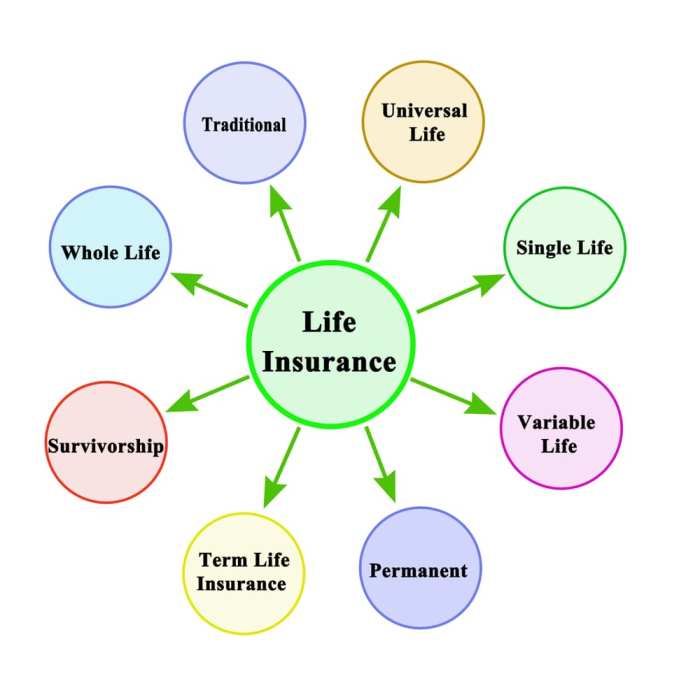

Types of Life Insurance

Term Life Insurance:

Term life insurance is a type of life insurance policy that provides coverage for a specific period, such as 10, 20, or 30 years. If the insured individual passes away during the term of the policy, the beneficiary receives the death benefit. However, if the insured outlives the term, the coverage expires, and there is no payout.

Whole Life Insurance:

Whole life insurance is a permanent life insurance policy that provides coverage for the entire lifetime of the insured individual. It offers a death benefit, as well as a cash value component that grows over time. Premiums are typically higher than term life insurance but remain constant throughout the policyholder’s life.

Universal Life Insurance vs. Variable Life Insurance

Universal Life Insurance:

Universal life insurance is a type of permanent life insurance that offers flexibility in premium payments and death benefits. It also includes a cash value component that earns interest over time. Policyholders can adjust their premiums and death benefits, making it a customizable option.

Variable Life Insurance:

Variable life insurance is another type of permanent life insurance policy that allows policyholders to invest a portion of their premiums in various investment options, such as stocks and bonds. The cash value and death benefit of variable life insurance can fluctuate based on the performance of the investments chosen.

Examples of Different Types of Life Insurance Policies

- Term Life Insurance: Policyholder pays premiums for a specific term.

- Whole Life Insurance: Provides coverage for the entire lifetime of the insured.

- Universal Life Insurance: Offers flexibility in premium payments and death benefits.

- Variable Life Insurance: Allows policyholders to invest in different options.

Coverage and Benefits

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. In the event of the policyholder’s death during the term, the beneficiaries receive a death benefit payout. This type of insurance is often more affordable compared to whole life or universal life insurance, making it a popular choice for individuals seeking temporary coverage.

Whole Life Insurance: Cash Value Component

Whole life insurance not only offers a death benefit but also includes a cash value component that grows over time. A portion of the premium payments goes towards this cash value, which accumulates on a tax-deferred basis. Policyholders can access this cash value through loans or withdrawals, providing a source of funds for various financial needs. Additionally, the cash value can be used to pay premiums or increase the death benefit amount.

Universal Life Insurance: Investment Options

Universal life insurance offers policyholders the flexibility to choose from a variety of investment options for the cash value component. These options may include fixed interest accounts, indexed accounts linked to stock market performance, or variable accounts with investment choices similar to mutual funds. Policyholders can allocate their cash value among these investment options based on their risk tolerance and financial goals.

Variable Life Insurance: Flexibility in Investment Choices

Variable life insurance allows policyholders to invest the cash value in separate accounts that function similarly to mutual funds. The cash value and death benefit fluctuate based on the performance of these investment accounts. Policyholders have the flexibility to adjust their investment choices within the policy, providing an opportunity for potential growth but also exposing them to investment risks. Variable life insurance offers the potential for higher returns compared to other types of life insurance, but it also carries a higher level of risk.

Premiums and Payments

When it comes to life insurance, understanding how premiums are calculated and the payment structures is crucial for policyholders to make informed decisions. Each type of life insurance has its own unique way of determining premiums and managing payment options.

Term Life Insurance Premiums

Term life insurance premiums are calculated based on several factors such as the insured individual’s age, health condition, coverage amount, and the length of the policy term. Typically, younger and healthier individuals pay lower premiums compared to older or less healthy individuals. Premiums for term life insurance policies are typically fixed for the duration of the term.

Whole Life Insurance Payment Structure

Whole life insurance policies require policyholders to pay a fixed premium amount for the entire duration of the policy. These premiums are typically higher compared to term life insurance due to the permanent coverage and cash value accumulation feature of whole life policies. Policyholders have the option to pay premiums on a monthly, quarterly, semi-annual, or annual basis.

Universal Life Insurance Premium Payments

In universal life insurance, policyholders have the flexibility to adjust their premium payments and death benefits within certain limits. The premiums paid by the policyholder are allocated into a cash value account, which earns interest over time. The policyholder can use the cash value to cover premiums or increase the death benefit.

Variable Life Insurance Payment Options

Variable life insurance allows policyholders to allocate their premiums into different investment options, such as stocks, bonds, or mutual funds. The cash value and death benefit of the policy fluctuate based on the performance of the selected investments. Policyholders can choose to pay premiums on a flexible basis, depending on the cash value and investment returns.

Riders and Additional Options

When it comes to life insurance, riders and additional options can provide policyholders with added flexibility and customization to meet their specific needs. Riders are add-ons to a basic life insurance policy that offer extra benefits or coverage for an additional cost. Let’s explore the common riders and additional options available for different types of life insurance.

Common Riders for Term Life Insurance

Term life insurance typically offers a variety of riders that can enhance the coverage of the policy. Some common riders include:

- Accidental Death Benefit Rider: Provides an additional death benefit if the insured dies as a result of an accident.

- Waiver of Premium Rider: Waives the premium payments if the policyholder becomes disabled and is unable to work.

- Convertible Rider: Allows the policyholder to convert the term policy into a permanent life insurance policy without the need for a medical exam.

Additional Benefits in Whole Life Insurance Policies

Whole life insurance policies come with built-in cash value that grows over time. In addition to the guaranteed death benefit, policyholders can also enjoy the following additional benefits:

- Dividend Payments: Policyholders may receive dividends from the insurance company based on the performance of the insurer’s investment portfolio.

- Loan Option: Policyholders can take out a loan against the cash value of the policy without undergoing a credit check.

- Accelerated Death Benefit: Allows the policyholder to access a portion of the death benefit in case of terminal illness diagnosis.

Enhancing Coverage of Universal Life Insurance with Riders

Universal life insurance offers flexibility in premium payments and death benefits. Riders can further enhance the coverage by providing additional benefits such as:

- Long-Term Care Rider: Helps cover the costs of long-term care services if the insured becomes unable to perform activities of daily living.

- Return of Premium Rider: Returns all or a portion of the premiums paid if the policyholder outlives the term of the policy.

- Spousal Rider: Extends coverage to the policyholder’s spouse with a separate death benefit.

Investment-Linked Options in Variable Life Insurance

Variable life insurance allows policyholders to invest a portion of their premiums in sub-accounts linked to the performance of investment options. Some investment-linked options include:

- Equity Funds: Invest in stocks and equities for potential high returns.

- Bond Funds: Invest in fixed-income securities for stable returns.

- Money Market Funds: Invest in low-risk, short-term securities for capital preservation.