With Understanding inflation at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling American high school hip style filled with unexpected twists and insights.

Inflation is not just about rising prices; it’s a complex economic phenomenon that impacts every aspect of our lives. From cost-push to demand-pull, the types of inflation are as diverse as the causes behind them. Let’s dive deep into the world of inflation and uncover its secrets.

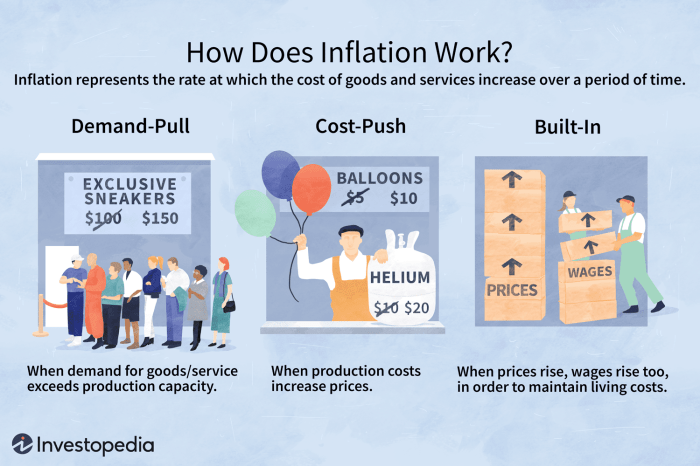

Definition of Inflation

Inflation is the rate at which the general level of prices for goods and services rises, leading to a decrease in the purchasing power of a currency. It is measured by calculating the percentage increase in the Consumer Price Index (CPI) over a period of time.

Types of Inflation

- Demand-Pull Inflation: This occurs when aggregate demand in an economy exceeds the supply of goods and services, leading to an increase in prices.

- Cost-Push Inflation: This type of inflation is caused by an increase in the cost of production, such as higher wages or raw material prices, which leads to higher prices for consumers.

Causes of Inflation and their Impact

- Monetary Factors: When there is too much money in circulation relative to the available goods and services, it can lead to inflation.

- Supply Shocks: Events like natural disasters or geopolitical tensions can disrupt the supply chain, leading to a decrease in supply and an increase in prices.

- Expectations: If consumers and businesses expect prices to rise, they may increase their demand now, causing inflation to spiral further.

- Impact on the Economy: Inflation can erode the purchasing power of consumers, reduce the value of savings, and lead to uncertainty in the economy, making it challenging for businesses to plan for the future.

Effects of Inflation

Inflation can have various effects on an economy, impacting individuals and businesses in different ways.

Purchasing Power

Inflation reduces the purchasing power of money over time. As prices rise, each dollar buys fewer goods and services. This means that consumers may need to spend more money to purchase the same items they previously bought for less.

Savings and Investments

Inflation can erode the value of savings and investments. When the rate of inflation is higher than the return on savings or investments, the real value of money decreases. This can discourage people from saving or investing, as the future purchasing power of their money is uncertain.

Moderate vs. Hyperinflation

Moderate inflation, within a certain range, is considered normal and can be beneficial for economic growth. It encourages spending and investment. However, hyperinflation, with extremely rapid price increases, can lead to economic instability, loss of confidence in the currency, and ultimately, economic collapse.

Factors Influencing Inflation

Inflation is influenced by a variety of factors that can either contribute to its rise or help control its levels. Understanding these factors is crucial in managing the economic impact of inflation.

Role of Central Banks in Controlling Inflation

Central banks play a crucial role in controlling inflation through monetary policy. By adjusting interest rates, setting reserve requirements, and conducting open market operations, central banks can influence the money supply in the economy, which in turn affects inflation rates. Additionally, central banks can use tools like quantitative easing to stimulate or slow down economic growth, thus impacting inflation.

Supply and Demand Dynamics Contribution to Inflation

The basic economic principle of supply and demand also plays a significant role in influencing inflation. When the demand for goods and services exceeds the available supply, prices tend to rise, leading to inflation. Conversely, when there is excess supply compared to demand, prices may fall, resulting in deflation. Understanding these dynamics is essential in predicting and managing inflation rates.

External Factors Influencing Inflation Rates

External factors such as international trade and oil prices can have a significant impact on inflation rates. For example, changes in global market conditions, trade agreements, or geopolitical events can affect the prices of imported goods, leading to inflation. Similarly, fluctuations in oil prices can impact production costs and consumer prices, influencing inflation rates. Keeping track of these external factors is essential for policymakers and economists to anticipate and address inflationary pressures.

Strategies to Combat Inflation

Inflation can be a major concern for economies, leading to decreased purchasing power and economic instability. Governments and central banks implement various strategies to combat inflation and maintain price stability.

Monetary Policy Tools to Control Inflation

Monetary policy plays a crucial role in controlling inflation. Central banks use tools such as:

- Interest Rate Manipulation: Central banks adjust interest rates to influence borrowing, spending, and investment, which can help control inflation.

- Open Market Operations: Central banks buy or sell government securities to regulate the money supply in the economy.

- Reserve Requirement Changes: Adjusting the amount of reserves banks are required to hold can impact lending and money creation.

Fiscal Policy Measures to Curb Inflation

Governments also use fiscal policy to combat inflation. Measures include:

- Reducing Government Spending: Lowering government expenditures can decrease overall demand in the economy, helping to reduce inflationary pressures.

- Tax Increases: Raising taxes can reduce disposable income, curbing spending and inflationary tendencies.

- Supply-Side Policies: Improving productivity, reducing regulations, and promoting competition can help alleviate supply constraints and reduce inflation.

Examples of Successful Inflation-Fighting Strategies

Countries around the world have employed successful strategies to combat inflation, such as:

- Germany: After experiencing hyperinflation in the early 1920s, Germany implemented strict monetary policies and introduced a new currency to stabilize prices.

- Chile: In the 1980s, Chile implemented a credible inflation-targeting framework that helped bring down inflation rates significantly.

- Japan: Through a combination of monetary stimulus and structural reforms, Japan managed to combat deflationary pressures and stabilize prices in the 2000s.