Venture capital funds play a crucial role in the growth and success of startups and innovative companies. In this guide, we will delve into the world of venture capital funds, exploring their definition, types, investment processes, risks, and returns. Get ready to uncover the intricacies of this fascinating investment landscape.

What are Venture Capital Funds?

Venture capital funds are investment funds that provide capital to startup companies and small businesses that have the potential for high growth. These funds typically invest in companies that are in the early stages of development and have innovative ideas or disruptive technologies.

Purpose of Venture Capital Funds

Venture capital funds serve the purpose of providing financial backing to promising startups that may not have access to traditional forms of financing, such as bank loans or public markets. By investing in these high-risk, high-reward ventures, venture capital funds aim to generate significant returns for their investors.

- Venture capital funds help fuel innovation by supporting entrepreneurs and startups with groundbreaking ideas.

- They play a crucial role in driving economic growth by fostering the development of new industries and technologies.

- These funds provide expertise and mentorship to help startups navigate the challenges of scaling their businesses.

Operation of Venture Capital Funds

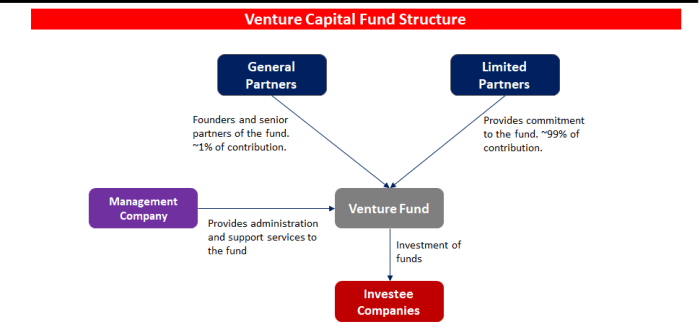

Venture capital funds raise capital from institutional investors, high-net-worth individuals, and corporations. They typically form a limited partnership structure, where the fund managers make investment decisions on behalf of the investors. The fund managers then invest the capital in promising startups in exchange for equity stakes.

Venture capital funds often take an active role in the companies they invest in, providing strategic guidance, networking opportunities, and operational support to help the startups succeed.

- Investments made by venture capital funds are high-risk but have the potential for high returns if the startup is successful.

- These funds have a defined investment horizon, typically ranging from 7 to 10 years, during which they aim to exit their investments through acquisitions or initial public offerings (IPOs).

- Successful exits allow venture capital funds to realize their returns and distribute profits to their investors.

Types of Venture Capital Funds

Venture capital funds come in different types, each catering to specific stages of a company’s growth and development. The main types include early-stage, expansion-stage, and late-stage venture capital funds.

Early-Stage Venture Capital Funds

Early-stage venture capital funds focus on providing funding to startups in their early stages of development. These funds are crucial for helping young companies turn their innovative ideas into viable products or services. Examples of successful companies funded by early-stage venture capital include Uber, Airbnb, and Pinterest.

Expansion-Stage Venture Capital Funds

Expansion-stage venture capital funds target companies that have already developed a product or service and are looking to expand their operations. These funds help companies scale their business and reach new markets. Successful companies funded by expansion-stage venture capital funds include Spotify, Dropbox, and Slack.

Late-Stage Venture Capital Funds

Late-stage venture capital funds invest in companies that have already established a strong market presence and are looking to further grow and solidify their position in the market. These funds often provide capital for acquisitions, product development, or international expansion. Examples of successful companies funded by late-stage venture capital funds include SpaceX, Palantir Technologies, and WeWork.

Process of Investing in Venture Capital Funds

Investing in venture capital funds involves a series of steps that both investors and venture capitalists go through to ensure a successful partnership. It is essential to understand the criteria that venture capitalists look for in potential investments and the due diligence process that is conducted before committing to a venture capital fund.

Criteria for Potential Investments

- Venture capitalists look for startups with high growth potential and innovative business ideas that can disrupt industries.

- They consider the experience and expertise of the founding team, as well as their ability to execute the business plan.

- The size of the market and the scalability of the business are important factors that venture capitalists take into account.

- Investors also assess the competitive landscape and the differentiation of the startup’s product or service.

Due Diligence Process

Before investing in a venture capital fund, due diligence is conducted to evaluate the potential risks and rewards of the investment. This process involves:

- Reviewing the startup’s business plan, financial projections, and market analysis to assess its viability and potential for growth.

- Conducting background checks on the founding team to ensure their credibility and track record in the industry.

- Assessing the intellectual property rights of the startup to protect its innovations and prevent any potential legal issues.

- Examining the startup’s customer base, sales pipeline, and partnerships to understand its market traction and growth prospects.

Risks and Returns

Investing in venture capital funds can offer the potential for high returns, but it also comes with significant risks. Understanding these risks and potential returns is crucial for investors looking to enter this asset class.

Risks Associated with Investing in Venture Capital Funds

When investing in venture capital funds, investors face several risks. These include:

- High failure rate: Startups have a high failure rate, and many investments may not yield returns.

- Illiquidity: Investments in venture capital funds are typically illiquid, meaning investors may not be able to access their funds easily.

- Market risk: The performance of the overall economy and financial markets can impact the success of venture capital investments.

- Management risk: The success of a venture capital fund relies heavily on the skills and experience of the fund managers.

Potential Returns from Venture Capital Funds

Venture capital funds have the potential to offer high returns to investors who are willing to take on the associated risks. Some potential sources of returns include:

- Successful exits: When a startup in the portfolio of a venture capital fund goes public or gets acquired, it can result in significant returns for investors.

- Portfolio diversification: Investing in a diverse range of startups can help mitigate risk and increase the chances of achieving high returns.

- Value creation: Venture capital funds often work closely with portfolio companies to help them grow and increase their value, which can lead to attractive returns.

Examples of Successful and Unsuccessful Investments in Venture Capital

Successful investments in venture capital funds include companies like Facebook, Google, and Amazon, which have delivered substantial returns to their investors. On the other hand, there are also examples of unsuccessful investments where startups fail to achieve success, resulting in losses for investors. Understanding these examples can provide valuable insights into the risks and potential returns associated with venture capital investments.