Kicking off with Understanding income statements, this opening paragraph is designed to captivate and engage the readers, providing an insightful overview of income statements and their significance in financial analysis. From defining income statements to analyzing revenue and expenses, this guide delves into the intricacies of financial statements used by businesses to assess their financial health.

What are income statements?

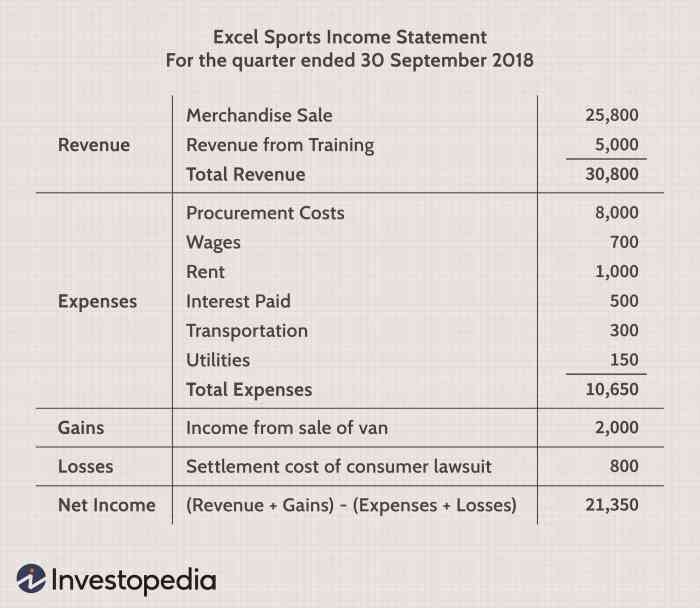

Income statements are financial documents that provide a summary of a company’s revenues, expenses, and profits over a specific period of time. They are essential for businesses as they help track financial performance, make informed decisions, and communicate the company’s financial health to stakeholders.

Income statements typically consist of three main components:

– Revenue: This includes all income generated from the company’s primary activities, such as sales of goods or services.

– Expenses: These are the costs incurred by the company to generate revenue, including operating expenses, salaries, and interest payments.

– Net Income: Calculated by subtracting total expenses from total revenue, net income represents the profit or loss of the company during the period.

The importance of income statements for businesses cannot be overstated. They provide valuable insights into the company’s profitability, operational efficiency, and financial health. By analyzing income statements, businesses can identify areas of strength and weakness, make strategic decisions to improve performance, and attract investors or lenders by demonstrating financial stability and growth potential.

Analyzing revenue on income statements

Revenue is a crucial component of an income statement as it represents the total amount of money a company earns from its normal business activities within a specific period. It is essential to understand how revenue is recorded on an income statement to evaluate the financial performance of a company accurately.

Recording Revenue on an Income Statement

Revenue is typically recorded on an income statement at the top line, also known as the “top line revenue.” This figure represents the total amount of money generated by a company before deducting any expenses. It is essential to note that revenue does not equate to profit, as it does not account for costs incurred in generating that revenue.

Gross Revenue vs. Net Revenue

Gross revenue refers to the total revenue a company earns from its primary business activities, excluding any deductions. On the other hand, net revenue, also known as net sales, reflects the revenue remaining after deducting discounts, returns, and allowances from the gross revenue. Net revenue provides a more accurate picture of a company’s sales performance.

Types of Revenue on an Income Statement

- Product Sales Revenue: This includes revenue generated from the sale of goods or products.

- Service Revenue: Revenue earned from providing services to customers.

- Interest Revenue: Income earned from interest on investments or loans.

- Dividend Revenue: Revenue earned from dividends on investments in other companies.

Understanding expenses on income statements

Expenses on income statements represent the costs incurred by a business to generate revenue. It is essential to understand the various types of expenses included, how they are categorized, and how businesses can utilize this data for decision-making.

Types of Expenses

- Operating Expenses: These are day-to-day expenses incurred in the normal course of business operations, such as rent, utilities, salaries, and advertising costs.

- Cost of Goods Sold (COGS): This includes the direct costs associated with producing goods or services sold by the company, such as raw materials and labor.

- Interest Expenses: These are payments made on loans or other borrowed capital.

- Depreciation and Amortization: These expenses account for the gradual loss of value of assets over time and the allocation of the cost of intangible assets.

- Income Taxes: This represents the taxes owed by the business to the government based on its taxable income.

Categorization and Reporting of Expenses

- Expenses are categorized based on their nature and function, allowing businesses to track and analyze spending in different areas.

- They are reported in the income statement under specific headings to provide clarity on where the money is being allocated.

- Expenses are typically deducted from revenue to calculate the net income or profit of the business.

Using Expense Data for Decision-Making

- By analyzing expense data from income statements, businesses can identify areas of overspending and implement cost-saving measures.

- Comparing expenses over different periods can help track financial performance and make informed decisions for future budgeting.

- Understanding the breakdown of expenses can also assist in pricing strategies, investment decisions, and overall financial planning.

Profitability metrics derived from income statements

Profitability metrics are crucial indicators of a company’s financial performance and overall health. They provide insights into how efficiently a company is operating and generating profits. Key metrics derived from income statements include gross profit, operating profit, and net profit.

Gross Profit

Gross profit is calculated by subtracting the cost of goods sold (COGS) from total revenue. It represents the amount of money a company makes from its core business activities before deducting operating expenses. A high gross profit margin indicates that a company is effectively managing its production costs.

Gross Profit = Total Revenue – Cost of Goods Sold

Operating Profit

Operating profit, also known as earnings before interest and taxes (EBIT), is calculated by subtracting operating expenses from gross profit. It reflects the profitability of a company’s core operations, excluding non-operating items like interest and taxes. A positive operating profit signifies that a company is generating profits from its regular business activities.

Operating Profit = Gross Profit – Operating Expenses

Net Profit

Net profit, or net income, is the final amount of money a company retains after deducting all expenses, including taxes, interest, and one-time charges. It is a key indicator of a company’s overall profitability and financial success. A consistent and growing net profit is crucial for a company’s sustainability and growth.

Net Profit = Total Revenue – Total Expenses

Comparing and contrasting these profitability metrics can provide a comprehensive view of a company’s financial performance. While gross profit focuses on production efficiency, operating profit highlights operational effectiveness, and net profit reflects the bottom line profitability after all expenses are considered. By analyzing these metrics together, investors and stakeholders can assess the overall health and profitability of a company.